- Short-Bitcoin investment products saw inflows last week.

- Bitcoin logged its third-consecutive week of outflows.

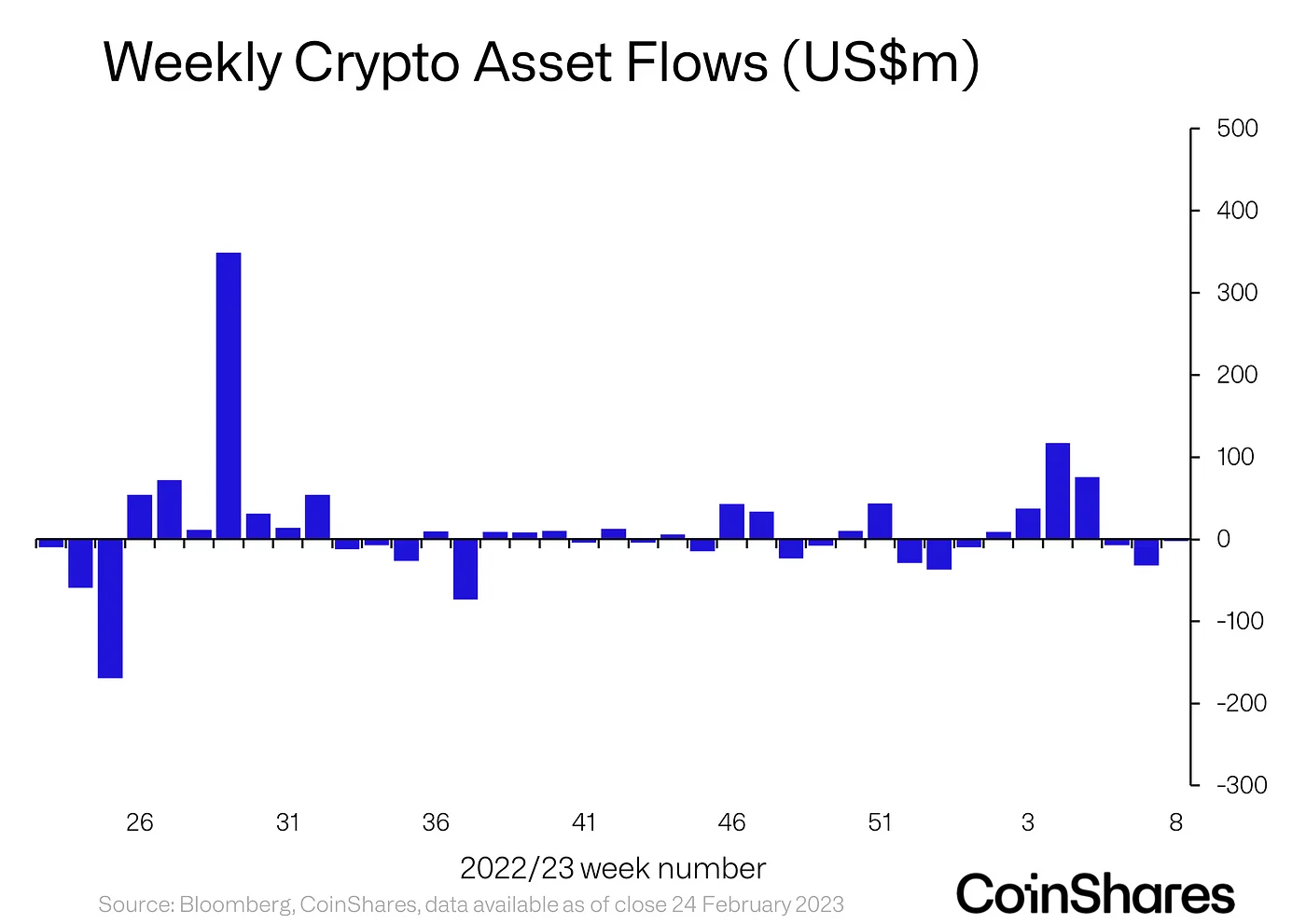

In a new report, digital asset investment firm CoinShares found that the negative sentiments lingering in the digital assets market culminated in a third consecutive week of outflows for Bitcoin [BTC] as investors shifted their attention to short investment products last week.

Is your portfolio green? Check out the Bitcoin Profit Calculator

After a sustained surge in cryptocurrency prices at the start of the year, the market has been moving sideways in the last month. This has prompted several investors to sell their holdings to safeguard against significant price drops. Negative sentiments have re-emerged, resulting in BTC experiencing three consecutive weeks of outflows, with $12 million withdrawn.

Coinshares said,

“This negative sentiment was solely from the US.”

It further added:

“We believe this reaction reflects nervousness amongst US investors prompted by the recent stronger-than-expected macro data releases, but also highlights its sensitivity to the regulatory crackdown in the US.”

Source: Coinshares

Short BTC products are the ultimate winners

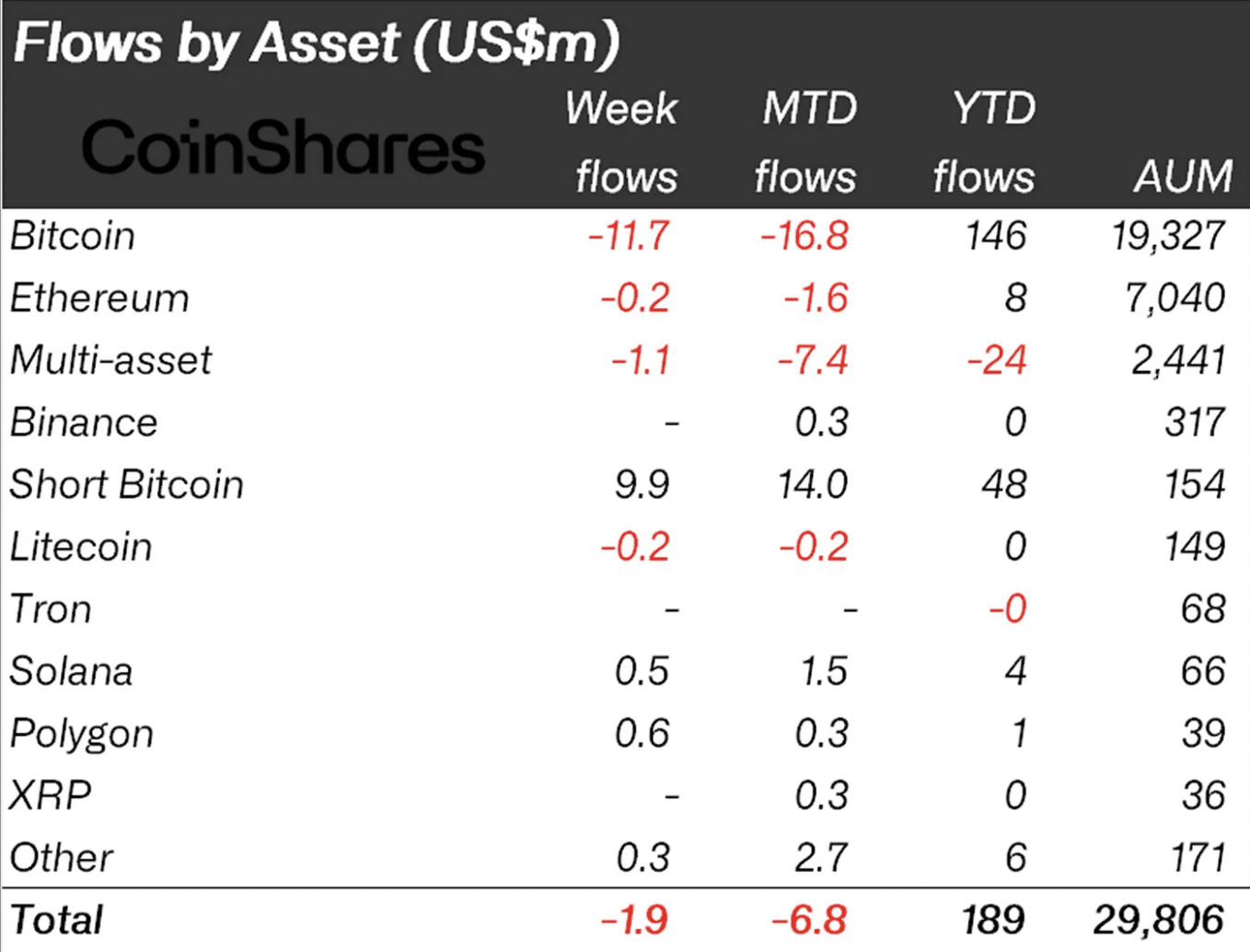

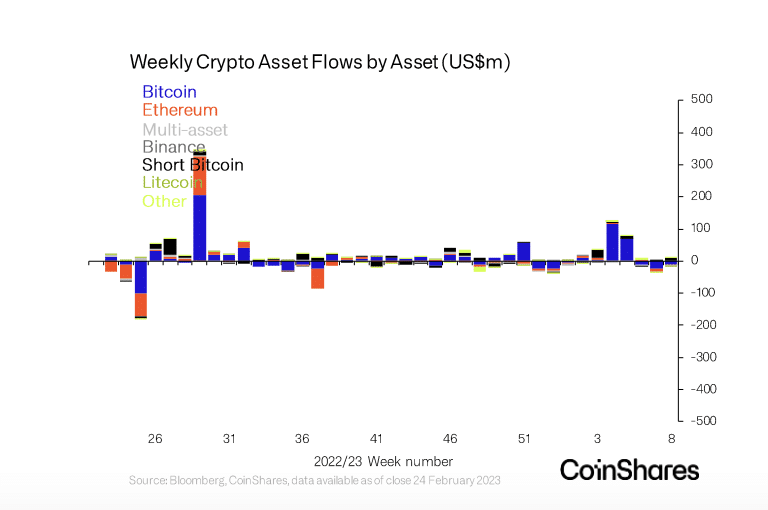

According to Coinshares, last week, investors funneled funds into Short-Bitcoin products. As a result, Short-Bitcoin saw inflows of $10 million last week, bringing its total inflows for February to $14 million. On a year-to-date, Short-Bitcoin products have logged inflows of $48 million.

A “short” position in financial markets refers to a wager that a particular asset’s price will decrease. Per the report, the fact that the largest inflows logged last week were into short-investment products reflected the general frenzy by US investors who expect BTC’s price to decline further should the Federal Reserve remain hawkish in its approach.

Coinshares noted:

“Opinions remain polarised though, with the US seeing outflows totaling US$14m, where recent macro data has increased fears amongst investors that the US Federal Reserve (FED) will be more hawkish than expected.”

Source: Coinshares

Ether and other alts?

Per Coinshares, while the general market suffered outflows that totaled $2 million last week, Ethereum [ETH] remained largely unaffected by negative market sentiments, with only $200,000 being withdrawn.

On the other hand, minor inflows were seen in Polygon [MATIC], Solana [SOL], and Cardano [ADA], with totals of $600 million, $500 million, and $400 million, respectively.

Source: Coinshares

Read Bitcoin’s [BTC] Price Prediction 2023-24

Further, the negative sentiment also affected blockchain equities, resulting in outflows amounting to $7.2 million.

While noting that these companies are mostly focused on growth, Coinshares stated that they were susceptible to changes in interest rate expectations and, therefore, remained vulnerable.

![Bitcoin [BTC] bears keep the faith as short funds see $10M inflows: Report](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/02/1_RtCnpA_50kmp_H7UVCmuAA.webp-1024x725.webp)