Data shows the Bitcoin funding rates on the cryptocurrency exchange BitMEX have turned quite negative recently. Here’s why this may be bullish.

Bitcoin Funding Rates On BitMEX Have Plunged To Deep Red Values

As pointed out by an analyst in a CryptoQuant post, BTC felt a bullish boost the last time this pattern was observed. The “funding rate” is an indicator that measures the number of periodic fees that futures traders on a derivative exchange are currently exchanging between each other.

When the value of this metric is positive, it means the holders of long contracts are currently paying a premium to the short holders in order to keep their positions. Such a trend implies that the majority of the investors on the exchange hold a bullish sentiment right now.

On the other hand, negative values of the indicator suggest the shorts are overwhelming the longs at the moment. Naturally, this kind of trend is a sign of a bearish mentality being more dominant among the futures traders on the platform.

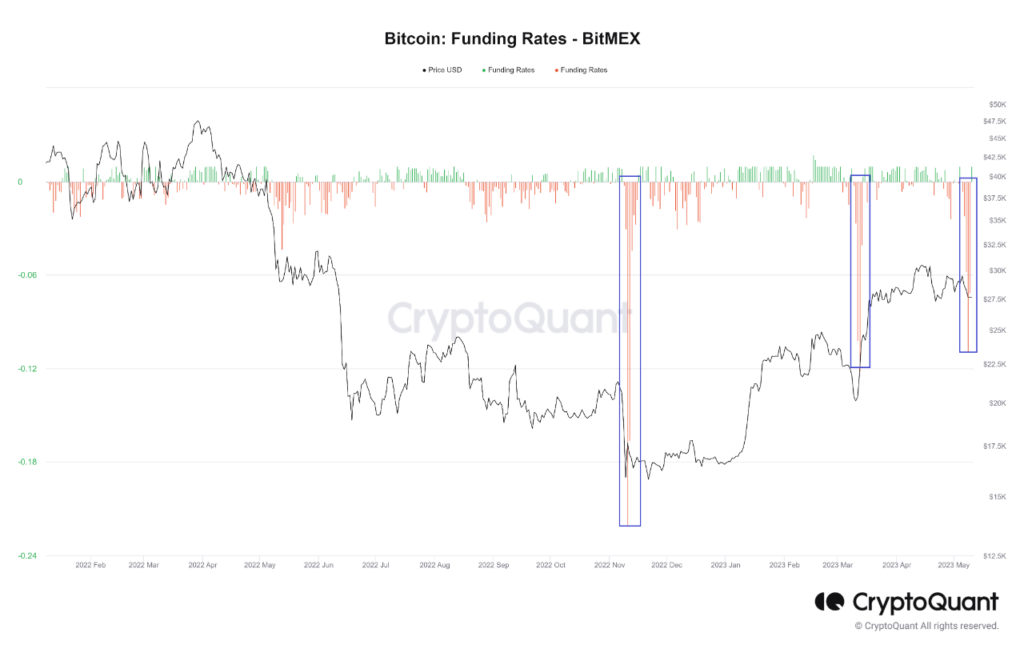

In the context of the current discussion, the relevant derivative exchange is BitMEX. Here is a chart that shows the trend in the Bitcoin funding rates for this platform over the last year and a half:

Looks like the value of the metric has been quite red in recent days | Source: CryptoQuant

As shown in the above graph, the Bitcoin funding rates on the BitMEX exchange have taken a plummet toward deep negative values recently. This means that a large number of short contracts are piling up on the platform in comparison to long contracts.

Generally, when the futures market becomes too unbalanced towards any one side, a sharp price move in the opposite direction to what the investors are heavily betting on becomes more probable.

This is because a mass liquidation event, called a “squeeze,” is generally more likely to take place towards the side that has more contracts open. In a squeeze, a swing in the price triggers a large amount of simultaneous liquidations and these liquidations only end up fueling said move further in return. A cascade of liquidations can then occur thanks to this amplified price move.

Since the funding rates on BitMEX are heavily lopsided towards the negative side right now, a short squeeze is a possibility in the near term. From the chart, it’s visible that the indicator displayed a similar trend just earlier in the year.

This negative spike in March occurred as Bitcoin’s price plunged below the $20,000 level, but these red values were only temporary, as a short squeeze took place not too long after and lead to BTC recovering in spectacular fashion.

The metric observed some even more negative values following the November 2022 FTX crash, but the price didn’t see any appreciable surge following them. Though, nonetheless, Bitcoin still saw the bottom coincide with the red BitMEX funding rates.

It now remains to be seen whether the pattern that was seen in March 2022 repeats this time as well, with BTC observing a short squeeze that reverses the current decline.

BTC Price

At the time of writing, Bitcoin is trading around $27,500, down 4% in the last week.

BTC seems to have plummeted over the last couple of days | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, CryptoQuant.com