- About 95% of the supply was in profit at press time.

- A correction might follow once Bitcoin breaches $60k.

Bitcoin [BTC] lifted 9.31% in the last 24 hours to breach $57k for the first time since November 2021. Yes, the same November 2021 during which the king coin sailed to its all-time highs (ATH).

The market most likely reacted to MicroStrategy’s acquisition of 3,000 Bitcoins during the month of February, taking its overall Bitcoin holdings to a whopping 193,000 Bitcoins. Note that MicroStrategy is the largest corporate owner of Bitcoin.

Bitcoin rises from the ashes

The world’s largest digital asset was up more than 200% from its bottom during the crypto winter of 2022 – the time when sentiment around digital assets hit a rock bottom.

However, navigating through the challenging times, Bitcoin now stands as one of the most lucrative assets that one could include in their investment portfolio.

As of this writing, the leading crypto was exchanging hands at $56k, according to CoinMarketCap, with experts pinning their hopes high on the magical $69k figure.

About 95% of the supply was in profit at press time, as per AMBCrypto’s assessment of Santiment’s data. With an eye on $69k, the network was inching closer to 100% profitability.

Source: Santiment

Watch out for this levels

Noted crypto market analyst Ali Martinez dubbed this phase as one of “hope”, a market psychology when investors start believing that the rally would continue. His advice to investors – take any correction as an opportunity to buy the dip.

Well, corrections are inevitable as investors look to profit-take, aren’t they? But how soon will the next come?

A researcher and verified author on CryptoQuant predicted a macro correction once Bitcoin’s supply in profit exceeds 96%. The forecast was based on historical trends.

“I think we can assume that soon, the price will rise to the level of 55-60K or even form a new ATH, after which, the market will go into a correction, at the end of which a bull rally will begin.”

Read BTC’s Price Prediction 2024-25

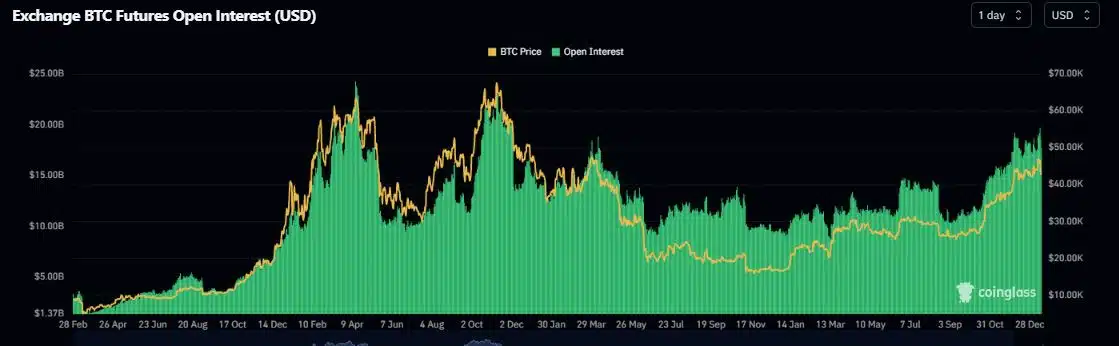

The rally spurred a 8% rise in Open Interest (OI) in Bitcoin futures market, according to AMBCrypto’s analysis of Coinglass’ data.

In fact, the OI, a proxy for total money invested in the derivatives market, was at an ATH of $25.51 billion as of this writing.

Source: Coinglass