- Bitcoin’s social dominance has hit its highest point since September 2022

- Longs were unable to avoid liquidations as losses continue to pour in

Bitcoin’s [BTC] price drop since the new month began might have been demoralising for investors. However, the king coin continues to exert supreme dominance in the market. This claim is because the number one cryptocurrency in market value has outperformed top altcoins over the aforementioned time period.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

A quick assessment of the market puts BTC with a 6.21% declinem at the time of writing. However, fellow competitors like Litecoin [LTC] fell by 12.54% while Cardano [ADA] dropped by 10.37%.

Needless to say, there is only a tiny chance that BTC could imitate its January and February performance. However, the crypto’s initial resistance to its historical March falls may now be in motion.

Is a historical recoil on the way?

Santiment, in its 7 March tweet, affirmed that BTC has been comparatively outperforming a majority of the market’s altcoins. Despite the admission, however, the on-chain analytics platform also pointed to the social dominance trend.

🧐 #Bitcoin‘s price is -6% in March, but still performing better relative to most #altcoins. With #crypto giving up much of their Jan/Feb gains, attention has returned to $BTC. Higher Bitcoin social dominance historically has initiated market rebounding. https://t.co/jNM0hwCyeR pic.twitter.com/J0re8Kok87

— Santiment (@santimentfeed) March 7, 2023

Social dominance gauges the share of discussion referring to an asset. According to Santiment, the metric surged to its highest level since September 2022. Historically, such events prepare the way for a market rebound.

The aforementioned observation implies that BTC is getting hyped. However, the case for capitalizing on short-term bottoms may again be non-existent as the dominance, previously at 19.19%, fell to 13.86% at press time.

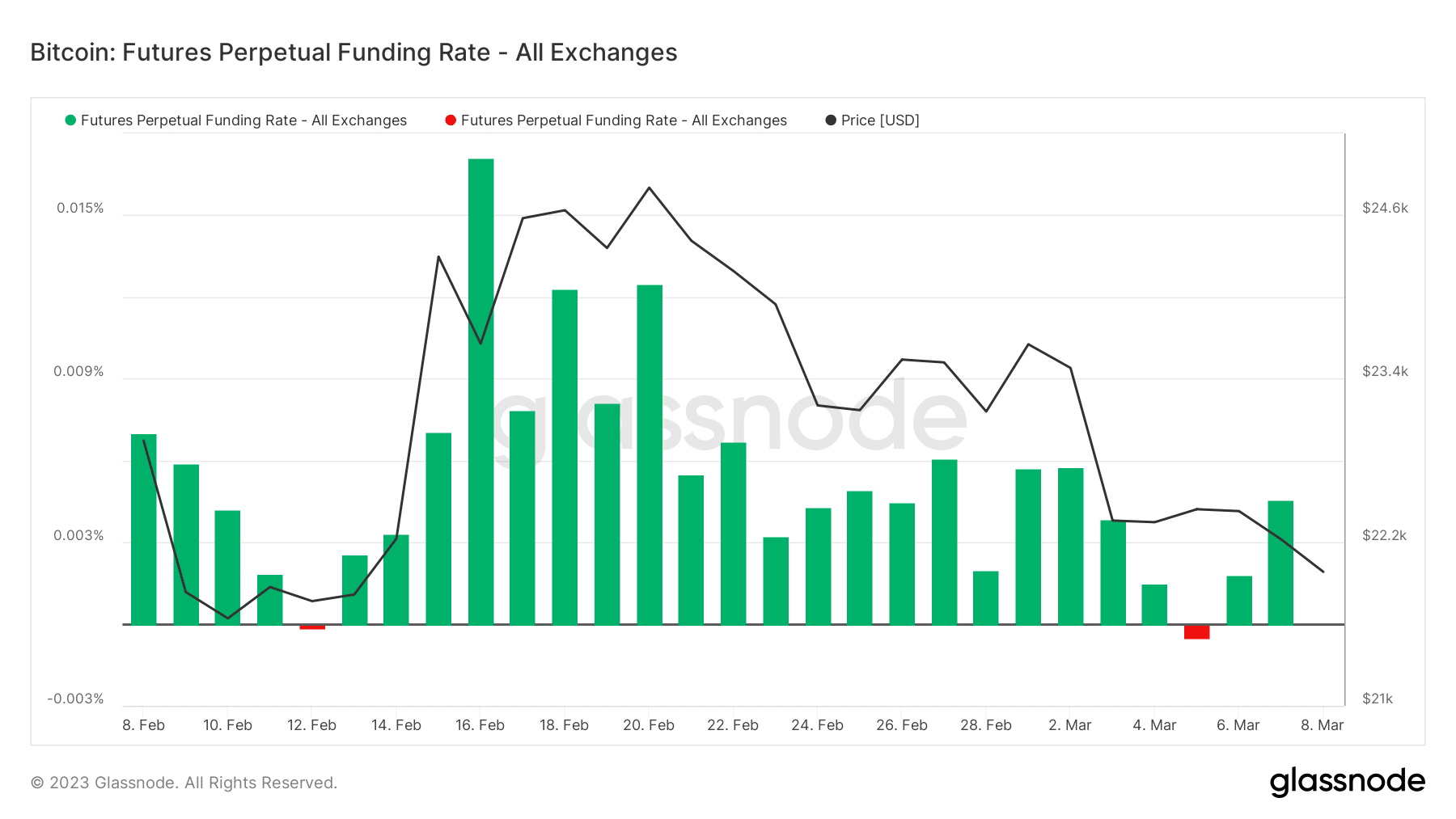

Despite the initial hike, short-positioned traders did not renege on maintaining their position and gained significantly over longs. This was due to the Futures perpetual funding rate, according to Glassnode.

A positive rate means that long positions paid shorts while a negative rate implies otherwise. At press time, the perpetual funding rate was 0.05%, meaning that most longs were liquidated across exchanges.

Source: Glassnode

Is your portfolio green? Check the Bitcoin Profit Calculator

Going down the drain?

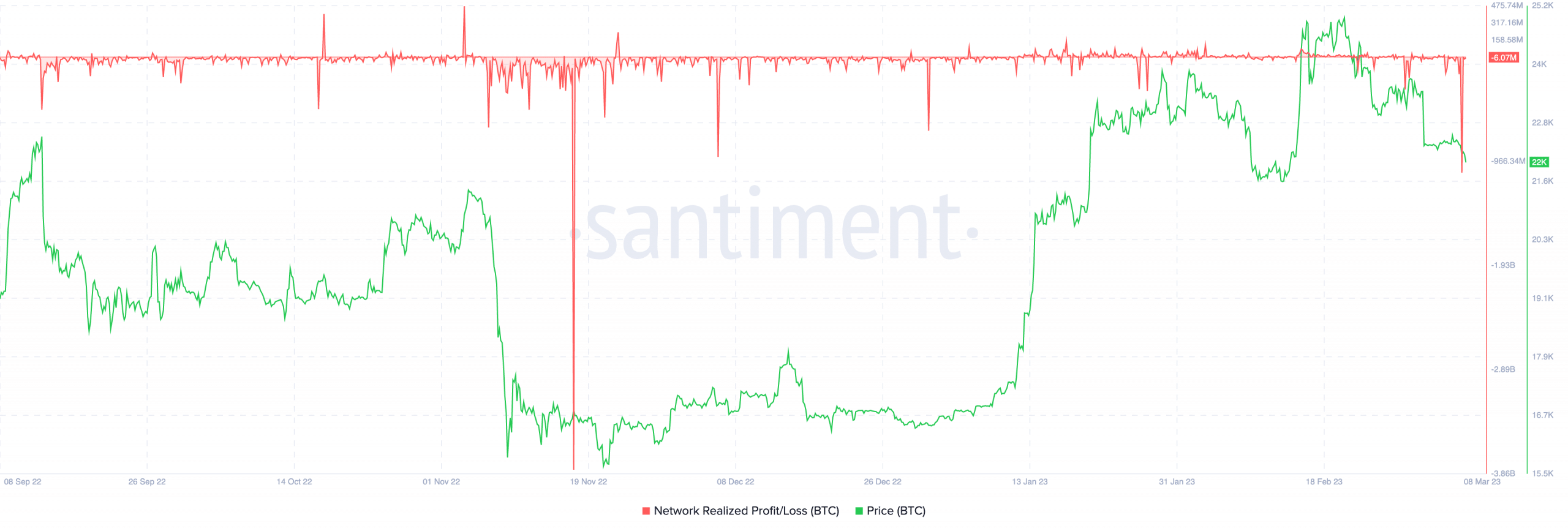

On account of the latest price dip, the greens recorded in the first two months seem insufficient to exclude holders from accruing losses. Based on Santiment’s data, the network’s realized profit and loss remained negative at -6.07 million.

A typical interpretation of the framework indicates capital inflows to absorb the sell-side while on-chain profits are being realized. On the flip side, negative values stay the course when the price trends lower and capital outflows occur.

Source: Santiment

Nevertheless, the metric condition could also signal an upside reversion, as suggested by the social dominance hike.

Even so, BTC is on the verge of losing its hold on $22,000. Additionally, developments like the Silvergate dump and overall sentiment could also propel the coin below its prevailing value.

![Bitcoin [BTC]: What its social dominance stats tell us about its ‘king coin’ label](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/03/glassnode-studio_bitcoin-futures-perpetual-funding-rate-all-exchanges-2-1024x576.png)