- ORDI’s market capitalization has crossed the $1 billion mark.

- Its price recently clinched an all-time high.

BRC20 meme coin Ordi [ORDI] has achieved a significant milestone, becoming the first Bitcoin [BTC] BRC20 token to surpass a $1 billion market capitalization.

AMBCrypto found that the altcoin’s price rallied to an all-time high of $63 during the intraday trading session on the 5th of December. At press time, ORDI exchanged hands at $60, still logging a 24% price jump in the last 24 hours.

According to CoinMarketCap, the token’s value has risen by over 200% in the last week. This has made it the crypto asset with the most gains in the last seven days, according to the cryptocurrency price tracker.

ORDI puts the Bitcoin network under pressure

The surge in ORDI’s value is attributable to the general uptick in the trading activity around BRC-20 tokens in the past few days. According to data from Dune Analytics, on the 3rd of December, BRC20 token minting touched a high of 450,000.

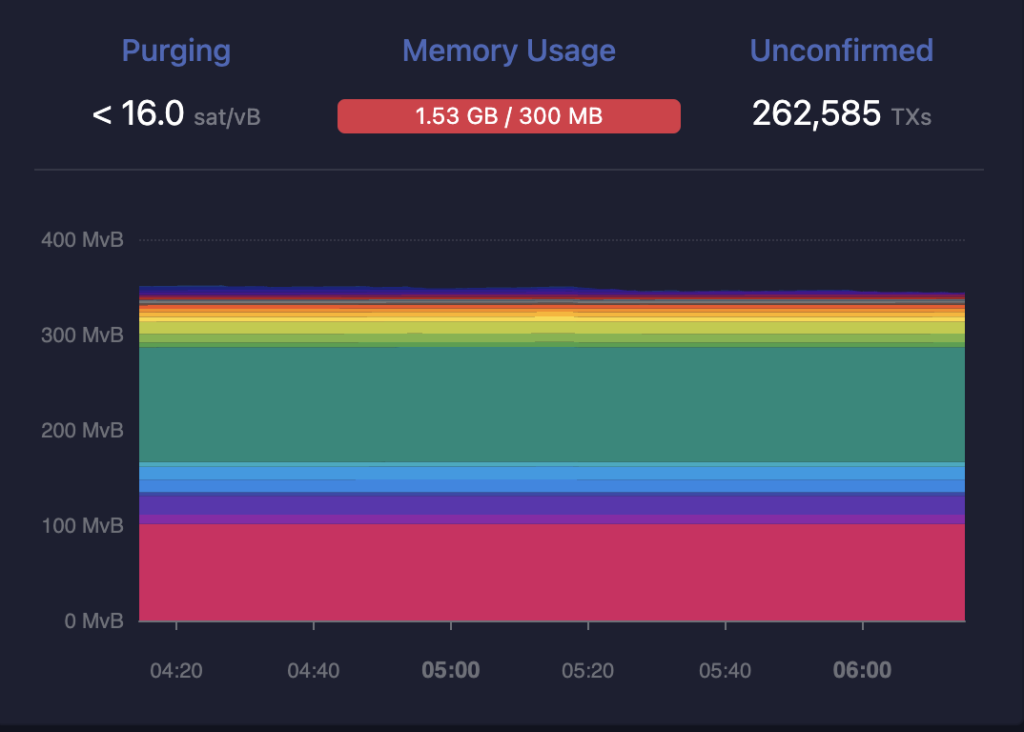

As a result, the Bitcoin network has become congested with unconfirmed transactions clogging up the meme pool. According to data from mempool.space, over 267,000 transactions were waiting to be confirmed on the Bitcoin network at press time.

The memory pool, which is the temporary storage area for pending transactions, was at 1.54GB at this time, significantly above the 300 MB capacity.

Source:mempool.space

Due to the activity around inscriptions on the Bitcoin network, the average transaction fee on the blockchain has climbed to its highest since April.

At press time, data retrieved from BitInfoCharts showed that the average BTC transaction fee was $19.48. The last time the transaction fee on the Bitcoin network was this high was in May.

Source: BitInfoCharts

ORDI is the talk of the town

As many continue to ape in to profit from ORDI’s price rally, an assessment of the token’s performance on a daily chart revealed that it has seen huge demand in the past few days.

Read Ordi’s [ORDI] Price Prediction 2023-24

Signaling that the market has become overheated, its Relative Strength Index (RSI) and Money Flow Index (MFI) were spotted at overbought highs at press time.

ORDI’s RSI was 86.43, while its MFI was 96.31. It is, however, key to note that at these values, these indicators suggest that there is too much buying pressure and that the asset is likely to experience a price pullback.

Source: TradingView