- Long-term Bitcoin holders remained unfazed by market volatility.

- Retail investors and whales showed growing interest in BTC.

Amidst recent uncertainties surrounding the crypto market due to the SEC’s lawsuit and FOMC’s announcement, long-term Bitcoin [BTC] holders have continued to display unwavering faith in BTC, unaffected by the recent market volatility.

Is your portfolio green? Check out the Bitcoin Profit Calculator

For old time’s sake

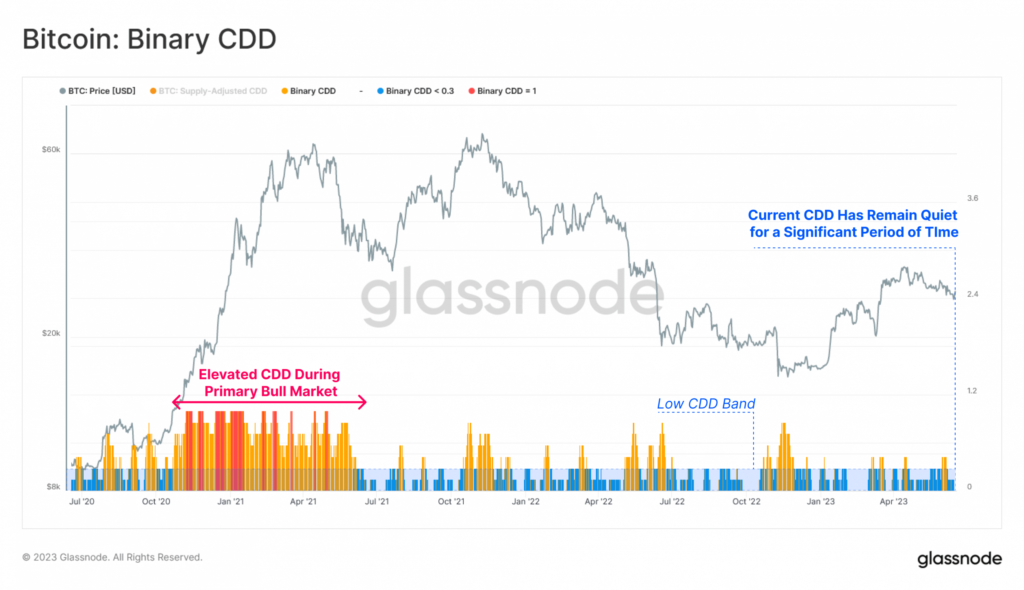

According to data from Glassnode, the spending of mature coins, which have been held for an extended period, remained relatively inactive compared to their typical level, even amidst significant year-to-date (YTD) price fluctuations. This suggested that long-term holders were holding steadfast, not succumbing to panic selling or excessive trading.

Furthermore, the press time level of the Binary Bitcoin Coin Day Destruction, a metric linked to the king coin’s movement and spending, remained relatively low compared to the substantial levels observed during the bull market of 2021.

This indicated that there had been relatively less activity in terms of Bitcoin spending lately, highlighting long-term holders’ patience and confidence.

Source: Glassnode

Alongside the increased positive sentiment showcased by long-term holders, retail investors have also begun showing interest in the king coin. According to Glassnode’s data, the number of addresses holding more than 1 coin has reached an all-time high of 4,394,881.

In addition to retail investors, whales are also re-entering the Bitcoin market, as the number of addresses holding more than 1 BTC experienced an upward trajectory over the past week.

This renewed interest from large-scale investors further reinforced the notion that Bitcoin continued to attract attention and confidence from a diverse range of market participants.

📈 #Bitcoin $BTC Number of Addresses Holding 1+ Coins just reached an ATH of 1,006,245

View metric:https://t.co/s7tx1xxyz3 pic.twitter.com/OND9zhRWsP

— glassnode alerts (@glassnodealerts) June 16, 2023

Bitcoin’s trader behavior

The Open Interest for Bitcoin has been on the rise as well, indicating growing market engagement and activity. The put-to-call ratio stood at 0.49 at press time, reflecting an optimistic sentiment among traders.

This sentiment was reinforced by the belief that the press time market conditions were favorable for Bitcoin’s future growth.

Source: TheBlock

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Bitcoin was trading at $26,568 at press time, experiencing a significant recovery following a correction in the previous week. Alongside its price recovery, BTC’s MVRV ratio also increased during this period. This suggested that some holders may start feeling the pressure to sell soon.

Additionally, the declining Long/Short difference implied a growing number of short-term addresses holding Bitcoin, who may be more inclined to sell their holdings once they become profitable.

Source: Santiment