- CryptoQuant’s latest analysis stated that short-term holders could make a profit upon selling their BTC.

- Despite a bearish front put forth by indicators, retail demand for BTC did witness a small win.

Bitcoin [BTC] failed to cross the $31k mark after 13 July and has been lurking in the $29k-$30k range for the better part of a month now. At press time, data from CoinMarketCap indicated that BTC was exchanging hands at $29,404 and showed some signs of recovery.

However, as per CryptoQuant’s latest analysis, BTC short-term holders stood in a profitable position as compared to long-term holders.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Longs vs Shorts

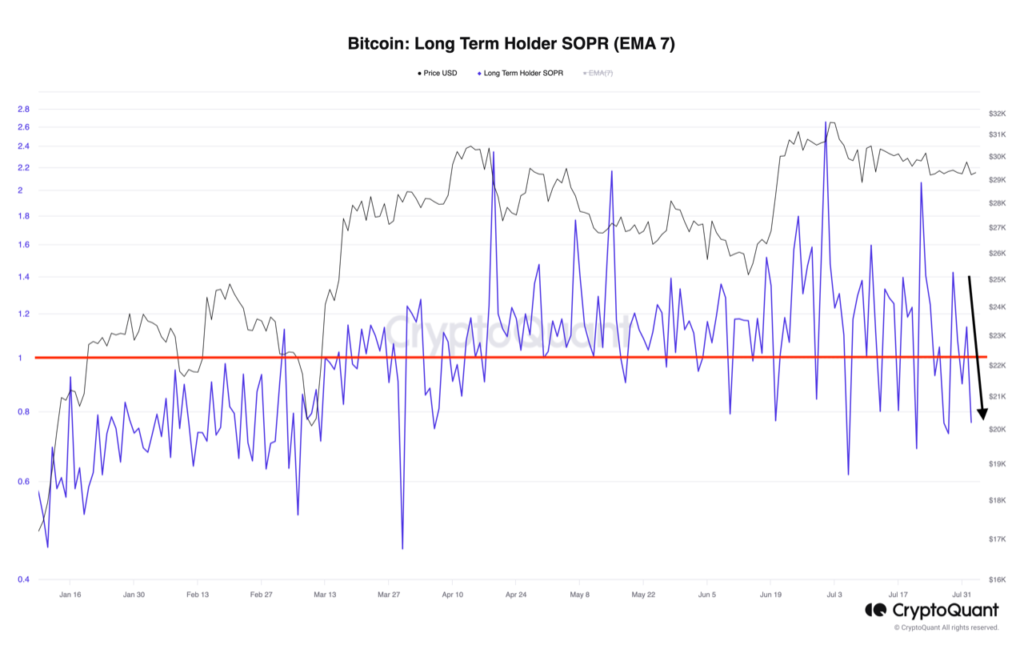

CryptoQuant analyst Onchained analyzed BTC’s short term and long term holder spent output profit range ratios. Upon analyzing the long term holder spent output profit range ratio (LTH-SOPR), it was seen that the LTH-SOPR stood below 1. This indicated that long-term BTC holders were selling their BTC at a loss.

Additionally, Onchained stated that holders could be succumbing to unfavorable selling conditions to re-enter the market by buying at lower prices.

Source: CryptoQuant

Onchained also analyzed the short term holder spent output profit range (STH-SOPR). As of 3 August, the STH-SOPR fluctuated around 1, which was an indication that short-term traders would be selling at a slight profit.

Source: CryptoQuant

Bears at an advantage

As per the TradingView chart, BTC was the in the green at the time of writing. However, BTC’s indicators didn’t exactly scream bullish. The Moving Average Convergence Divergence (MACD) displayed a bearish crossover with the signal line above the MACD line below the zero line.

This indicated that the bears had a tight hold over the king of cryptocurrencies at the time of writing. Furthermore, the Relative Strength Index (RSI), at 45.92, also suggested that the price favored the bears at press time. A further drop in the RSI would be an indication of intense selling pressure around the cryptocurrency.

How much are 1,10,100 BTCs today?

However, BTC’s rising Money Flow Index (MFI) was an indication of flowing liquidity in the cryptocurrency.

Source: TradingView

Despite the disappointing front put up by the indicators, there was some good news for BTC. As per glassnodealerts’ latest tweet, BTC holders holding 0.01+ BTC reached an all-time high on 3 August.

📈 #Bitcoin $BTC Number of Addresses Holding 0.01+ Coins just reached an ATH of 12,228,546

Previous ATH of 12,227,528 was observed on 02 August 2023

View metric:https://t.co/oyguxpaA2y pic.twitter.com/kUXJ2rOlpU

— glassnode alerts (@glassnodealerts) August 3, 2023

Furthermore, the number of holders holding 0.1+ BTC also reached an all-time high of 4,431,809. This was an indication of a recovering BTC on the retail front.