All applicants for a spot Bitcoin exchange-traded fund (ETF) have submitted their final Form S-1 amendments to the United States Securities and Exchange Commission (SEC). This marks a pivotal moment, especially as the deadline for submission was set for 8:00 am EST today, January 8.

Leading the pack, Valkyrie submitted its final S-1 amendment well ahead of the speculated January 10 date, which many industry insiders believe could see the first approvals of spot Bitcoin ETFs in the US. Following suit, major players such as WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, ARK Invest, 21Shares, Bitwise, Franklin Templeton and Grayscale also completed their submissions.

However, Hashdex has not updated its S-1. The new filings are the penultimate step before the spot Bitcoin ETF approvals. The last one is the SEC voting on the 19b-4s filings in the coming days, specifically on Wednesday.

Scott Johnsson, finance lawyer at Davis Polk elaborated: “Best guess on timing (not definitive): – Monday: “Final” S-1/3 filed – Wednesday: 19b-4 approval orders issued post-close – Thursday: Requests for acceleration from issuers – Friday: Notice of effectiveness filed from SEC – Tuesday: Trading starts”

Best guess on timing (not definitive):

– Monday: “Final” S-1/3 filed

– Wednesday: 19b-4 approval orders issued post-close

– Thursday: Requests for acceleration from issuers

– Friday: Notice of effectiveness filed from SEC

– Tuesday: Trading starts— Scott Johnsson (@SGJohnsson) January 8, 2024

Others expect that the spot Bitcoin ETFs could even start trading as early as Thursday or Friday.

Fee War For Spot Bitcoin ETFs Begins

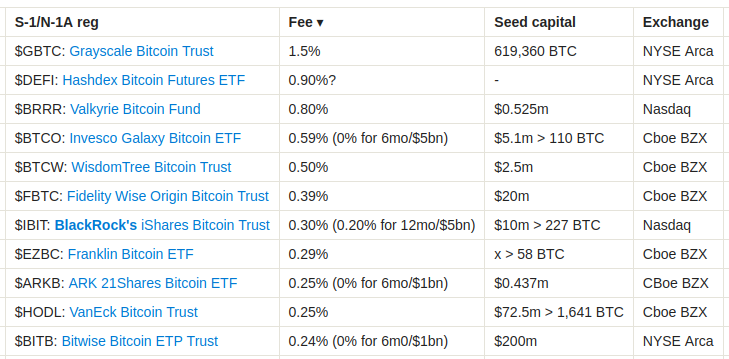

The S-1 amendments are crucial as they disclose information about fees for the potential ETFs. In an interesting turn of events, several filers have significantly lowered fees for trading their potential spot Bitcoin ETF products. Initially, BlackRock was leading with the lowest fees. Katie Greifeld, anchor of The Close and ETF IQ on Bloomberg, highlighted:

BLACKROCK’S FEE is finally listed. Final fee is 30bp, BUT 20 bps in the first 12 months or until the first $5 billion in assets. That’s the new low-water mark.

However, Cathie Wood’s Ark Invest announced lower fees shortly after. The latest S-1 of Ark shows a drop from 0.80% to 0.25%, and a special offer of 0% fees during a six-month period from the day of listing, for the first $1 billion in transactions. Eric Balchunas, a Bloomberg analyst, commented on this competitive landscape:

But wait, ARK just dropped their fee to 0.25% in an S-1 filed 20 minutes after BlackRock’s. Told y’all the fee war would break out bf they even launched. And this is w out Vanguard on the mix. Damn. […] ARK going from 80 bps to 25 bps in one shot is breathtaking. The fee wars are intense but that’s another level. Altho they kinda had to. BlackRock at 30 bps is potential instant destroyer of anyone much higher.#

However, Ark was undercut at the last minute as well. Bitwise submitted a 0.24% fee. No fees are charged for the first six months or $1 billion AUM.

Notably, VanEck also disclosed a fee of only 0.25%, though without any special promotions for the launch, unlike BlackRock and Ark Invest. The leading quartet is followed by Franklin Templeton (0.29%), Fidelity Wise Origin Bitcoin Trust (0.39%), WisdomTree Bitcoin Trust (0.50%), Invesco Galaxy Bitcoin ETF (0.59%), Valkyrie Bitcoin Fund (0.8%), Hashdex (0.90%) and Grayscale (1.5%).

Eric Balchunas elaborated that, historically, temporary fee waivers have not significantly impacted investor decisions, as advisors tend to focus on long-term fees. However, given the uniformity of services offered by these ETFs, he suggested that fee differences might play a more significant role this time. “Historically this hasn’t moved the needle much […] Advisors focused on regular fees since they are long term investors. That said, given all these ETFs all do the same thing, maybe it will matter all else equal, we’ll see,” he remarked.

Katie Greifeld commented, “I spoke too soon re: low-water mark! Ark and 21 Shares are going 0.25% and NO FEE for the first six months or until $1 billion in assets. These are very, very low numbers. […] VanEck also coming in hot with a 25 bp fee. For context, GLD — the largest physically backed commodity ETF — charges 40bp.”

Following the news, the Bitcoin price reacted with a 2% jump, rising as high as $45,300.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.