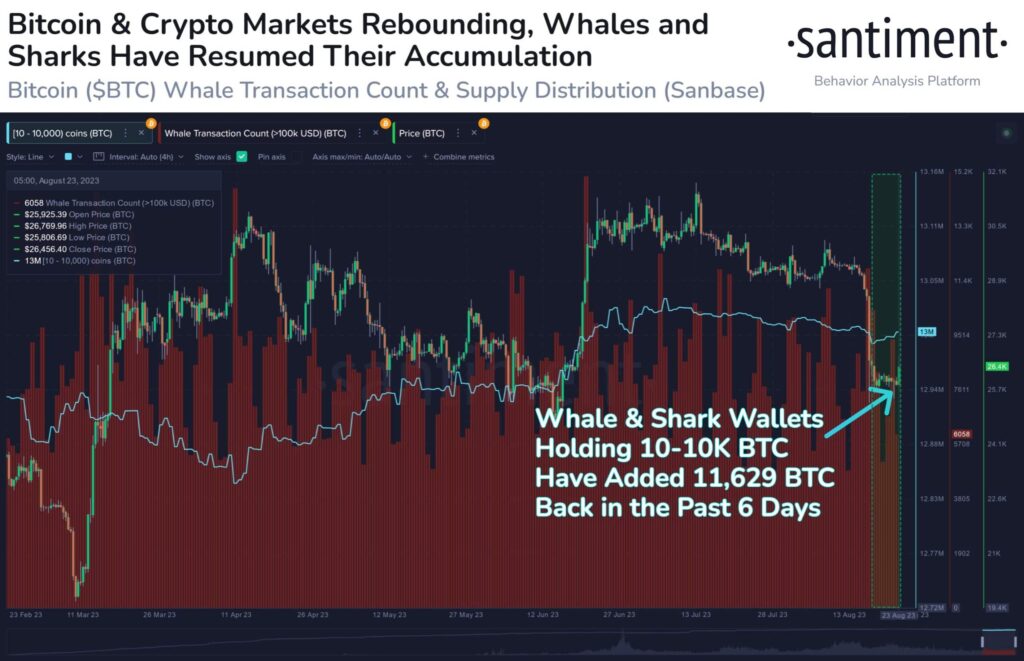

- Addresses holding between 10 to 1o,000 BTCs added about 11,629 tokens since the 17 August crash.

- The wallets holding more than 0.01 coins recorded a fresh all-time high as well.

Bitcoin’s [BTC] dramatic crash last week caused a big dent to investor portfolios, wiping out billions of dollars in market capitalization in a jiffy. Since then, the king coin has been rangebound, barely touching the $26,000 mark, data from CoinMarketCap showed.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, in a drastic turn of events, Bitcoin bumped to as high as $26.8k during 23 August trading hours. Furthermore, the token’s trading volume shot by 8.27% in the last 24 hours. An increase in price coming alongside an increase in volume is typically indicative of buying pressure and a bullish indicator for short and medium-term investments.

Although prices at press time pulled back to $26.4k, the brief rally, coming almost after a week of gloom, brought cheers and hopes to the market participants.

But what was behind the sudden uptick?

Whales show the way

The voracious appetite of Bitcoin’s large investors was again put to display as this influential cohort quietly went on adding to their existing positions.

According to popular on-chain analytics firm Santiment, addresses holding between 10 to 1o,000 BTCs added about 11,629 tokens to their existing supply since the crash on 17 August. At press time market price, this quantity amounted to $307 million.

Source: Santiment

It is well known that whales or smart money investors utilize the period of inactivity to strategically enter into accumulation mode. The “Buy the Dip” strategy, which involves adding to an existing long position of a fundamentally strong asset, has been frequently put to use by seasoned holders of Bitcoin.

A look at the whale transaction count revealed that large investors have been active since the start of the week. After a dip over the last weekend, trades worth more than $1 million increased to nearly 1330 per day.

Source: Santiment

Retail investors not too far behind

While the affinity shown by Bitcoin whales was hard to miss, retail investors of the coin also had a compelling story to narrate. This group, often known as non-professional investors, trades in much lower sums and is perceived as lacking in knowledge and research on investments.

However, these individual investors seem to also have their eyes set on the bullish potential of Bitcoin. As per a recent update by Glassnode, the wallets holding more than 0.01 coins recorded a fresh all-time high.

In fact, over a longer period of time, this cohort has steadily grown in number, surviving the tough periods of a bear market that may have come by.

📈 #Bitcoin $BTC Number of Addresses Holding 0.01+ Coins just reached an ATH of 12,264,393

Previous ATH of 12,264,262 was observed on 22 August 2023

View metric:https://t.co/oyguxpaA2y pic.twitter.com/dPnMTZzoai

— glassnode alerts (@glassnodealerts) August 24, 2023

It’s critical to gain the attention of the general public for an asset to become totally mainstream and accepted. Therefore, the rise in retail adoption appeared a promising signal for Bitcoin.

HODLing stays the norm

Of late, the long-term holders (LTH) of the coin have aggressively added to their stacks. At the time of writing, they held nearly 75% of the total circulating supply. The accumulation is rooted in the increasing popularity of BTC as a safe-haven asset.

Having weathered the U.S. banking crisis without too much damage, free from U.S. regulators’ hawkish radar, and upcoming bullish events like halving and spot ETF approval, led investors into believing that the “digital Gold” was not a misnomer after all.

Source: Glassnode

Is your portfolio green? Check out the Bitcoin Profit Calculator

Ethereum shows similar trend

It wasn’t just Bitcoin that was devoured by the whales. The second-largest digital asset Ethereum [ETH] was also snapped up since the market crash last week.

As per data from Lookonchain, four whale addresses amassed more than 56k ETH tokens in the past seven days. About 96% were acquired by just three addresses who added roughly 18k coins each to their portfolios.

The accumulation spree boosted ETH’s price as well over the last 24 hours. The largest altcoin exchanged hands at $1,674.73 at the time of writing, up 1.86%, per CoinMarketCap data.