What is Asymetrix Protocol?

The Asymetrix protocol does exactly what its name suggests. It distributes bet profits asymmetrically. In other words, it randomly allocates additional bonuses as you bet. The protocol tries to attract as many people staking ETH. In return, you can get a great reward.

The inspiration for the Asymetrix protocol came from a financial instrument called Premium Bonds in the UK, which has assets worth over £100 billion and is used by 22 million people.

This idea will suit the crypto community, as it is fair, verifiable, decentralized, non-custodial, and community driven. Asymetrix will bring this success story to crypto with all the advantages of decentralization.

Why is Asymetrix Protocol so attractive?

The goal is to create an analog of Premium Bonds in crypto with a large number of winners. Asymetrix will distribute staking rewards in such a way that the base average return for all users is not significantly reduced (e.g. 3% APR instead of 5% for ETH staking), while still offering the opportunity to claim super large rewards (equivalent to up to 1 million USD).

This approach will benefit everyone, incentivizing users to hold ETH and secure the network by staking, with the chance to receive excellent, life-changing rewards.

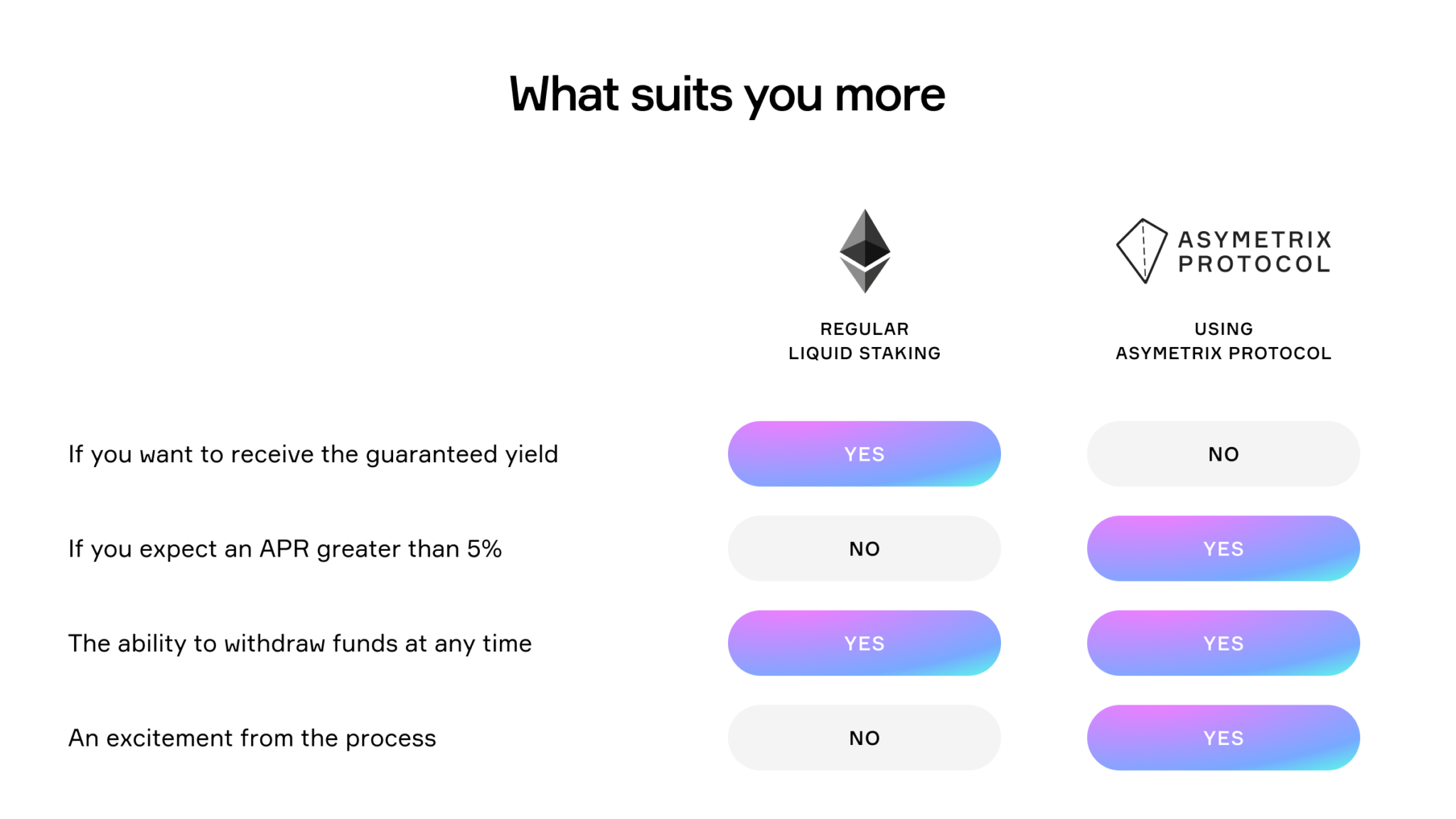

You can compare it with the lottery to bet your ETH. The image below gives you an idea of what to expect. So let’s take a look at this. Your main asset is stETH which you bet at 4.5% APR. You bet because it makes a profit, and you know exactly when and where you get that profit. You can withdraw anytime you want.

How the protocol works?

Asymetrix is started when a User submits their stETH token into the protocol. After a user deposits money into the Asymetrix Protocol, the smart contract mints PST (Group Share Token) at 1:1 and sends it to the user’s wallet. The PST token reflects the user’s share in the protocol and is required for withdrawals.

The minimum deposit amount is 0.1 stETH in the current version of the protocol. However, the deposit does not have to be a multiple of 0.1 stETH (i.e. 0.11234 stETH is accepted). Please note that the current version of the Asymetrix Protocol has a minimum deposit of 0.1 stETH.

ETH staking rewards are accumulated within the protocol. The balance of stETH in the protocol is growing at the current Lido APR rate and is updated every 24 hours.

Profits are distributed to users through a draw. The draw takes place every 604800 seconds (~once a week, this parameter is adjusted at the discretion of the DAO). Selected winners are determined using Chainlink VRF, which is a best-practice solution in the crypto space to ensure provably fair randomness.

Your exact win rate changes dynamically in real-time (see the following article for more information). By default, the user’s initial deposit remains in the protocol for the next withdrawal. No need to re-enter each withdrawal manually.

In the event of a win, the user automatically gets their reward in the form of PST (an amount equivalent to stETH), so the user’s balance is increased, which automatically increases the odds for the next draw. Therefore, there is no need to claim rewards every time. It will be done automatically.

Users can withdraw their deposits at any time. The Asymetrix protocol will burn the current user’s PST tokens to obtain stETH tokens at a 1:1 ratio.

Let’s say 100 users each deposit 1 stETH into the Asymetrix smart contract, resulting in a total of 100 stETH. Holding stETH generates a staking bonus of 5 stETH, which is distributed fairly and randomly to one winner. While some users may get a 0% staking bonus, the winners will receive an impressive 500% return on their investment! It is important that all users keep their initial deposit, ensuring that there are no downsides to participating in the Asymetrix protocol.

How is the winner selected?

Since the protocol accumulates yield over time, a fundamental metric is a time the user’s stETH has been in the pool and how much yield it has generated for the protocol. Otherwise, a crypto whale could cheat by entering the protocol at the last minute with a big deposit, receive huge odds, and “steal” yields from small users.

Therefore, the first indicator that affects the odds is TWAB (time-weighted average balance). This indicator displays the user’s contribution to the pool’s total yield generated between draws.

Next is the PICKS parameter. You can think of picks as the number of tickets you hold. Each user has a certain number of PICKS, and every pick in the draw takes part in the process of selecting the winner.

When we have a number of picks for each user, the Asymetrix creates the list for the draw.

As the next step, the list of all participating tickets (PICKS LIST) is hashed to generate a unique ID for the request. A request is then sent to Chainlink VRF to generate random numbers. Chainlink VRF generates random numbers, which can range up to 2^256 possible values. A modulo function is applied to the results to ensure the result falls within the range required for the number of participating tickets.

Once there are random numbers within the required range, it is matched with the content of the relevant PICKS LIST to determine a winner. Winners are determined based on the randomly generated numbers by Chainlink VFR that fall within the valid range, providing fair and equal odds for each ticket.

Detailed information for each draw is available on a separate page, allows users to ensure that the draw is fair, transparent, and fully traceable.

The bottom line is that both parameters affect your odds: the size of the user deposit and the time deposit was in the protocol. Asymetrix protocol dynamically calculates odds for all users.

ASX Token

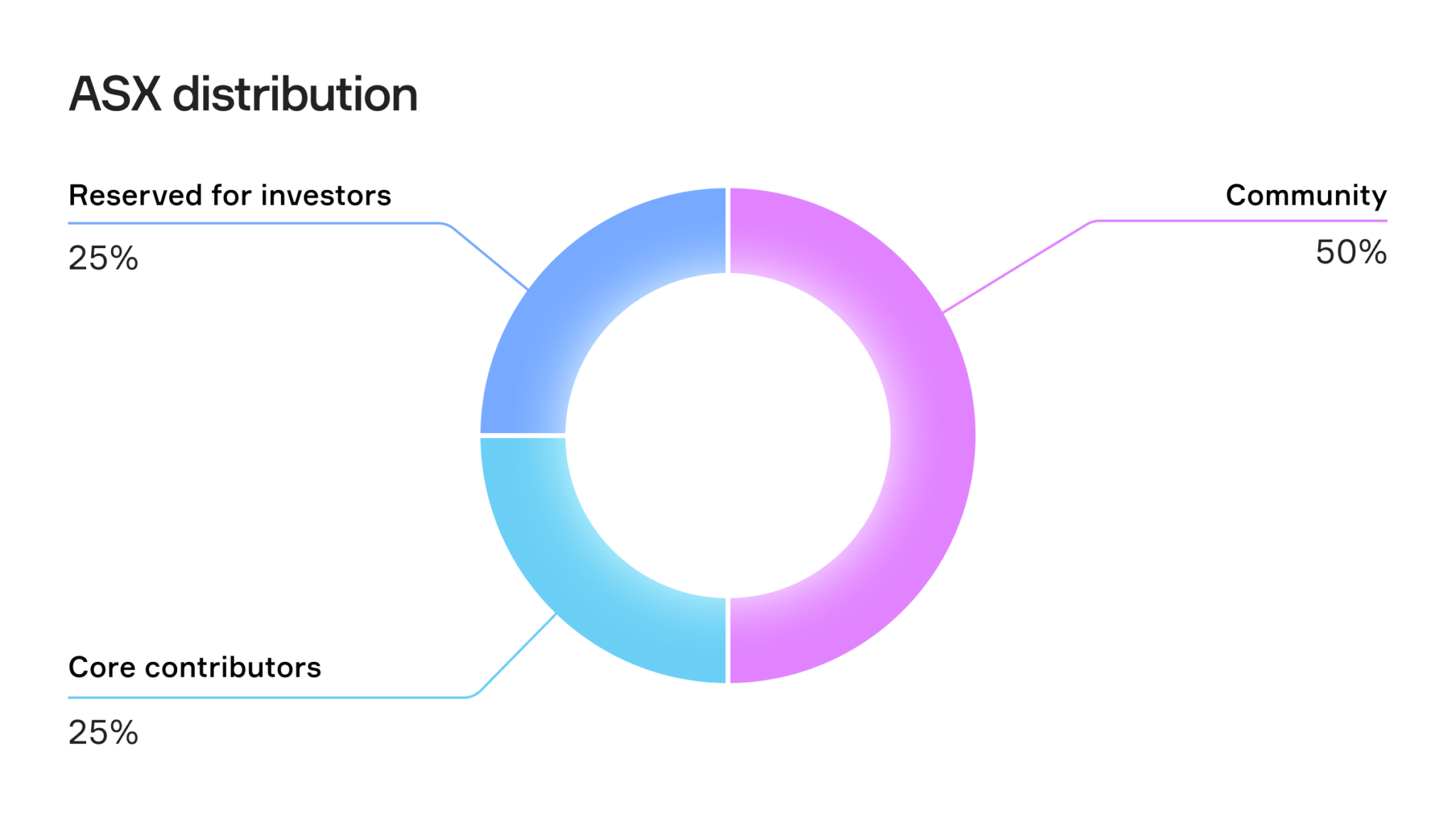

The core of any project is the community, that’s why fair token distribution is the most important part. The Asymetrix protocol allows users to earn ASX governance tokens on completely equal and transparent terms. This approach fits perfectly with the main feature of the protocol: cultivating thrifty behavior because all users can earn ASX regardless of the outcome of the draw.

The total amount of ASX – 100,000,000.00 ASX. Type – ERC-20

Governance model

The Asymetrix protocol was designed as a DAO with the ultimate goal of creating a fully decentralized protocol owned, controlled, and managed by the community.

The value of users in the DAO, expressed in ASX tokens, gives them weight in the governance vote. These tokens will be distributed among the users and participants of the protocol.

What are the benefits of participating in the DAO?

Through voting, users can now change the following protocol settings:

- Number of winners in each draw;

- Distribution of rewards among winners;

- Treasury management;

- The percentage of profits will go to the treasury or implement another mechanism to capture value in ASX tokens;

- Other decisions regarding the operation of the protocol.

How does the voting process work?

Discussions take place on forums, and people can create topics and participate in debates. It is also possible to create and participate in forum voting to check the temperature of an issue in advance.

Governance voting takes place on Snapshot and is free as no blockchain fees are required. Each token is equivalent to one vote, and users with a balance of 50,000.00 ASX can create a poll.

The minimum number of votes required to accept a proposal is 1,000,000.00 ASX for a positive (majority) vote. Any wallet that owns ASX can vote, but each account’s ASX token balance is taken when the proposal starts.

Fee

Judging from the current documents, the agreement does not have a clear business model or fee structure, nor does it charge any fees from the revenue generated by the agreement.

This means that all profits from the distribution of protocol revenue will go to users who deposit stETH into the protocol, while AXS token holders will not receive any rewards or dividends from the revenue of the protocol. This also means that the AXS token has no strong need or utility in the protocol, and its value depends entirely on speculative participation or governance.

Conclusion

Asymetrix Protocol allows holders of a small amount of ETH to participate in the exciting world of LSDfi, where they can enjoy high returns and randomness through asymmetric reward distribution. The protocol is also easy to use, as users deposit stETH into the smart contract and wait for weekly withdrawals. However, there is still plenty of room to improve the token design of the protocol, as the ASX token needs a clear value proposition or incentive to align the interests of users, developers, and governance participants.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.