Over the past week, Bitcoin (BTC) ‘s price has witnessed a notable surge, sparking heightened activity in the cryptocurrency market. One area that offers unique insights into traders’ sentiments and expectations about this price movement is the options market. We can gauge how traders are positioning themselves in anticipation of future price movements through metrics like open interest, volume, and strike prices.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset (in this case, Bitcoin) at a predetermined price on or before a specific date.

Options come in two primary forms: call options, which give the holder the right to buy the underlying asset, and put options, which give the holder the right to sell the underlying asset.

Options open interest represents the total number of outstanding (not yet settled) option contracts in the market. A high OI indicates significant interest in a particular option, suggesting strong sentiment (either bullish or bearish) towards the underlying asset. It provides a sense of the total market exposure or commitment traders have.

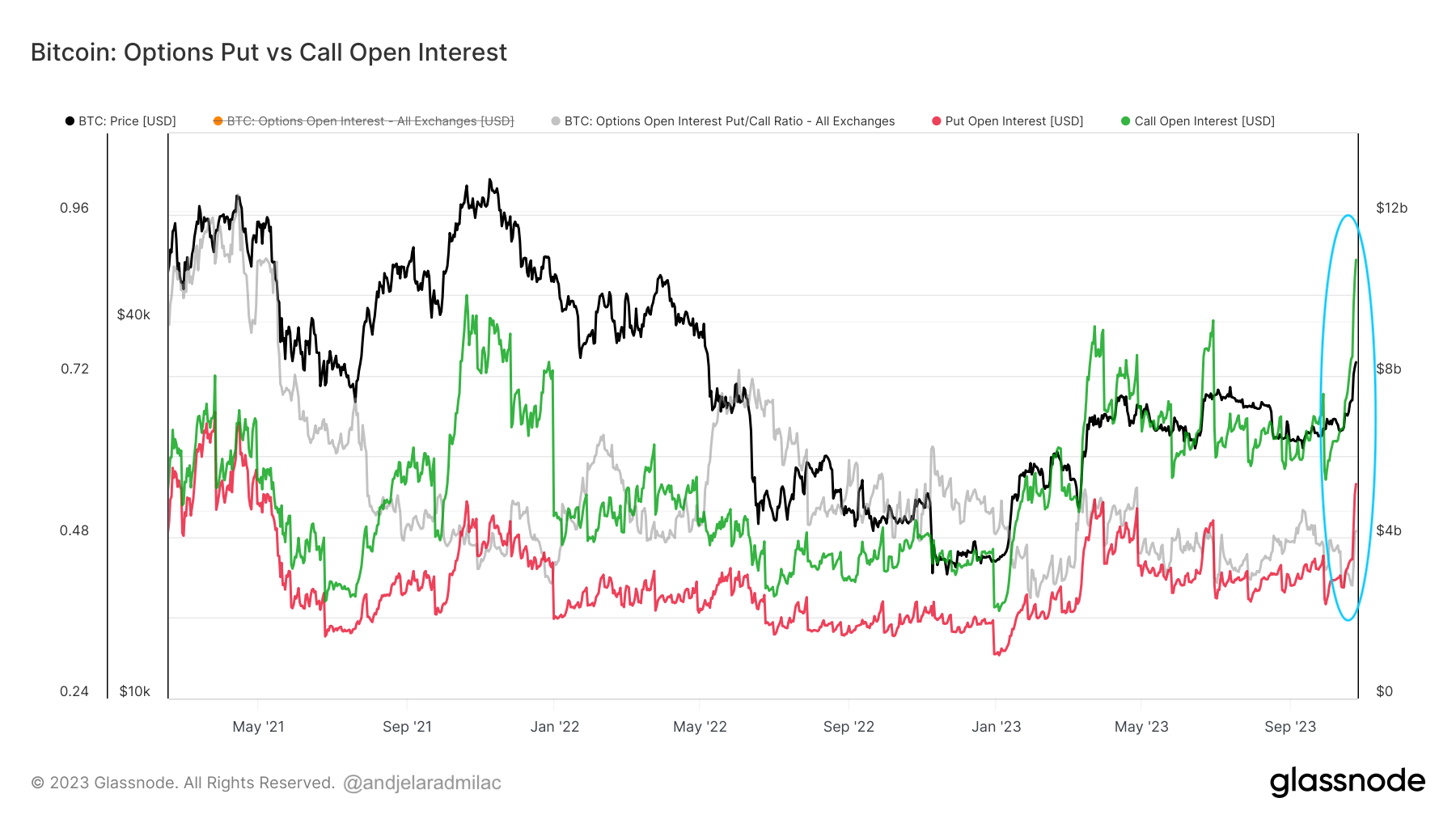

The open interest on calls reached an all-time high of $10.86 billion on Oct. 25, growing from $7.58 billion on Oct. 18. During the same period, open interest on puts increased from $3.34 billion to $5.31 billion.

The bullish trend in Bitcoin’s price from Oct. 18 to Oct. 25 was accompanied by increased put and call open interests. This suggests that traders actively participated in the market, with a historically unprecedented bullish expectation and a healthy bearish hedge. This could be due to various reasons, such as anticipated news events and increased volatility, most likely about the upcoming Bitcoin ETF in the U.S.

The put/call ratio is used to gauge market sentiment as it shows the proportion of puts to calls. A ratio above 1 indicates bearish sentiment (more puts than calls), while a ratio below 1 indicates bullish sentiment (more calls than puts). The increase in the ratio from 0.425 to 0.489 between Oct. 15 and Oct. 25 suggests that while the market remained bullish (since the ratio is still below 1), there was a relative increase in bearish sentiment or hedging activity compared to bullish sentiment.

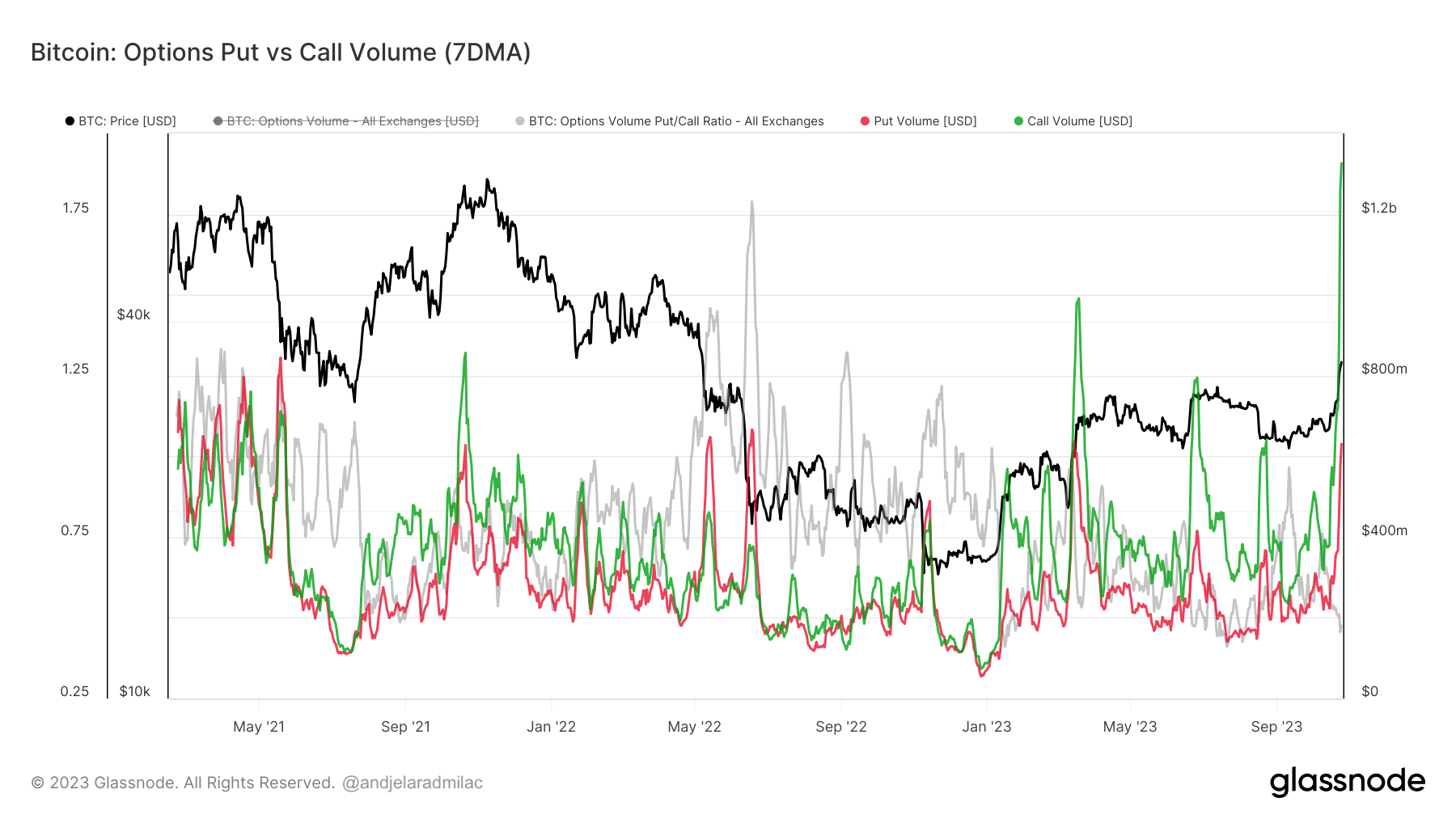

A similar increase was also seen in the options volume. While open interest represents the cumulative positions traders hold, the volume shows the current activity and liquidity in the market. A sudden spike in volume, especially when accompanied by significant price moves, can indicate strong sentiment and momentum.

From Oct. 18 to Oct. 25, the put/call ratio decreased from 0.538 to 0.475. This indicates a shift towards even more bullish sentiment over this period. The volume of both puts and calls increased significantly, but the call volume saw a more pronounced increase, reaching the largest in Bitcoin’s history, just like the call open interest. The record call volume on Oct. 25 suggests a particularly active and bullish day in the Bitcoin options market.

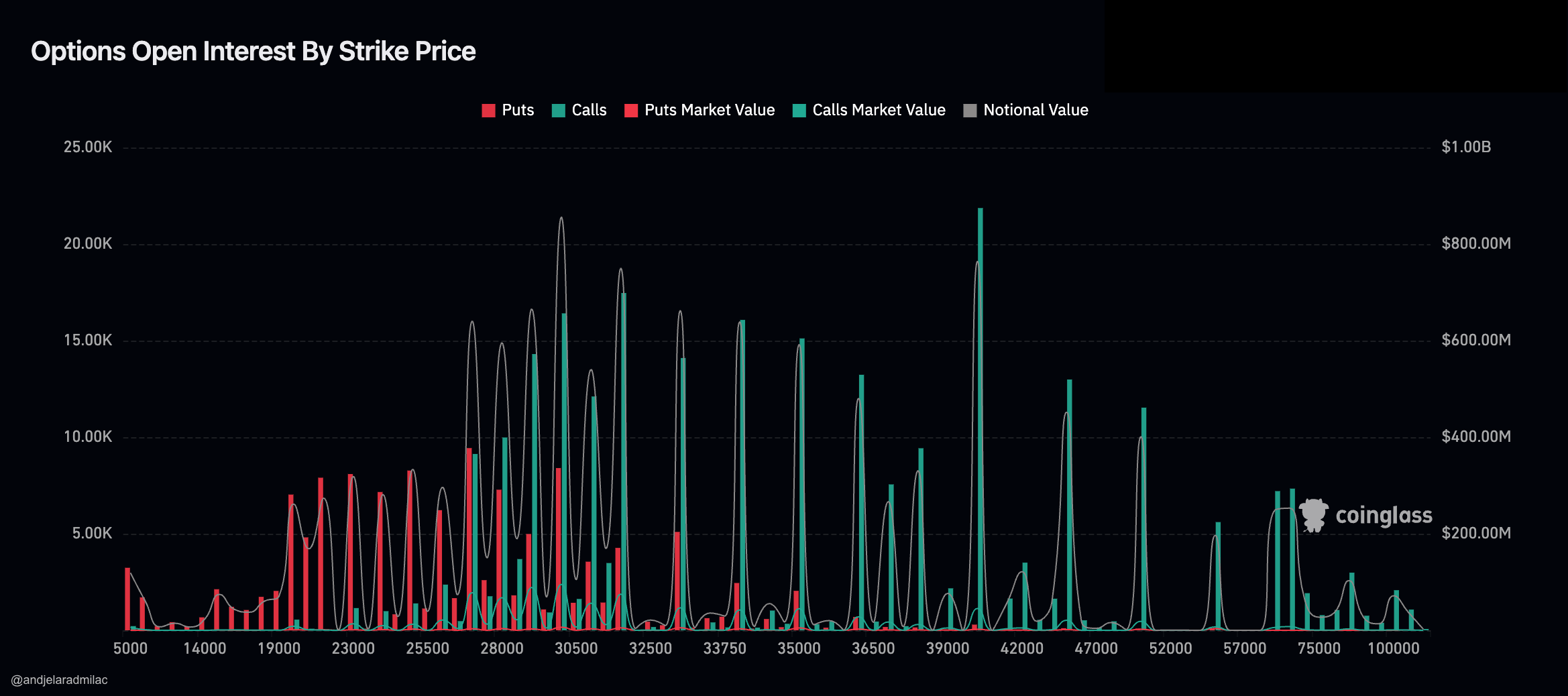

The high open interest at the $40,000 strike price further supports this bullish sentiment. It indicates that many traders anticipate or hope that Bitcoin will reach or surpass $40,000 by the expiration date of these options. While the high open interest for the $40,000 strike price shows optimism, the increasing put/call ratio we discussed earlier suggests that traders are also hedging against potential downside risks. This means that while many are optimistic about Bitcoin reaching $40,000, they are also preparing for scenarios where it might not. This is evident in the spike of put options at strike prices below $27,000.

The rise in both open interest and volume indicates that the options market for Bitcoin is becoming more active and liquid. It also shows a notable rise in interest from institutional and sophisticated traders, as most retail traders rarely stray from spot markets.

The post Bitcoin options market shows record call open interest and volume appeared first on CryptoSlate.