In a swift turnaround from yesterday’s dip, Bitcoin (BTC) surged to nearly $26,000 during Asian trading hours on Tuesday. This recovery, which saw the BTC climb from $25,210 to $25,973 in a mere 30 minutes (from 3:00 am to 3:30 am UTC), was not driven by any specific news event. Instead, the dynamics within the Bitcoin futures market played a pivotal role.

Why Has The Bitcoin Price Bounced Upwards?

Renowned analyst Skew provided a technical perspective on the price movement, referring to it as a “textbook short squeeze.” Delving deeper into Skew’s analysis, he pointed out a clear divergence in the Cumulative Volume Delta (CVD) of perpetual contracts (or “perps”) with the actual price. In trading, a divergence between CVD and price can signal a potential reversal. In this context, while sellers were trying to push the price below $25,000, the CVD indicated that buying pressure was mounting.

Furthermore, the futures market had a high number of short positions relative to the open interest (OI), and the funding rate was negative. A negative funding rate typically means that shorts are paying longs, indicating a bearish sentiment. Despite attempts to drive the price down, Bitcoin was reclaiming its swing long price level at $25,300 and failed to maintain the bearish trend in the lower time frame (LTF).

The spot market, where assets are bought and sold for immediate delivery, was showing signs of a bullish structure change, with prices gradually moving higher. Skew suggested that the culmination of these factors led to a short squeeze, where those who bet against the market (short sellers) are forced to buy back into the market to cover their positions, further driving up the price.

Skew’s analysis essentially highlights that while there was a bearish sentiment with many traders betting against Bitcoin, underlying indicators were hinting at a potential bullish reversal. For traders, the immediate goal post-squeeze is to reclaim $26,000.

TheKingfisher offered a more succinct take, hinting at the short squeeze and its impact on those who were betting against Bitcoin: “See you around high lev shorters. BTC Cleared them again.”

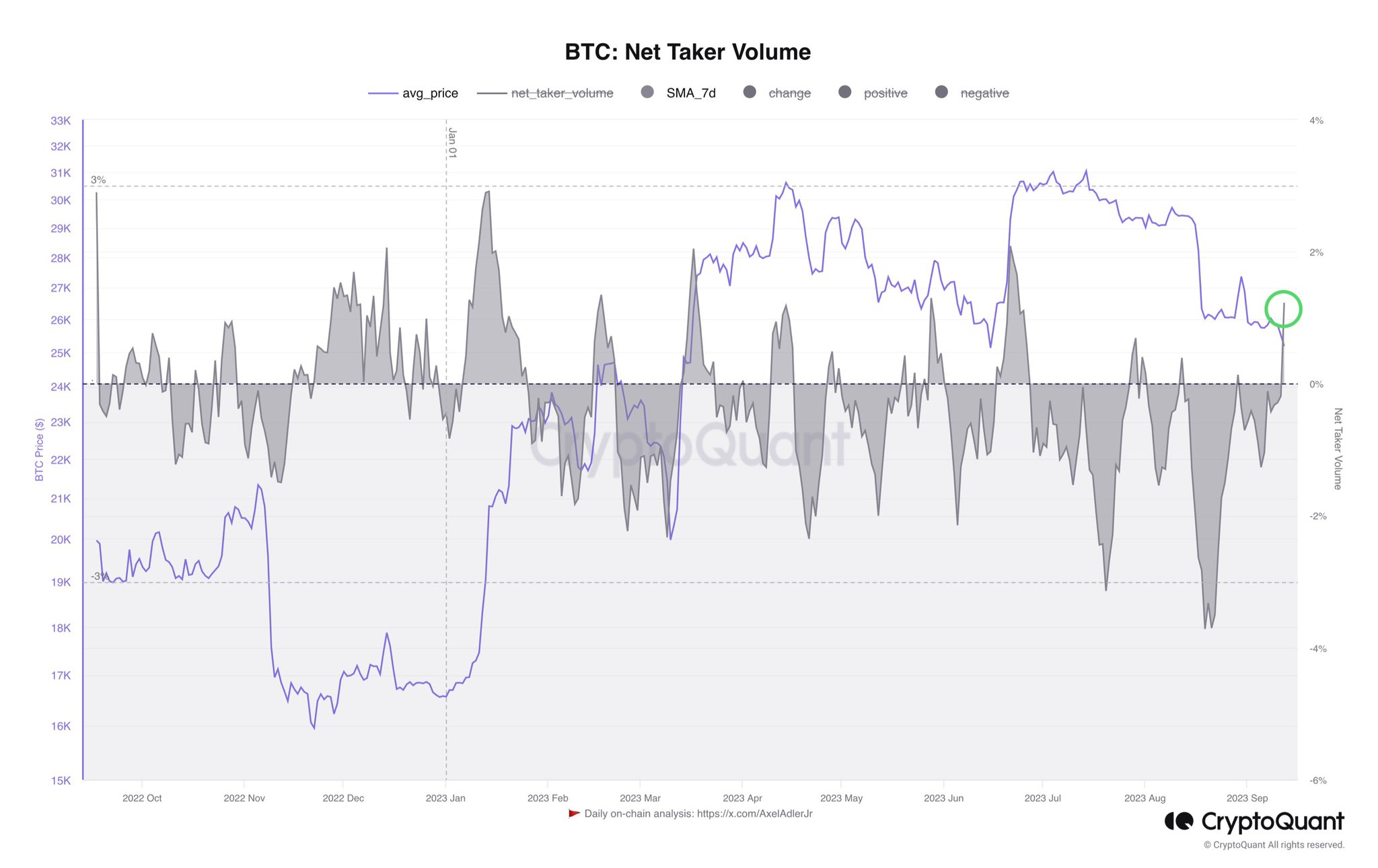

Axel Adler Jr. shed light on the broader market sentiment, noting, “Traders do not plan to go any lower. Net Taker Volume has risen by 9.79%. Over the past year, this is a new record for the balance of open Taker orders with long positions.”

Despite the rapid price movement, the short squeeze’s magnitude was relatively modest. Coinglass data reveals that about $12.32 million in BTC shorts were liquidated. For context, the most significant short liquidation event in the last three months occurred on August 17, amounting to $120 million, when BTC briefly dipped to $24,700 before making a quick recovery above $26,600.

The decline in open interest in futures on the major exchanges was also rather small. According to Coinglass, open interest fell from $10.66 billion to $10.65 billion. This slight decline suggests that few traders had to close their bets, with funding rates turning positive, signaling a shift from bearish to bullish sentiment.

At press time, BTC stood at $25,768.

Featured image from Millionero Magazine, chart from TradingView.com