- BTC’s NUPL suggests that the coin has commenced a new bull cycle.

- However, increasing coin dump indicates a lack of investors’ confidence.

In a new report, CryptoQuant analyst Sachi found that the assessment of Bitcoin’s [BTC] Net Unrealized Profit/Loss (NUPL) revealed that the leading coin has commenced a new bull cycle.

The NUPL is a metric used to evaluate the profit margin of the BTC market in relation to its market capitalization. A value below zero indicates an accumulation phase, while values above 0.5 suggest a distribution phase.

According to Sachi, “the crucial threshold to monitor is 0.2.” In the current market, BTC’s NUPL has reached this “crucial” position.

The review conducted by the analyst on BTC’s historical performance found that a golden cross, which typically occurs between the 128 and 200-day moving averages, signals the end of the accumulation phase when the NUPL metric reaches or surpasses 0.2. This signifies the commencement of a bull market.

Sachi concluded that a bull cycle was underway as all three critical factors were present once again in the current cycle.

Source: CryptoQuant

Is your portfolio green? Check out the Bitcoin Profit Calculator

Accumulation has slowed, but only because…

For the first time since the unexpected fallout of cryptocurrency exchange FTX, BTC traded momentarily above the $25,000 price mark on 16 February.

Although the king coin’s price later went on to trade below $25,000, for a few weeks, investors anticipated that BTC would reclaim the price position, leading them to open several long positions.

However, things failed to go as expected, leading to dwindling conviction in any further price rally. Investor’s confidence plummeted further on 3 March when BTC’s price suddenly fell by 5%, dropping from $23,500 to $22,240 due to a sense of insecurity and doubt surrounding Silvergate Capital.

This led to the liquidation of the long positions earlier opened.

While Sachi opined that the decline in accumulation and other factors ushered in a new bull cycle, a look at on-chain data and price chart revealed otherwise.

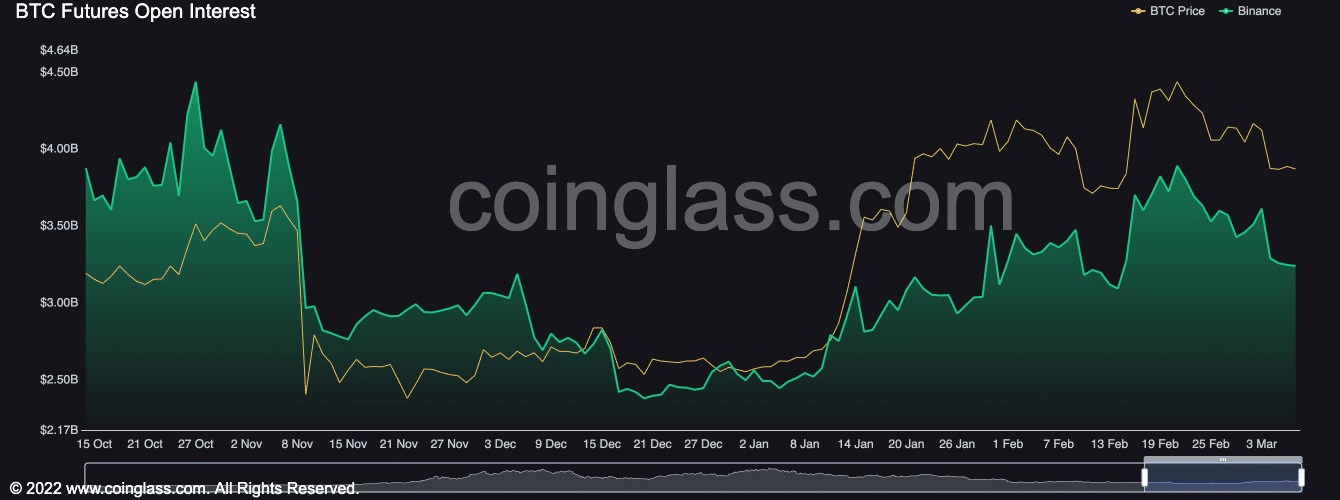

First, BTC’s Open Interest has been in a downtrend since 21 February. The fall in Open Interest coincides with a 10% fall in the asset’s value.

When the Open Interest of a crypto asset falls, it means that the number of outstanding contracts or positions in the market has decreased.

It is often accompanied by a decline in market sentiment or a decrease in the number of traders willing to take positions in the market. As expected, this drives down the value of an asset.

Source: Coinglass

Read Bitcoin [BTC] Price Prediction 2023-24

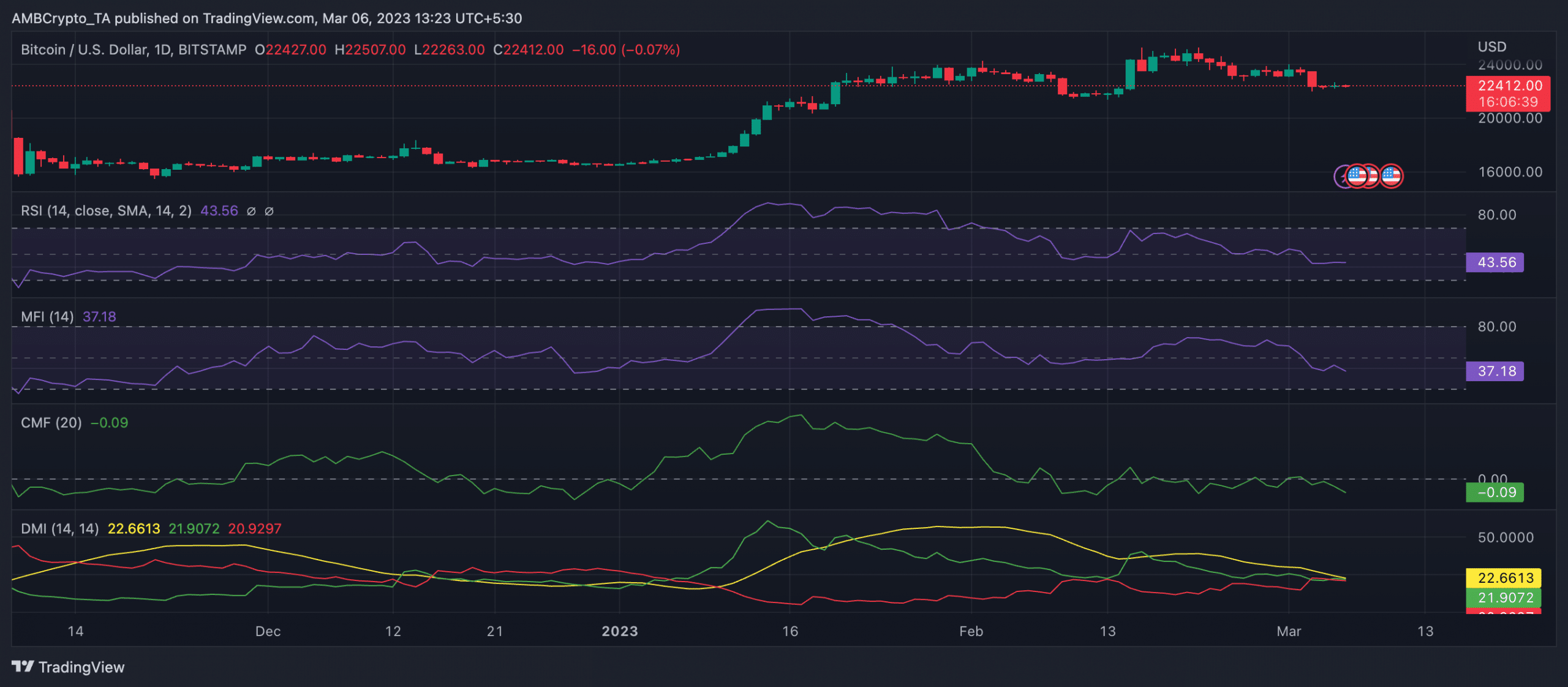

Further, on a daily chart, increased coin distribution has put the buyers at the sellers’ mercy. Key momentum indicators such as the RSI and MFI were positioned in downward trends and rested below their respective neutral regions.

Likewise, the coin’s Chaikin Money Flow (CMF) returned a negative -0.09 at press time, indicating the severity of coin distribution. Without a change in conviction, this usually precedes a further price drawdown.

Source: BTC/USDT on TradingView

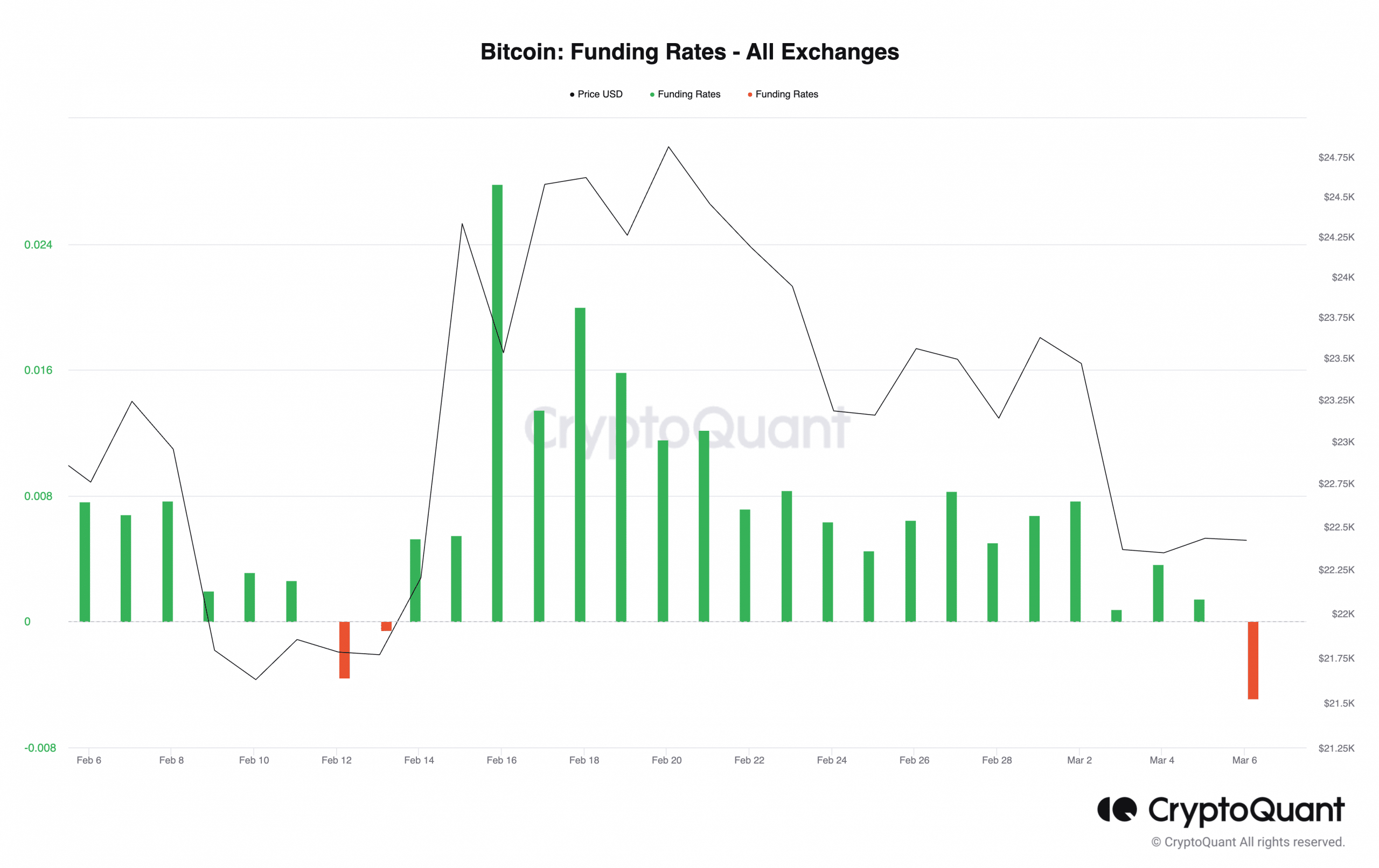

Lastly, a look at BTC’s funding rates across exchanges confirmed the lack of confidence that permeated the market at press time. Per data from CryptoQuant, as of this writing, short positions exceeded long positions. It was the highest negative funding rate year-to-date.

Source: CryptoQuant

![Bitcoin [BTC]: Indicators point at a bull cycle, and on-chain data reveals…](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/03/DrqnWZ8b_230ac2441fb19ad84fdf97ad96c3c868ba54c36c74bc795e17275c12de4faf1a.webp-1024x480.webp)