Bitcoin has surged above the $29,000 mark following the Fed rate hike of 25 bps, a sign that the asset may be decoupling from the stocks.

Bitcoin Has Jumped Despite Fed Interest Rate Hike Announcement

According to the on-chain analytics firm Santiment, the cryptocurrency market has shown some promising rise potential since the rate hike announcement has gone live.

In the past year, the US Federal Reserve System (“Fed”) interest rate hikes have generally been met with panic in the market, as coins like Bitcoin and Ethereum have suffered significant hits to their prices following them.

This has been because the sector has experienced a high correlation with the US stocks during this period, meaning that the prices of the assets in the two sectors have been moving in a similar fashion.

Recently, however, things have been changing for the better, as the cryptocurrency and stock markets have become increasingly separated. The initial reaction in the prices of assets like Bitcoin and Ethereum to the latest announcement has also been a positive indication of this.

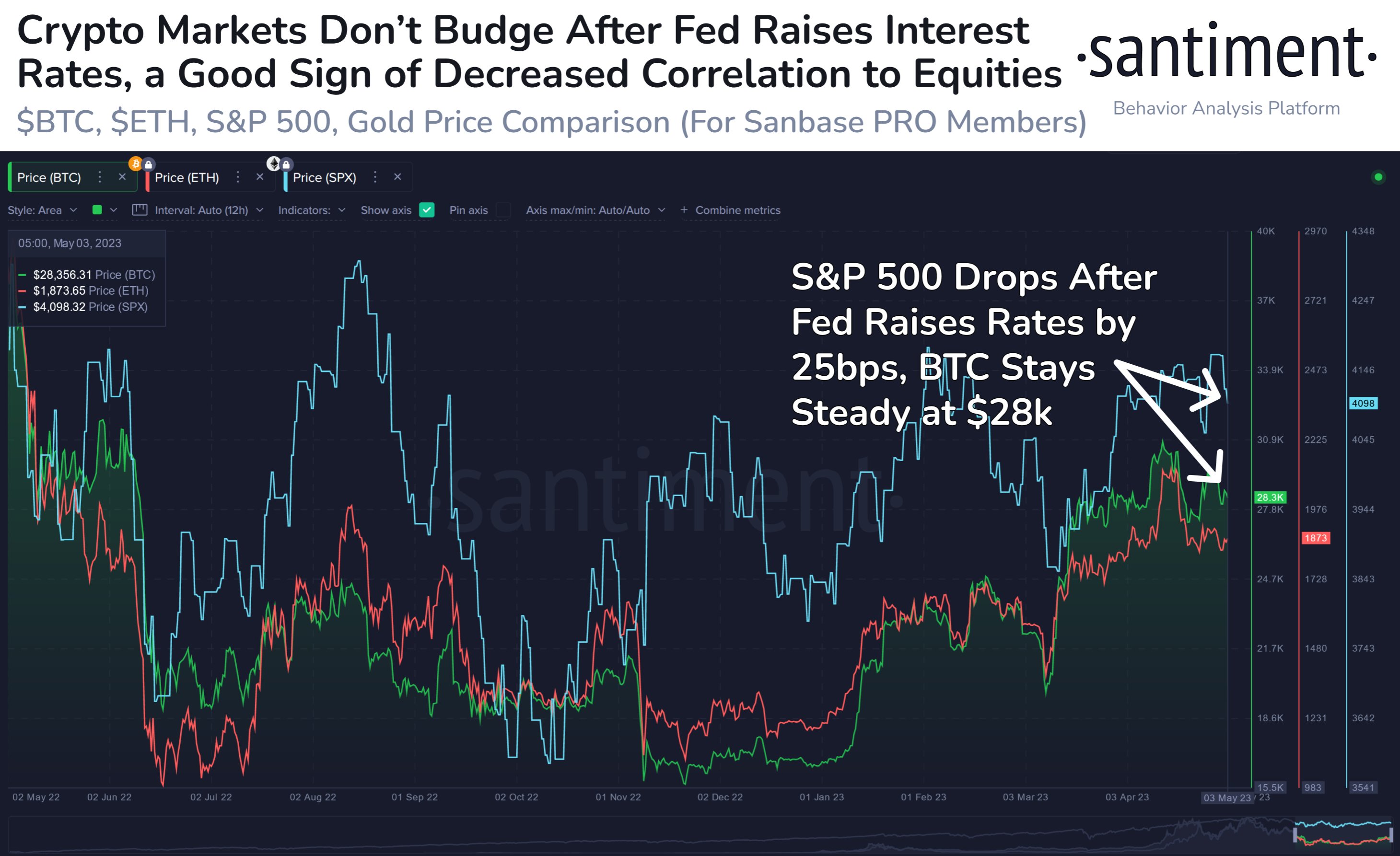

Here is the comparison between BTC, ETH, and S&P 500 that Santiment posted one hour after the FOMC meeting:

Looks like BTC didn't move much following the event | Source: Santiment on Twitter

As displayed in the above graph, S&P 500 fell shortly after the rate hike, while BTC and ETH remained steady, showing the disconnection between the two sectors.

Both Bitcoin and Ethereum have risen in the hours since then, breaking the $29,000 and $1,900 levels, respectively. This could be a sign that investors are at ease now that the meeting is behind them.

“At least for now, it seems that the initial reaction to this interest rate hike was: “At least it’s over with now. Crypto no longer needs to worry about fiscal policy until June,” notes Santiment.

On-chain data also shows that the trading volumes of the top cryptocurrencies by market cap have trended up since the meeting, an indication that activity has been increasing in the sector.

BTC's price has trended up since the announcement | Source: Santiment

Another indicator, the “active addresses,” which measures the daily total number of unique addresses that are taking part in some transaction activity on the Bitcoin blockchain, has also observed a surge following this Federal Open Market Committee (FOMC) meeting day, as the below chart highlights.

The indicator's value has been going up during the past day | Source: Santiment

This metric provides an estimation of the total number of unique users that are using the network right now, so its value going up suggests a high amount of traffic has visited the chain during the past day.

The latest spike in the Bitcoin active addresses is the highest seen in the last two weeks, with the one from two weeks ago being mostly due to a sharp plunge in the price.

“This rally seemed to be much more related to the rate hike finally being official, and you can see how active addresses pushed even higher directly after the announcement,” explains the on-chain analytics firm.

BTC Price

At the time of writing, Bitcoin is trading around $29,200, up 1% in the last week.

BTC has surged in the past day | Source: BTCUSD on TradingView

Featured image from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.net