- Short-term holders sold their BTC at the highest profit margin since April.

- Whales on the other hand were spending heavily.

Bitcoin’s [BTC] recent price rally created much excitement in the crypto world. However, the subsequent plateauing of BTC around the $34,000 to $35,000 mark raised questions about who will dictate its price in the short term.

Is your portfolio green? Check out the BTC Profit Calculator

Accumulations and Sell Offs

Short-term holders and whales were key players in the Bitcoin market. Short-term holders were currently selling at the highest profit margin since April, according to Crypto Quant analyst Julio Moreno’s data.

On the other hand, whales are spending at the highest level since June. This dynamic suggested that both short-term holders and whales are taking significant actions, possibly impacting BTC’s price levels. The direction in which they continue to move could shape Bitcoin’s near future.

After the recent #Bitcoin price rally we can see two interesting developments On-chain:

– Short-term holders are “selling” at the highest profit margin since April.

– Whales are “spending” at the highest level since June.

This could be consistent with a pause in the rally. pic.twitter.com/aaoVhCotWl

— Julio Moreno (@jjcmoreno) October 27, 2023

Looking at trader behavior

Furthermore, Bitcoin options open interest relative to perpetual swaps recently reached an all-time high. This development reflected a surge in interest and activity in Bitcoin options trading.

The growing options market could introduce more volatility and price uncertainty into the BTC market. Traders and investors need to closely monitor this trend as it could significantly affect price movements.

Bitcoin options open interest relative to perpetual swaps just reached an all-time high.

Not a bad idea to learn some basics on options, as they’ll have a larger impact on market structure moving forward. pic.twitter.com/TEuxFWBqSG

— Will Clemente (@WClementeIII) October 27, 2023

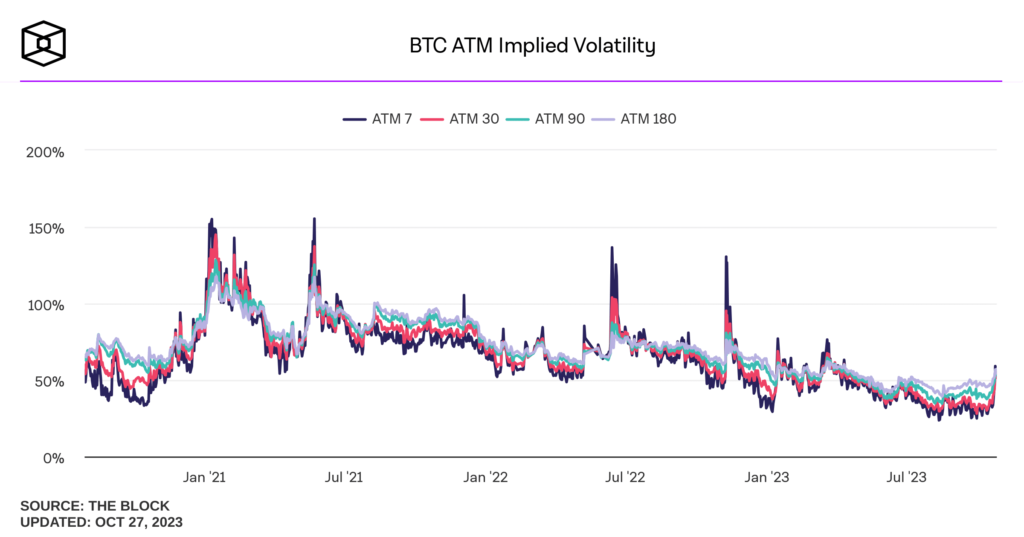

Implied Volatility (IV) for Bitcoin experienced a remarkable surge over the last few days. IV represented the expected volatility of an asset’s price.

When IV increases, it signifies that market participants anticipate more significant price fluctuations. This heightened IV could lead to increased price turbulence, making Bitcoin a potentially riskier asset in the short term.

Source: The Block

The 25 Delta Skew, a metric measuring options market sentiment, has shown a slight decline over the past few days. This suggests that traders may be less inclined to make bullish bets on Bitcoin.

Such shifts in sentiment can influence price actions. A reduced 25 Delta Skew might lead to more stable or even bearish price trends for Bitcoin.

Source: Velo

Read Bitcoin’s Price Prediction 2023-2024

Price remains stagnant

As for the king coin’s current state, it’s trading at $33,400. During this period, daily active addresses on the BTC network have experienced significant growth. This increase in activity shows that more users are engaging with the Bitcoin blockchain.

It could be an indication of renewed interest in Bitcoin and the broader crypto market, which may have implications for its price direction.

Source: Santiment