On-chain data from Glassnode shows the largest Bitcoin whales have been showing the opposite behavior to what other investors have been doing.

Bitcoin Market Is Observing A Moderate Distribution Phase Currently

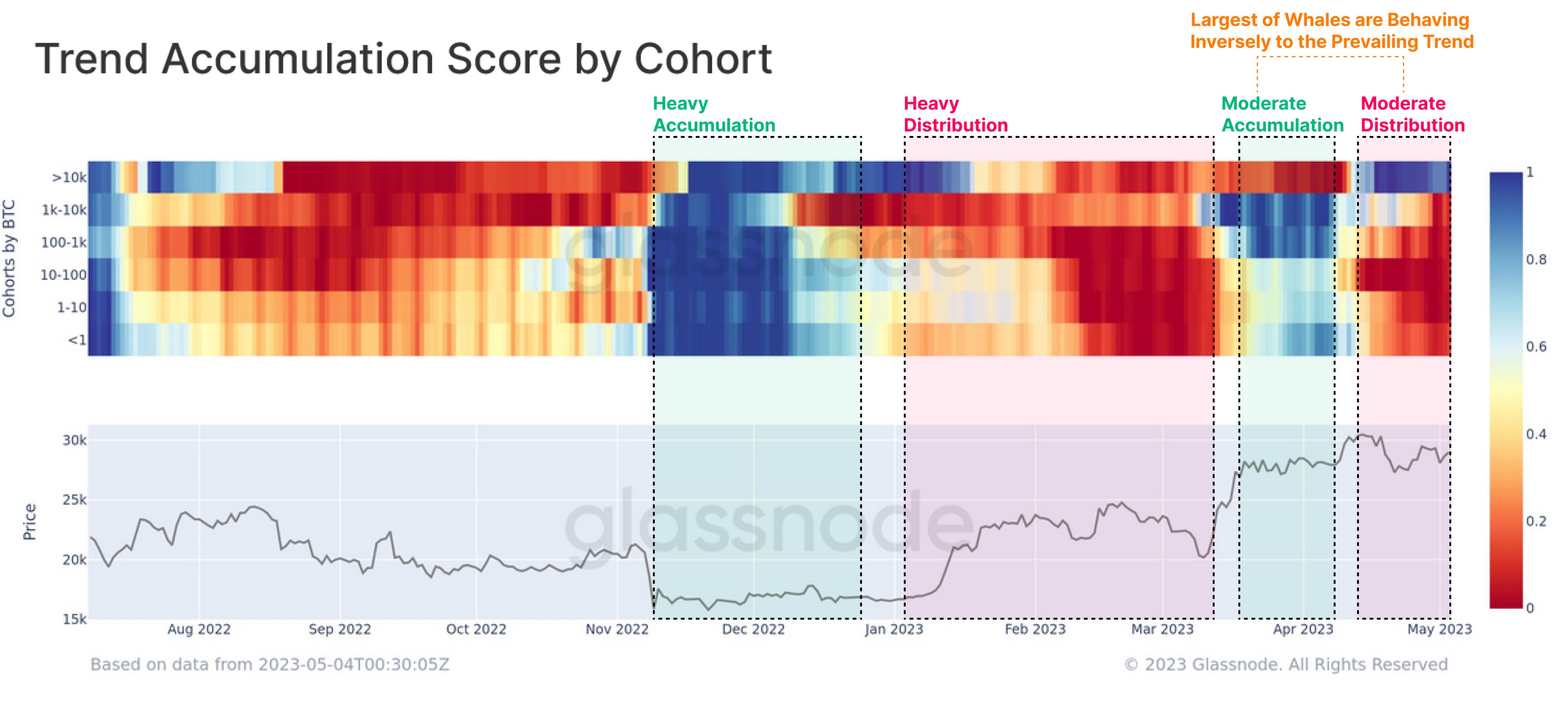

According to data from the on-chain analytics firm Glassnode, the behavior of the largest BTC whales has once again deviated from the rest of the market. The relevant indicator here is the “Trend Accumulation Score,” which tells us whether Bitcoin investors are buying or selling.

There are mainly two factors that the metric accounts for to find this score: the balance changes taking place in the holders’ wallets and the size of the investors making such changes. This means that the larger the investor making a buying or selling move, the larger their weightage in the Trend Accumulation Score.

When the value of this metric is close to 1, it means that the larger holders in the sector are accumulating right now (or a huge number of small investors are displaying this behavior). On the other hand, the indicator has a value near the zero mark suggesting the investors are currently displaying a distribution trend.

This indicator is generally defined for the entire market but can also be used on specific investor segments. In the below chart, Glassnode has displayed the data for the Bitcoin Trend Accumulation Score of the various holder groups in the market.

The value of the metric seems to be red for most of the market right now | Source: Glassnode on Twitter

Here, the investors in the market have been divided into six different cohorts based on the amount of BTC that they are carrying in their wallets: under 1 BTC, 1 to 10 BTC, 10 to 100 BTC, 100 to 1,000 BTC, 1,000 to 10,000 BTC, and above 10,000 BTC.

From the above graph, it’s visible that the Trend Accumulation Score for all these groups had a value of about 1 at the bear market lows following the November 2022 FTX crash, suggesting that the market as a whole was participating in some heavy buying back then.

This accumulation continued until the rally arrived in January 2023, when the market behavior started shifting. The holders began distributing during this period, selling especially heavily between February and March. Following this sharp distribution, the rally lost steam, and the price plunged below $20,000.

However, these investors once again started to accumulate as the price sharply recovered and the rally restarted. Though, this time, the accumulation was only moderate.

Interestingly, while the behavior in the market had been more or less uniform in the months leading up to this new accumulation streak (meaning that all the groups had been buying or selling at the same time), this new accumulation streak didn’t have the largest of the whales (above 10,000 BTC group) participating. Instead, these humongous investors were going through a phase of distribution.

Since Bitcoin broke above the $30,000 level in the middle of April 2023, the investors have again been selling, showing moderate distribution behavior.

Like the accumulation phase preceding this selling, the above 10,000 BTC whales haven’t joined in with the rest of the market; they have rather been aggressively accumulating and expanding their wallets. These holders seem to have decided to move in the opposite direction of the general market.

BTC Price

At the time of writing, Bitcoin is trading around $28,900, up 1% in the last week.

BTC has declined below $29,000 again | Source: BTCUSD on TradingView

Featured image from Rémi Boudousquié on Unsplash.com, charts from TradingView.com, Glassnode.com