- Bitcoin has recovered slightly from its 4.4% price decline.

- BTC spot ETF saw additional filings from applicants as news of rejection predictions made the rounds.

Bitcoin’s [BTC] value recently dropped due to the ongoing Fear Uncertainty and Doubt (FUD) surrounding the approval of the spot ETFs. Altcoins also experienced significant liquidations amid declining prices across various assets.

Bitcoin and the crypto market lose millions of dollars

In a recent update, Michael van de Poppe, the founder of MN Trading, mentioned that altcoins reached their highest liquidation levels in the last two years. These sell-offs coincided with a day when Bitcoin faced a significant price decline.

According to CoinMarketCap, these declines had a notable impact on the overall crypto market cap. As of this writing, it had decreased by about 4.7%, reaching $1.65 trillion.

While there is speculation that these declines were linked to reports of imminent rejections of BTC spot ETF proposals, no concrete evidence supported this claim.

Contrary to such rumors, a recent filing from Fidelity Wise Origin showed that the BTC spot ETF approval process was still in progress.

BTC spot ETF sees new filing; approval yet to come

On the 3rd of January, Fidelity Wise Origin Bitcoin Fund submitted a filing to the U.S. Securities and Exchange Commission (SEC). The Form 8-A filing showed its intention to register its shares as securities listed on the Cboe BZX Exchange.

While some quarters celebrated this filing as an approval, Bloomberg analyst James Seyffart made clarifications on X (formerly Twitter). He stated that this was a securities registration, not a confirmation of BTC spot ETF approval.

According to Seyffart, the complete approval process involves the 19b-4 approval and the issuance of the effective, approved, or completed S-1 document. However, this has yet to happen.

Notably, a similar filing was made on the 29th of December by Bitwise, but it gained less attention than the recent Fidelity Wise Origin filing.

Correction, not a reaction

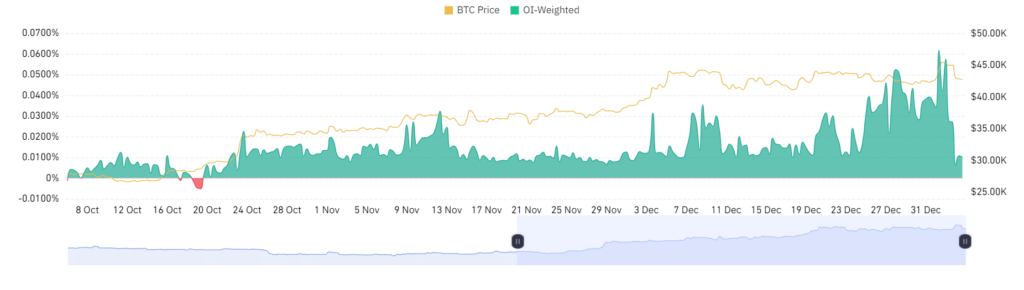

AMBCrypto’s analysis of Bitcoin’s Funding Rate on Coinglass showed an upward trend since around the 29th of December.

The chart showed that the Funding Rate climbed to around 0.03% on the 26th of December and increased to 0.05% by the 28th of December. Subsequently, there was a decline, but the trend gained strength in the new year.

By the 2nd of January, it had reached 0.06%, marking the highest point observed in the past few months. At the same time, the Open Interest was over $19 billion.

Source: Coinglass

As of the latest update, the Funding Rate was around 0.01%, while the Open Interest remained above $18.5 billion. The current downturn appeared to be more of a correction than a reactionary response.

Anticipations suggested a potential upswing in the coming days.

Bitcoin sees massive long liquidations

The recent decline in Bitcoin’s prices led to a substantial liquidation of long positions. This marked the highest level seen in the past few months, as AMBCrypto noted via Coinglass.

As of the 3rd of January, the long liquidation volume was over $137 million, while the short liquidation volume was about $27 million. However, at press time, short liquidations have taken the lead as prices experienced a slight increase.

The liquidation volume for shorts reached around $7.8 million, surpassing the long liquidation volume, which was less than $1 million.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite rumors circulating about the potential rejection of Bitcoin spot ETF proposals, there remains optimism and positive outlooks regarding their approval.

Some predictions suggest that the ETF approval could come in January, with a more specific timeframe between the 8th to the 10th of the month.