- Bitcoin’s hashrate and network difficulty could increase from their ATHs.

- Miners’ fees have improved, but total revenue remained underwater at press time.

Bitcoin’s [BTC] Year-To-Date (YTD) performance of over 70% has been one of the best in its history, considering the number of months it took to reach the landmark. But unbeknownst to many, the price rise also impacted the mining industry, which faced a lot of challenges in the past year.

How much are 1,10,100 BTCs worth today?

Stifel, a Canadian investment firm, gave an update on the matter in its 20 March blockchain industry update. According to the firm, the first three months of the year have affected an increase in the hashprice. The hashprice provides a clue into the hardware miners use. It also gives an overview of the revenue generated on a per terahash basis.

More competition in block production

Although the average hashprice fell 7% on a Month-on-Month (MoM) basis, it could still keep miners above water.

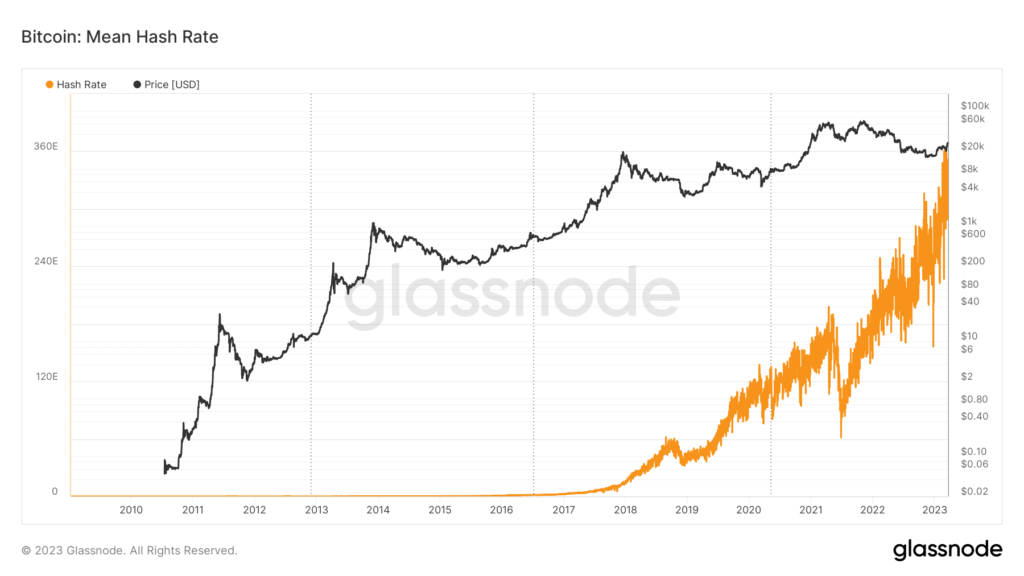

Furthermore, the rise in BTC’s price has also been followed by ATH records for the Bitcoin hashrate and network difficulty. However, Stifel noted that the network difficulty could add another 5.5% by 23 March.

The network difficulty measures how time-consuming and challenging it is to find the right hash for each block. At press time, the metric was 43.55 Target (T). This projection implied that discovering new Bitcoin blocks would be very competitive as the day goes by.

It was also the same projection for the hashrate as the organization firmly said it expected growth in that regard. As of the time Stifel published its report, the Bitcoin hashrate was 326 Exahash per second (EH/s). However, the firm gave its reason, saying,

“We expect continued growth to the overall network hash rate in the near term as newer gen machine deliveries are installed and brought online.”

The hashrate describes the amount of processing and computing power per second taken to verify transactions and secure the Bitcoin network. Interestingly, it may seem that Stifel was right after all. This was because Glassnode’s data at press time showed that the hashrate had increased to 348 EH/s.

Source: Glassnode

Thanks to BTC, fees have been…

Thus, the data above means that more equipment has been deployed to create new blocks. The release by Stifel also seemed to confirm this sentiment. For one, Stifel reported that mining companies HIVE-N and ARBK-N have both improved mining operations. And this was due to newly installed mining machines and the reduced cost of power.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Although total miner revenue was still in a struggling phase, the fees generated have been able to fill in. At the time of writing, miners’ revenue generated through fees increased by 4.916%. This explains that newly minted coins have resulted in profits for the operators.

Source: Glassnode

However, BTC has slipped from $28,00. But nonetheless, this might not be enough to halt the respite experienced by the mining industry. At the same time, it gives no certainty about improved conditions.