- There was a 30% monthly growth in new contracts on Avalanche in January.

- AVAX bottomed out on 13 January and rebounded impressively to clock gains of 14% until press time.

The Avalanche [AVAX] ecosystem has recorded significant growth since the start of 2023. According to a tweet, the daily gas usage on the network grew at an exponential rate on a year-to-date (YTD) basis.

Daily gas usage for @avalancheavax has been on the rise YTD.

Meanwhile new contracts rose 68% Month over Month.

What’s $AVAX cooking? 🔺 pic.twitter.com/JY95RTUB8O

— Emperor Osmo🧪 (@Flowslikeosmo) February 23, 2023

Read Avalanche’s [AVAX] Price Prediction 2023-24

One reason behind the surge could be the rise in the number of new contracts. According to Dune Analytics, there was a 30% monthly growth in new contracts in January, while February saw a whopping 75% jump in the number of new contracts.

Hype for Avalanche rises

Since the beginning of the year, Avalanche has forged high-profile partnerships to boost its network appeal. In January, it joined hands with Amazon AWS to promote the usage of blockchain technology for enterprises and government agencies.

Earlier this week, it took an enormous leap in the GameFi landscape after announcing a collaboration with Indian streaming platform Loco to launch a NFT gaming marketplace.

These high-value deals led to a surge in Avalanche’s social metrics, as mentions and engagements on social platforms increased by 16% over the past week.

🔺Avalanche Weekly Social Signals🔺

Most Influential Projects@CheemsInu@Ste_Cha_FEG@_VaporFi@GMDprotocol

Influencers of the Week@AltCryptoGems@0x_forexus@_TrueVoodoo@Jamyies

Source: @LunarCrush#AVAX $AVAX #Avalanche pic.twitter.com/rz8cZUyY6k

— AVAX Daily 🔺 (@AVAXDaily) February 23, 2023

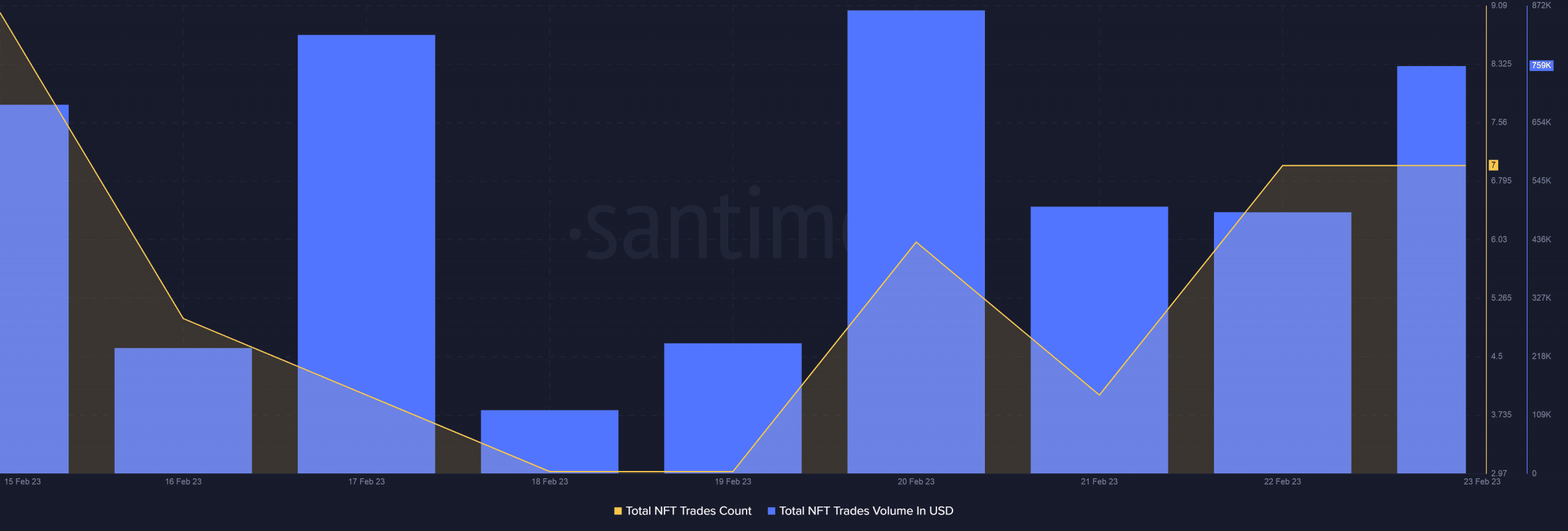

The past week also saw a growth in AVAX’s NFT ecosystem. As of 23 January, the NFT trade volume jumped by 55% over the previous day with a rise in the number of NFT transactions as well.

Source: Santiment

Which direction will AVAX go?

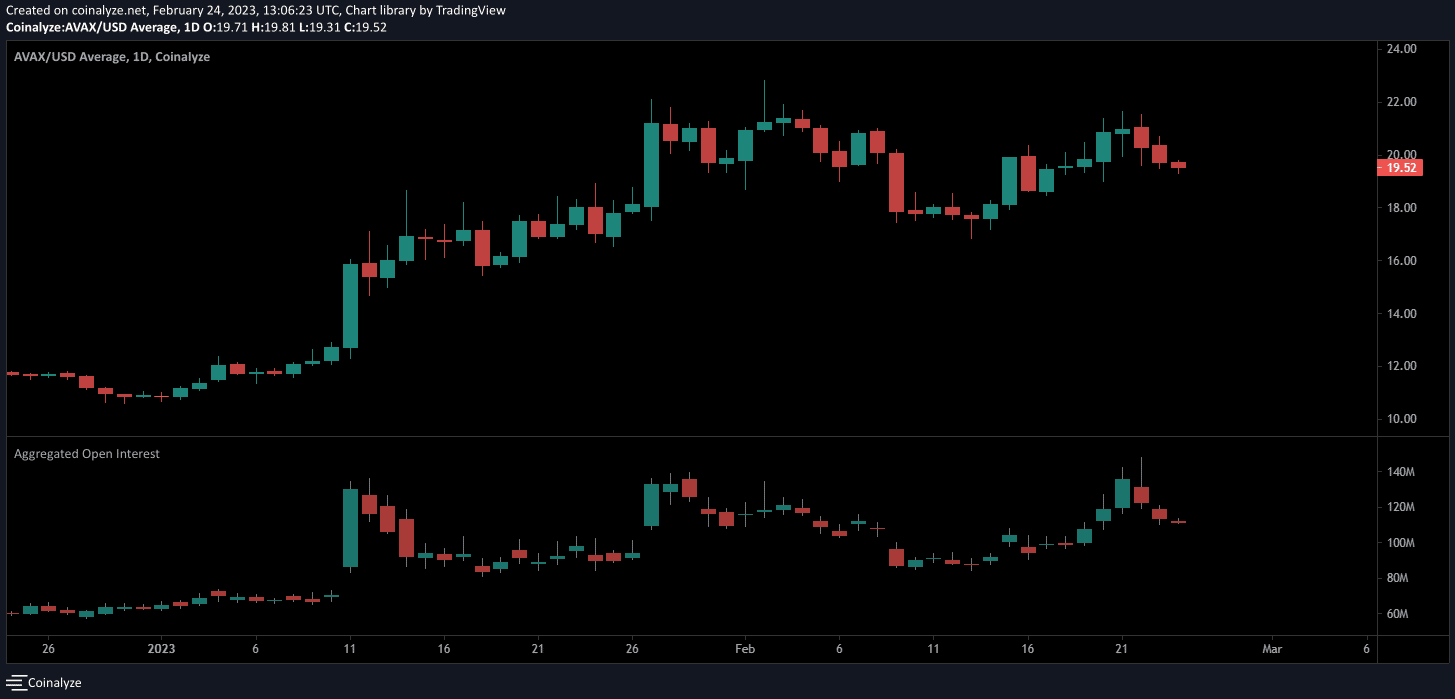

AVAX bottomed out on 13 January and rebounded impressively to clock gains of 14% until press time, data from CoinMarketCap showed.

AVAX broke past the indicated resistance at $19.54 on 19 February, but quickly retraced to test it as support. This could be a bullish signal in the short term.

Source: Trading View AVAX/USD

Realistic or not, here’s AVAX’s market cap in BTC terms

The Relative Strength Index (RSI) descended but was still above the neutral 50 mark. The Moving Average Convergence Divergence (MACD) line almost overlapped the signal line, suggesting that AVAX’s next move was difficult to predict.

AVAX saw a growth in its Open Interest (OI) and the trajectory aligned with that of its price. The growth in OI meant that new positions were being opened, which could aid the price in the short term.

Source: Coinalyze