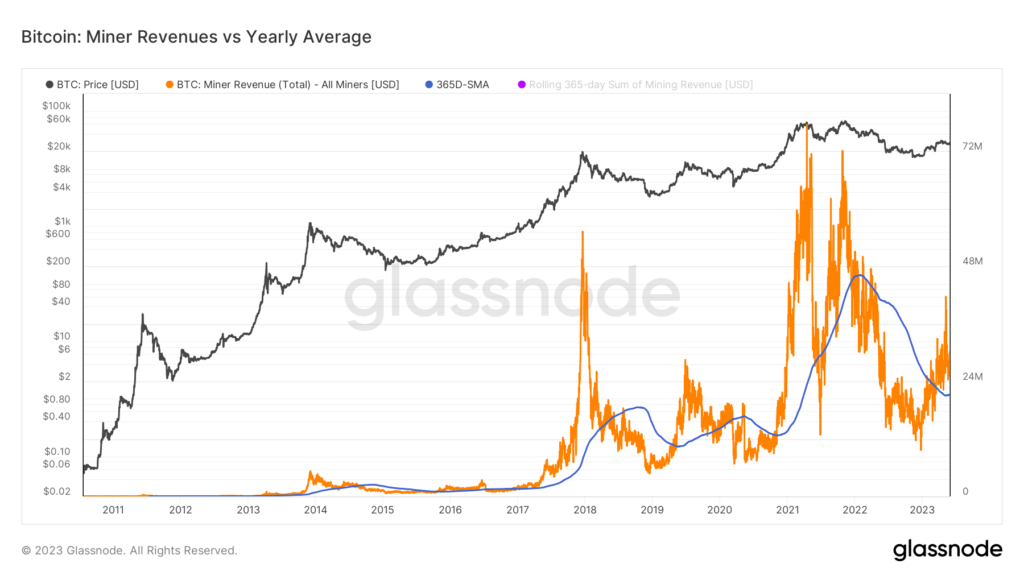

- Bitcoin’s fee revenue has been outstripping the yearly average since March 2023.

- Miner flows to exchanges declined, indicating that miners were not indulging in profit-taking as yet.

Bitcoin [BTC] mining has turned lucrative in 2023, with May becoming a successful month for a sector battered by 2022. According to on-chain analytics firm Glassnode, Bitcoin miners earned $17.8 million in fees during the recent peak, only bettered by two trading days during 2018.

At the peak of the BRC-20 frenzy, #Bitcoin Miners were earning $17.8M in transaction fees, with only 2 trading days across the 2018 peak recording a larger fee revenue.

Currently, Miners are earning $1.7M in fee revenue, a -$16.1M decline from the recent peak. However, this… pic.twitter.com/T5pJpeoxxk

— glassnode (@glassnode) May 29, 2023

As the network traffic has cooled off, the fee revenue has also climbed down from its zenith. However, when compared with historical data, this still remains a significantly high figure. Miners were earning $1.7 million in revenue, outperforming more than 83% of trading days.

Striking it rich

A better way to look at BTC miners’ growing profitability is by comparing the total daily revenue earned by miners to the 365-day simple moving average (SMA). The chart below shows that after staying below the SMA for most of 2022, the revenue has been outstripping the yearly average since March 2023, with the differential reaching $9 million in the last 24 hours.

Source: Glassnode

The network’s rapidly increasing hash rate was another indicator of miners’ growing prominence. The hash rate, or the computational power required to mine blocks, reached an all-time high (ATH) of 439 EH/s on 1 May and around 397 EH/s in the last 24 hours. While miners were undoubtedly investing more time and resources in mining, the returns justified the effort.

Source: Glassnode

Will miners lock in gains?

While high fees had the potential to increase miners’ reserves and incentivize mining, it also could lead to more sell pressure from the miners. Data from CryptoQuant revealed that after a small period in mid-May, the number of coins transferred from miners’ wallets to exchanges had dropped, implying that miners were not indulging in profit-taking as yet.

Source: CryptoQuant

How much are 1,10,100 BTCs worth today?

Relief for Bitcoin miners

This proposed 30% tax on energy costs for cryptocurrency miners in the U.S., which drew widespread criticism, has been revoked, according to Congressman Warren Davidson on 29 May. The controversial Digital Asset Mining Energy (DAME) excise tax was part of a bill aimed at preventing the nation from defaulting on its debts.

As per Statista, the U.S. is a major center for global Bitcoin mining, accounting for a lion’s share of the total hash rate for the period 2019-2022.

Yes, one of the victories is blocking proposed taxes.

— Warren Davidson 🇺🇸 (@WarrenDavidson) May 29, 2023