On-chain data shows the Bitcoin exchange whale ratio has spiked recently, something that could lead to further downside in the asset’s value.

Bitcoin Exchange Whale Ratio Has Sharply Surged Recently

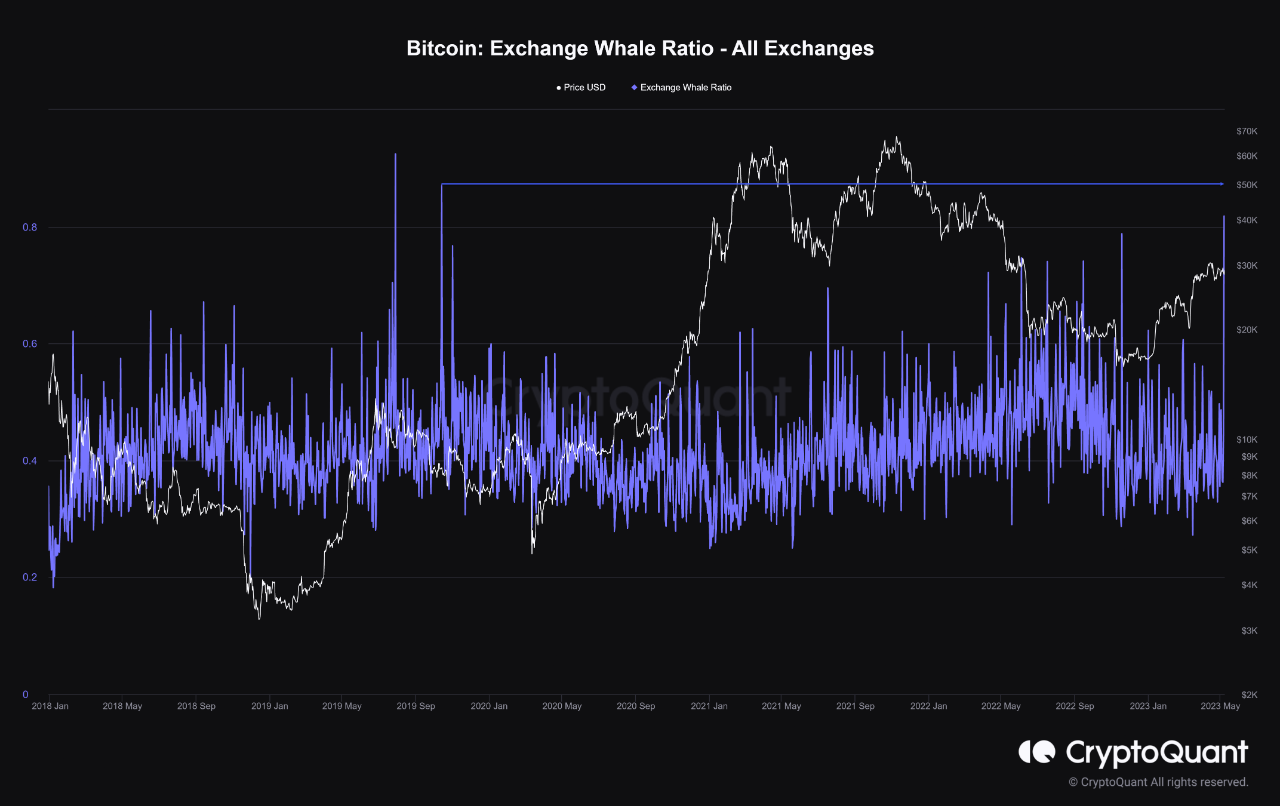

As pointed out by an analyst in a CryptoQuant post, the exchange whale ratio is currently at its highest level since September 2019. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top 10 inflows to exchanges and the total exchange inflows.

An “exchange inflow” is any movement of Bitcoin towards the wallets of centralized exchanges from addresses outside such platforms (like self-custodial wallets).

The top 10 inflows here refer to the 10 largest inflow transactions going towards these platforms. Generally, these largest transfers are coming from the whales, so the exchange whale ratio can tell us how the inflow activity of the whales currently compares with that of the entire market (the total inflows).

When this indicator has a high value, it means these humongous holders are making up a large part of the total inflows currently. As one of the main reasons why investors move their coins to exchanges is for selling-related purposes, this kind of trend can be a sign that whales are selling right now.

On the other hand, low values of the metric imply this cohort isn’t making too many inflows relative to the rest of the market. Such a trend can be either neutral or bullish for the cryptocurrency’s price, depending on some other market conditions.

Now, here is a chart that shows the trend in the Bitcoin exchange whale ratio over the last few years:

Looks like the value of the metric has been pretty high in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin exchange whale ratio has observed a pretty large spike recently. This suggests that whales are making up a rather large part of the total exchange inflows currently.

The metric has crossed the value of 0.8 in this spike, implying that more than 80% of the inflows are coming from these humongous investors right now. This level of ratio hasn’t been seen in the market since way back in 2019.

This previous spike of similar scale occurred as the price was winding down from the April 2019 rally, and shortly after it took place, Bitcoin registered an extension in its drawdown.

An even larger spike in the ratio was also observed earlier in the same year, around when the aforementioned April 2019 rally topped out. The timings of these two spikes may suggest that it was the dumping from the whales that influenced the market and caused the price to go down.

If these previous instances of whale inflow activity of similar levels are anything to go by, then the Bitcoin price may face a bearish decline in the near term due to the current potential selling pressure from this cohort.

The drawdown may have possibly also already started, as the cryptocurrency’s price has taken a dive below the $28,000 mark today.

BTC Price

At the time of writing, Bitcoin is trading around $27,900, down 2% in the last week.

BTC has plunged in the past day | Source: BTCUSD on TradingView

Featured image from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com