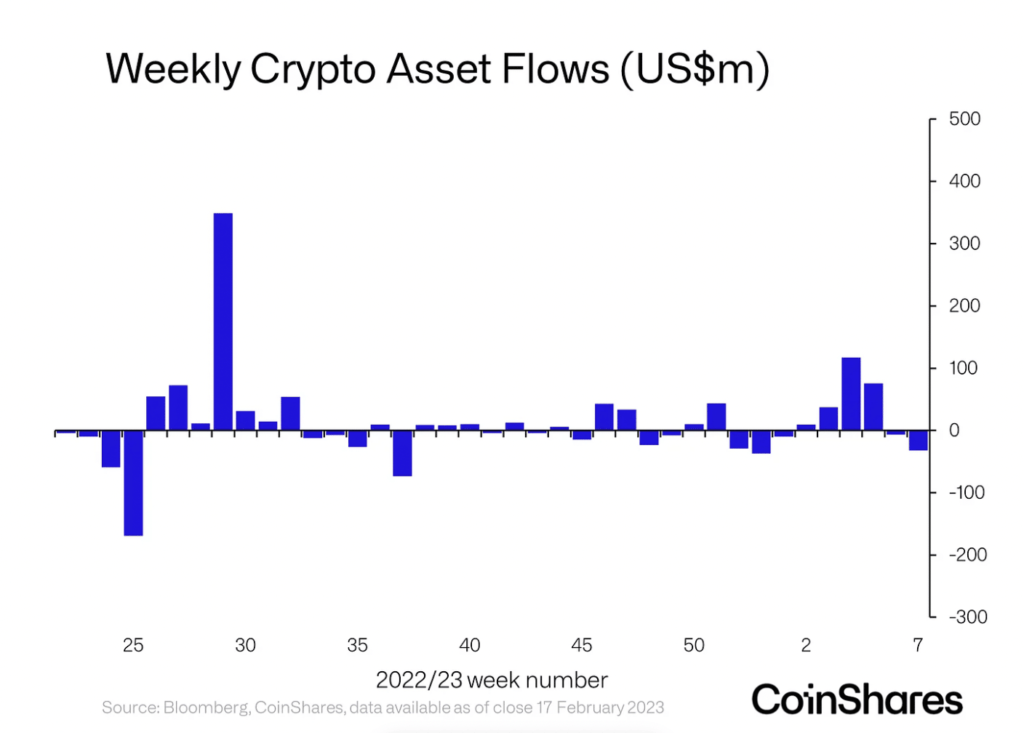

- Digital asset investment products logged the second week of consecutive outflows last week.

- In spite of the negative sentiment, BTC’s price was undeterred as it rallied.

In a new report, CoinShares, a digital asset investment firm, reported a significant shift in investor sentiment toward cryptocurrencies. After several weeks of price growth for many digital assets, negative sentiment has re-entered the market, resulting in two consecutive weeks of outflows from digital asset investment products.

As per CoinShares, in the last week, digital asset investment products

“Saw outflows totaling US$32m last week, the largest since late December 2022.”

The report, released on 20 February, suggested that investors have become increasingly cautious about further price rallies, prompting them to withdraw their funds from the market to hedge against any sudden price drops.

The shift in sentiment is a stark contrast to the bullish outlook that has been prevalent in the last month as leading digital assets such as Bitcoin [BTC] and Ethereum [ETH] saw significant price gains culminating in increased inflows for these assets.

Source: CoinShares

King in all ramifications? Bitcoin bears an uneasy burden

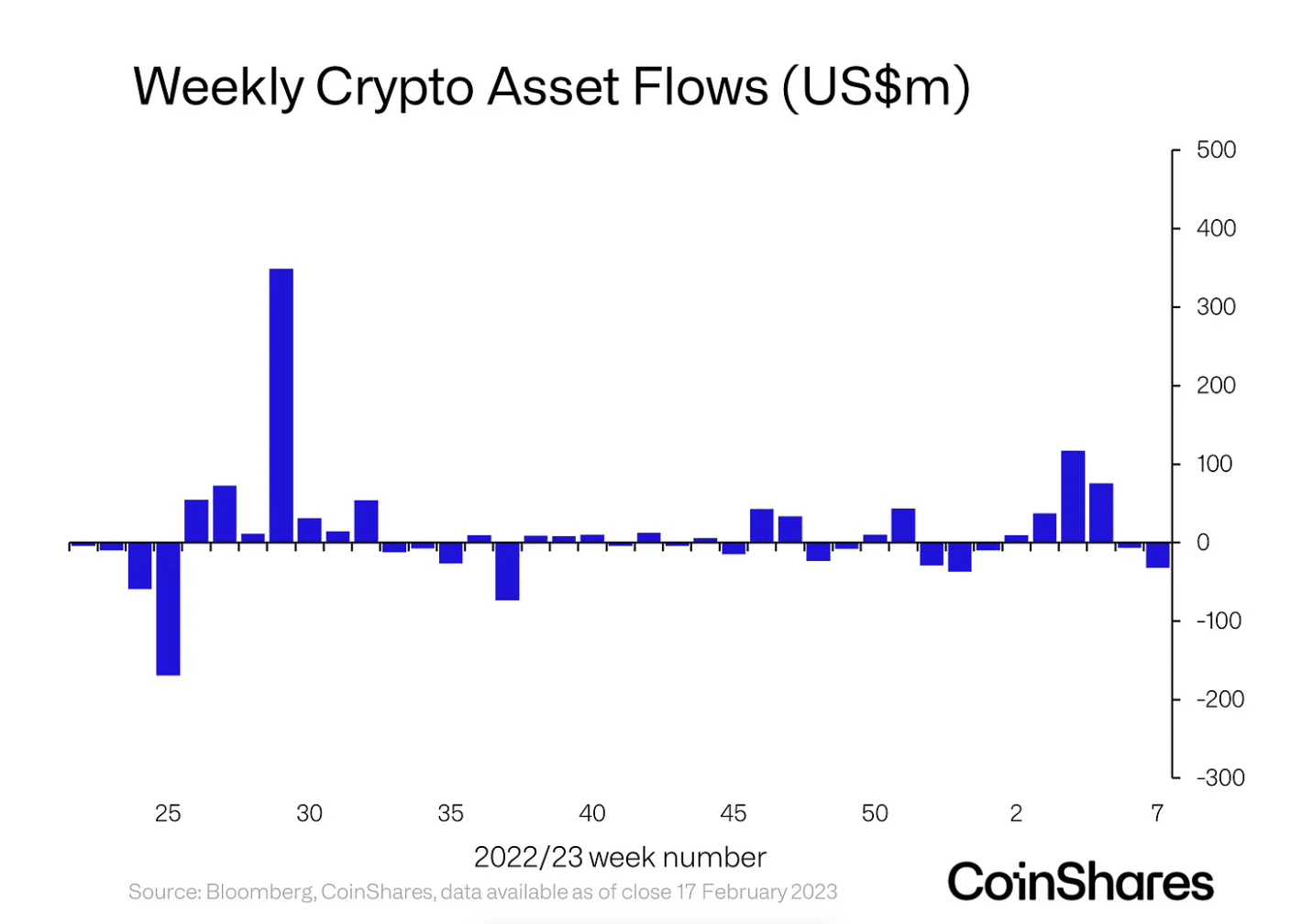

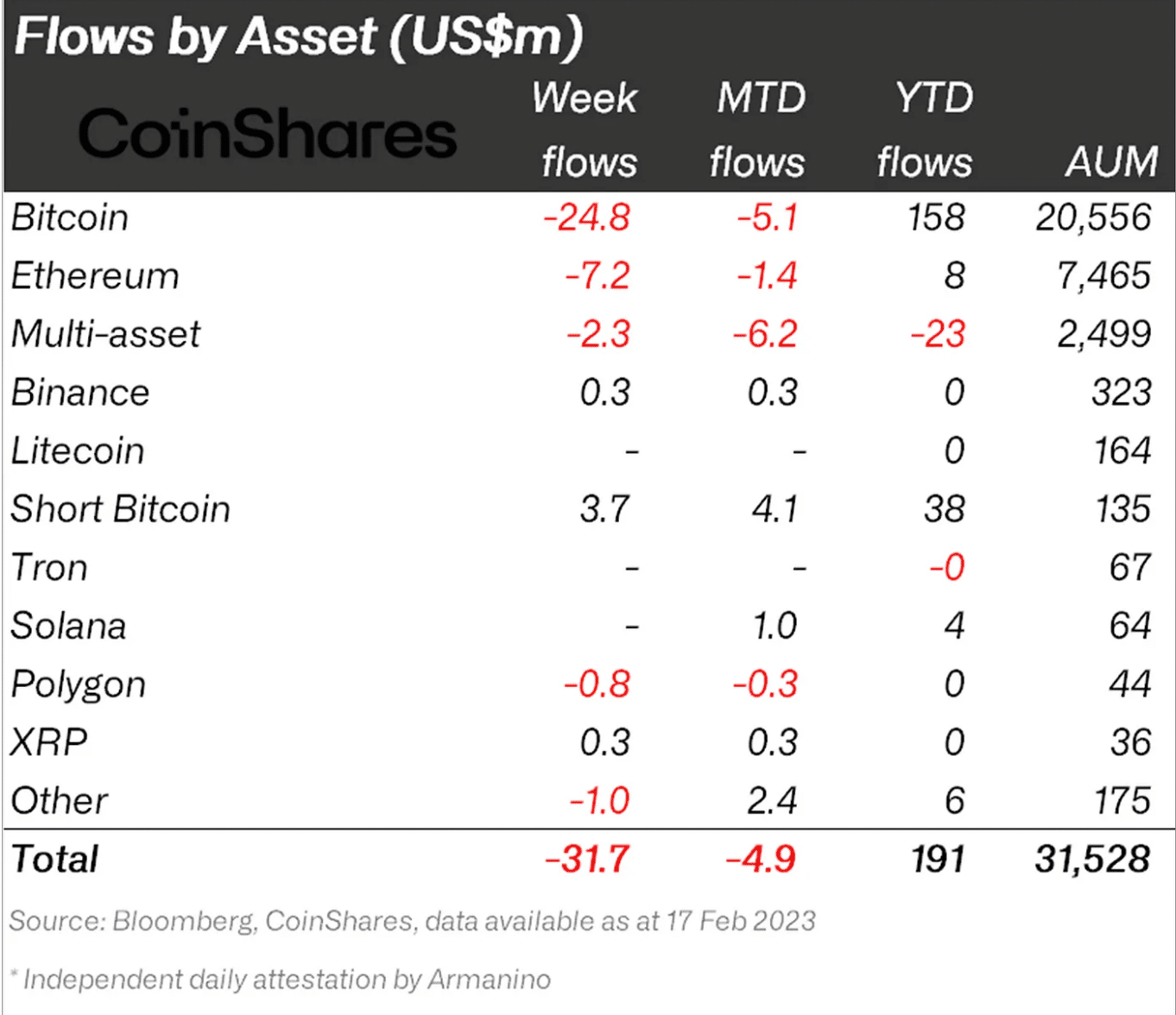

According to the report, of the $32 million removed from the digital assets investments market last week, leading cryptocurrency BTC was the most affected, recording up to $25 million in outflows. This represented 78% of the total sums taken out.

In the previous week, BTC saw outflows that totaled $10.9 million. The recent $25 million outflows brought the total outflows for the king coin on a month-to-date to $35.9 million.

Interestingly, the case was different for short-bitcoin investments. After logging a minor outflow of $3.5 million the week before, the asset class saw inflows totaling $3.7 million last week. CoinShares found:

“Short-bitcoin investment products saw inflows of US$3.7m and has seen some of the largest inflows YTD of US$38m, second only to Bitcoin with US$158m.”

Source: CoinShares

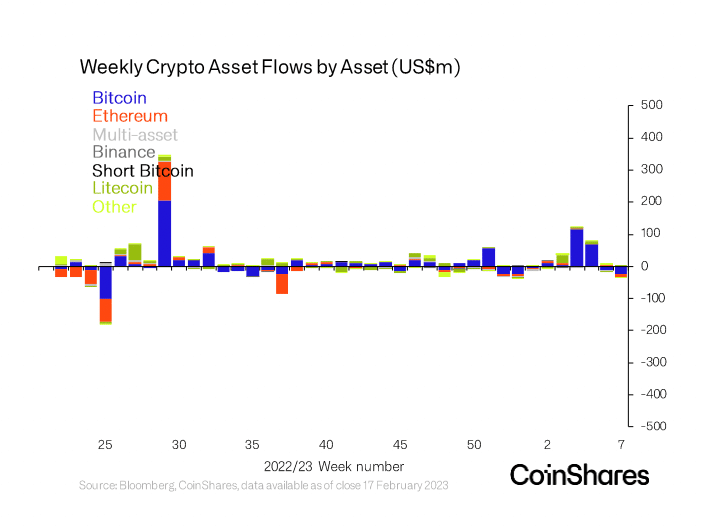

Investors were divided on the altcoins

Per CoinShares, investors’ sentiments were positive and negative for the altcoins. While some assets saw inflows, some registered outflows, the report stated.

Crypto assets such as ETH, Cosmos [ATOM], Polygon [MATIC], and Avalanche [AVAX] experienced outflows of $7.2 million, $1.6 million, $0.8 million, and $500,000, respectively. Conversely, assets, including Aave [AAVE], Fantom [FTM], Ripple [XRP], Binance Coin [BNB], and Decentraland [MANA], all posted inflows “between US$0.36m — US$0.26m.”

Source: CoinShares

Here comes the silver lining for digital assets

While negative sentiments permeated the general market last week, CoinShares found that it was “not expressed in the broader market.”

According to the report, despite the negative sentiments, BTC’s price rallied, pushing the coin’s total assets under management (AuM) to $30 billion, the highest level since August 2022.

“We believe this is due to ETP investors being less optimistic on recent regulatory pressures in the US relative to the broader market,”

CoinShares opined, commenting on what might have prompted the price growth amid declining positive sentiments.