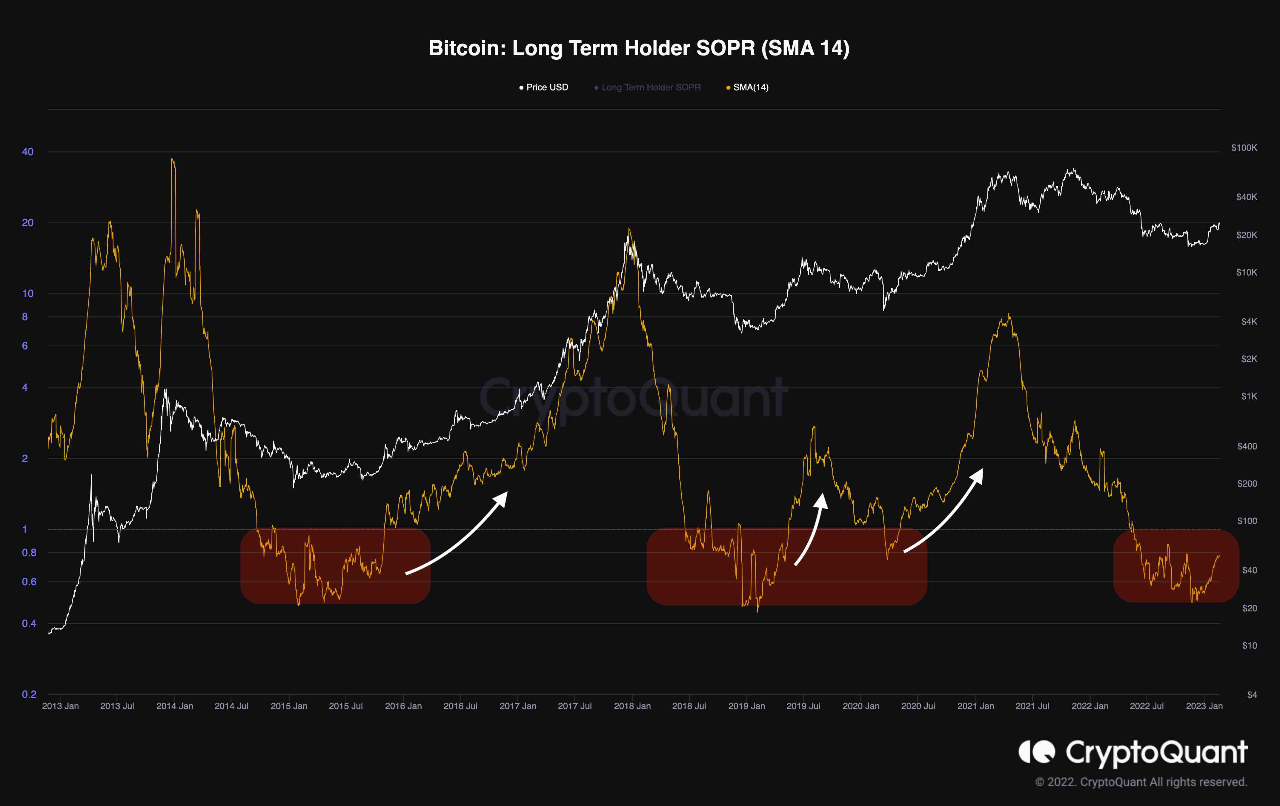

- As per an analyst, BTC’s LTH SOPR had been trending below one since late May 2022.

- Mining activity on the BTC network was significantly impacted by the king coin’s price.

On-chain assessment of the leading coin’s performance revealed that the year-to-date (YTD) rally in Bitcoin’s [BTC] price has caused its long-term spent Output Profit Ratio (LTH SOPR) metric to grow.

According to Glassnode Academy, the SOPR metric is used to understand the overall market sentiment and analyze profitability and losses incurred during a specific period for a particular crypto asset.

In addition, the indicator tracks the amount of profit realized for all on-chain coin transactions.

Read BTC’s Price Prediction 2023-2024

As far as BTC is concerned, the LTH SOPR offers insights into the psychology of long-term holders during a bear market. When the metric is below one, it suggests that long-term holders are realizing losses and could be motivated to sell.

Conversely, when the metric is above one, long-term holders are realizing profits and may be encouraged to hold or accumulate more BTC.

CryptoQuant pseudonymous analyst Greatest Trader noted that the bearishness that plagued the 2022 trading year resulted in significant losses for market participants, including long-term investors per the LTH SOPR.

According to Greatest Trader, the LTH SOPR had been trending below one since late May 2022, indicating that long-term holders constantly lost money.

However, with the general uptrend in the crypto market since the year began, “the metric started recovering and slightly increased due to the uptrend in Bitcoin’s price,” Greatest Trader found.

While this might be taken as conclusive proof that a bull market was underway, Greatest Trader opined that:

“Yet, it is still too early to name the $15.5K level the bear market’s bottom, as the recent impulsive rally could just be a bull trap.”

The analyst warned further that it was pertinent for traders and investors to closely monitor the SOPR metric in the short term to anticipate potential price direction and market sentiment.

Source: CryptoQuant

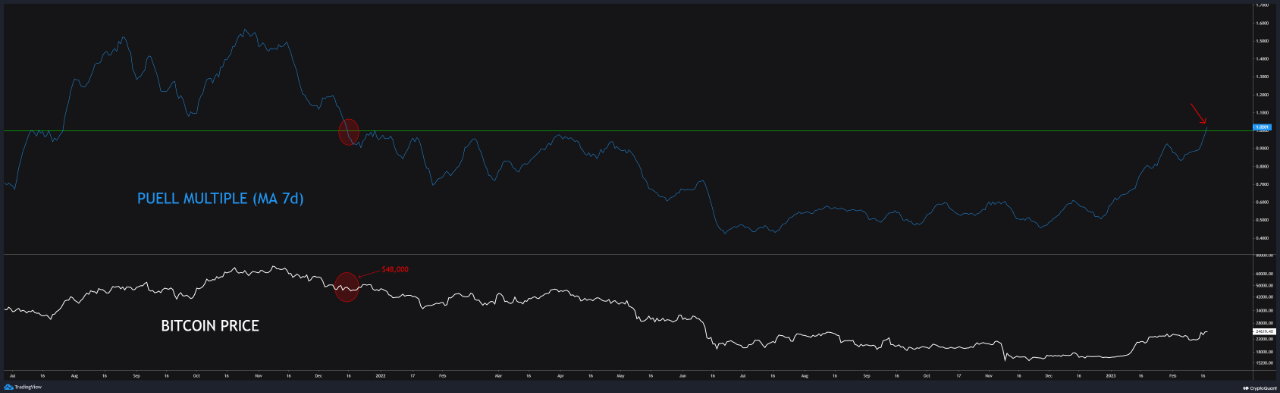

Keep your eyes on the miners

Mining activity on the BTC network is significantly impacted by the king coin’s price and vice versa. According to CryptoQuant analyst Gaah, miners are the only entity that requires an ongoing cost, such as running electricity, so their behaviors are always tied to BTC’s price.

Therefore, the study of metrics such as Puell Multiple, which compares the estimated 365-day average revenue to miners’ short-term revenue, becomes crucial for determining the future direction of BTC’s price as it offers insights into miner behavior.

How much are 1,10,100 BTC worth today?

Gaah found that since the last local price fund in November 2022, the average miners’ revenue has doubled compared to the previous year.

This increase in average revenue may cover the mining costs, reducing the need for miners to sell their BTC and, in turn, decreasing the selling pressure on the market.

According to Gaah, in the short term, Puell multiple values above 1.00 are essential to measuring the possible future behavior of miners.

If the average revenue continues to increase, miners may not need to sell their BTC to cover their costs. Hence, it remains a key metric to pay attention to.

Source: CryptoQuant

![Bitcoin [BTC]: The two metrics that are crucial to your holdings this week](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/02/aleksi-raisa-DCCt1CQT8Os-unsplash-1-2-1000x600.jpg)