- Assessing Bitcoin’s next move now as the bears take a breather.

- Whale activity suggests prospects of a potential bullish relief.

Appetite for leverage in Bitcoin [BTC] trading exposed the inherent risks on the market when interest rates surge. In BTC’s case, many traders are forced to liquidate just so they can afford to keep up with debt due to rising rates.

Is your portfolio green? Check out the Bitcoin Profit Calculator

It is no surprise that the U.S Federal Reserve’s decision to keep rates high is associated with Bitcoin’s recent bearish sentiment. Many analysts currently expect Bitcoin’s potential upside to be subdued as the FED is anticipated to keep interest rates high.

The FED is not expected to decrease interest rates substantially unless the level of inflation goes below the 2% level.

It might take a while before inflation levels are down to favorable levels. This means interest rates may not favor a substantial Bitcoin surge (all factors held constant). However, that might be subject to treasury bond dumping. Such a situation could force the FED to intervene and lower interest rates.

The dumping of large amounts of Treasury bonds could trigger a global margin call on levered credit positions, rapidly spiking rates in the U.S. and potentially forcing the Fed to restart QE to contain the avalanche- this time to the tune of trillions of dollars.

Recall that… pic.twitter.com/4gPTPIlayY

— Peruvian Bull (@peruvian_bull) August 21, 2023

Evaluating the possibility retesting the $20,000 price tag

Bitcoin might be oversold after the recent crash but that does not necessarily negate more downside possibilities. Peruvian Bull’s analysis suggests that there could be another wave of sell pressure before the FED lowers interest rates.

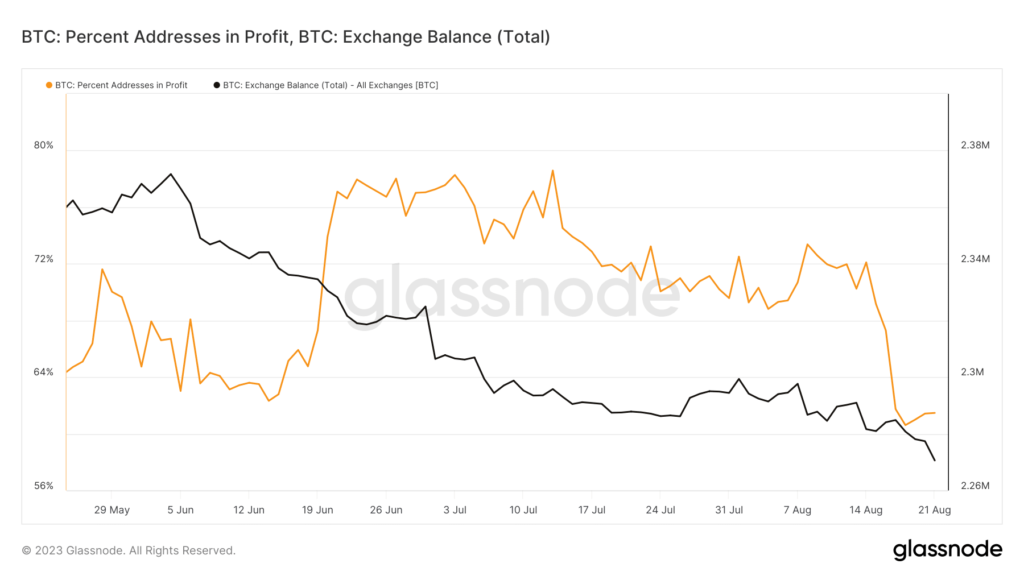

Can Bitcoin really drop from the current level? Well, the recent sell pressure lowered the level of profitability. According to Glassnode data, the percentage of Bitcoin addresses in profit is now at $61.47%. This means there is still more room for another shakedown.

Source: Glassnode

Bitcoin exchange balance has also dropped below June levels, which underscores a fall in the level of confidence in the market. Despite the above observations and the discounted price, the level of demand, especially from whales, remains low.

A substantial price drop usually triggers some accumulation, which in turn offers some short-term relief.

Check out Bitcoin’s price prediction for 2023/2024

Let’s take a look at some on-chain findings which suggest that there might be some bullish attempts in the next few days. Miner balances have been on the rise, which meant that BTC miners are opting to hodl in anticipation of higher prices. It also means things are not so bad as to warrant a selloff. Bitcoin whales holding over 1,000 BTC (denoted in green) have been gradually re-accumulating since 19 August.

Source: Glassnode

Meanwhile, addresses in the 10,000 BTC range accumulated back to 13 August levels. This means they exited before the crash and accumulated back suggesting that they anticipate some upside. Nevertheless, these findings are subject to market changes. In this case, interest rate related announcements should definitely be on the list of factors to watch.