- Bitcoin and Ethereum defy negative market sentiment, witnessing a trading volume surge to month-high levels.

- Traders maintain a positive outlook on BTC and ETH as flows remain negative.

Bitcoin and Ethereum, along with the entire cryptocurrency market, responded to the recent move by the Security and Exchange Commission (SEC). Nevertheless, there has been a notable turnaround following the noticeable decline in trading activity triggered by the SEC’s latest action.

Realistic or not, here’s ETH’s market cap in BTC terms

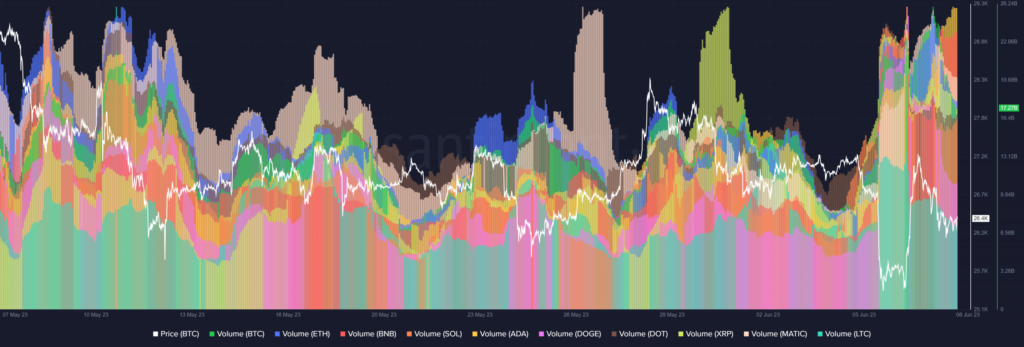

Bitcoin and Ethereum volume surge to month-high

Following the SEC’s announcement that Binance US and Coinbase were facing legal action, major cryptocurrencies, including Bitcoin and Ethereum, experienced a decline in both price and trading volume. This decline could be attributed to FUD as market participants observed the overall market reaction.

However, a significant resurgence in trading volume has been witnessed across the market after the initial dip on 5 June, igniting renewed interest in dip buys and panic sells.

Source: Santiment

Santiment data revealed that Bitcoin and Ethereum reached their highest monthly volume levels.

Analyzing the chart, it became apparent that Bitcoin’s volume exceeded 20 billion after the decline on June 4. It temporarily dropped to around 8 billion on that day but quickly spiked the following day, reaching its peak for the month.

Similarly, Ethereum’s volume dipped to approximately 3 billion on June 4 but surged to around 10 billion in the subsequent days. As of this writing, Ethereum’s volume has already reached around 7 billion.

This spike in volume was not limited to Bitcoin and Ethereum alone but was also observed in other cryptocurrencies like Binance Coin (BNB), Solana, and Cardano.

Bitcoin and Ethereum see a negative flow

Analyzing the Netflow data of Bitcoin and Ethereum on CryptoQuant revealed a consistent negative flow over the past few days. This suggested that sellers rather than buyers have primarily driven the recent surge in trading volume.

Specifically, examining the Netflow metric of Bitcoin, it spiked to over -10,000 on June 7. It represented the highest flow recorded in the month. As of this writing, the Netflow remained on the negative side, surpassing 1,000.

Source: CryptoQuant

Ethereum’s Netflow also experienced a spike in negative territory on 5 June, reaching approximately -360,000, marking its highest flow for the month so far. As of this writing, the Netflow for ETH already exceeded 9,000 on the negative side.

Source: CryptoQuant

Is your portfolio green? Check out the Bitcoin Profit Calculator

Analyzing current market sentiment

Coinglass data indicated that despite the prevailing market sentiment, traders maintained a positive outlook on Bitcoin and Ethereum. This optimism is reflected in the funding rate metric, which revealed that traders placed their bets on a price increase for these two assets. As of this writing, the funding rate remained positive for BTC and ETH on most exchanges, indicating the prevailing sentiment among traders per Coinglass.