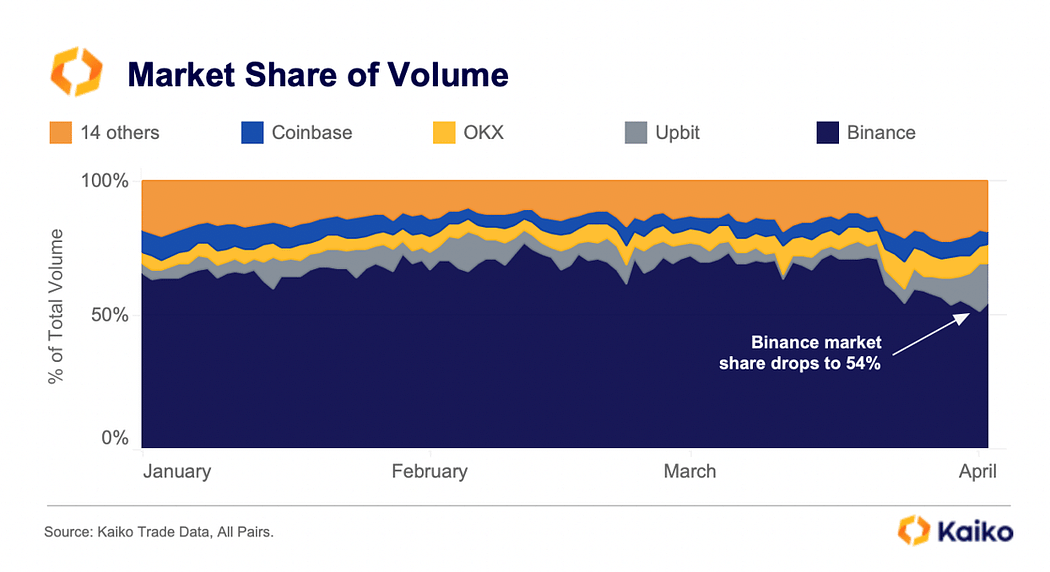

Top crypto exchange Binance has seen its market share plunge in recent weeks amid regulatory issues in the United States, according to crypto data provider Kaiko.

Kaiko notes in a recent newsletter that Binance lost 16% of its market share in just the past two weeks.

The firm notes that the decline occurred in part due to the recent news that the Commodities Future Trading Commission (CFTC) charged the exchange, its CEO Changpeng Zhao, and the company’s former chief compliance officer Samuel Lim with a long list of regulatory violations.

However, Kaiko attributes the majority of the lost market share to Binance ending its no-fee trading promotion for 13 BTC spot trading pairs.

“Binance lost 16% market share of spot volume in just two weeks after the CFTC lawsuit and end of zero-fee trading. But the trend is quite different when looking at derivatives volumes: Binance only lost about 2% of market share for perpetual futures trade volume. This suggests that the majority of market share was lost purely due to the end of zero-fee spot trading, rather than trepidations around a lawsuit.”

The data provider notes that Binance remains the largest exchange in the world with 54% dominance over the global market.

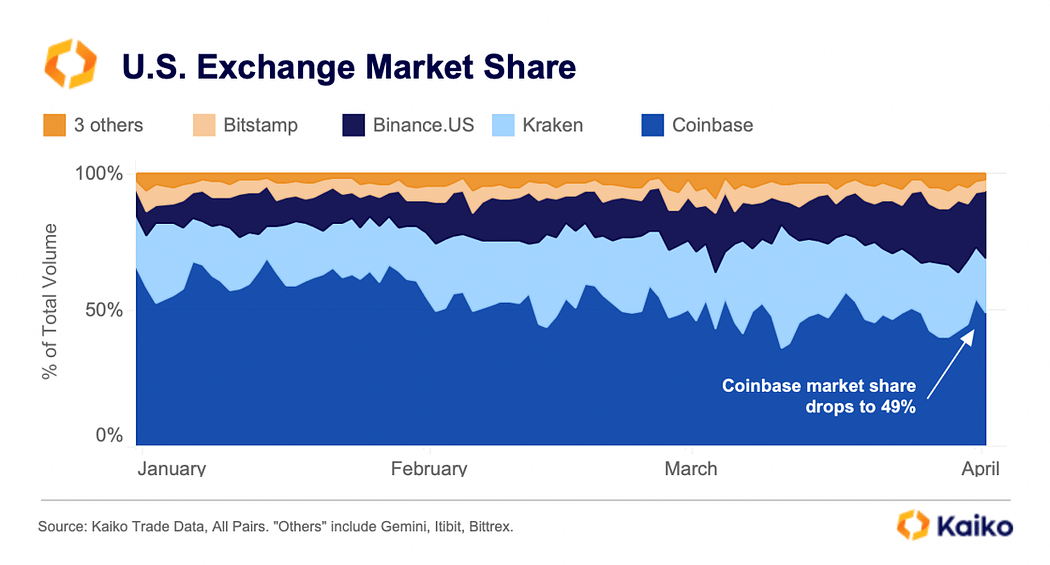

Kaiko also reports that top US crypto exchange Coinbase lost a significant chunk of its domestic market share.

“Even Coinbase, which has historically made very strong efforts with regulators, received a Wells Notice focused on its staking service while Kraken was forced to shut down its service earlier this year. Throughout Q1, Coinbase’s [US] market share dropped from a weekly average of 60% to just 49%.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney