- Long-term holdings continued to charge to new highs.

- Short-term holders’ confidence has moved to a neutral state.

Excitement was in the air as Bitcoin [BTC] blasted past the $35,000 barrier for the first time since May 2022, the fateful month which precipitated the crypto bear market.

How much are 1,10,100 BTCs worth today?

Following BTC’s most significant pump of 2023, when it rallied from a low of $27.1k to a high of $35.1k, the prices have started to consolidate around yearly highs. At the time of writing, BTC exchanged hands at $34,168, marking 18% weekly gains, according to CoinMarketCap.

Long-term holders undeterred

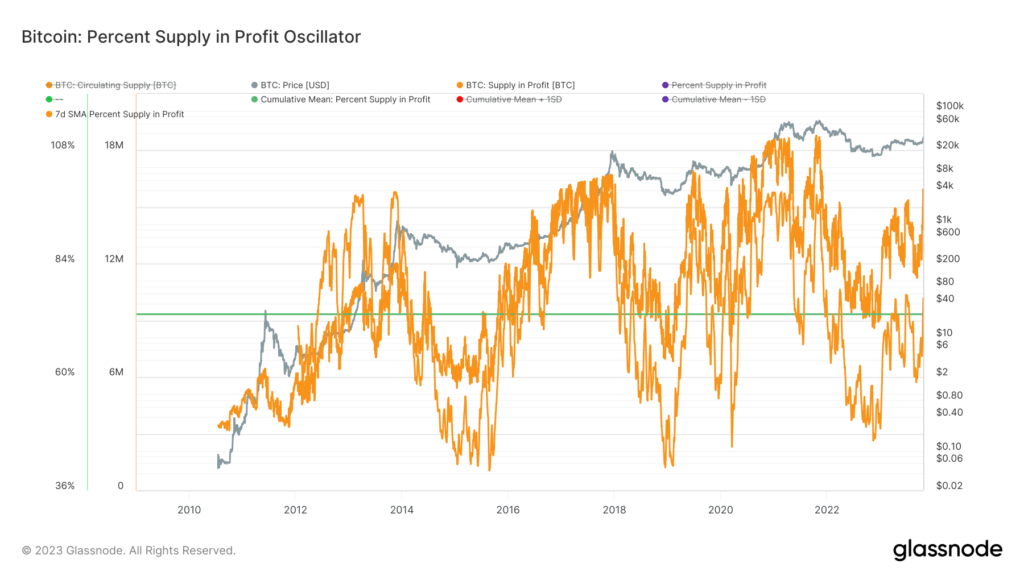

Naturally, a rally of such proportions could have far-reaching impacts on the behavior of holders. According to the latest report by the on-chain analytics firm Glassnode, a considerable chunk of BTC’s supply, nearly 4.7 million, became profitable.

With this, more than 80% of the BTC’s in public hands was in profit. In fact, the Percent Supply in Profit Oscillator climbed above the long-term average.

Source: Glassnode

However, the prospect of profits failed to deter the resoluteness of long-term holders (LTH). Known as diamond hands or experienced investors, these users don’t spend their holdings for at least 155 days and are thought to possess high risk tolerance.

The conviction was on display yet again as LTH holdings continued to charge to new highs. At the time of writing, nearly 14.8 million BTC were in custody of the LTH cohort.

Source: Glassnode

Interestingly, nearly 30% of LTH supply was underwater, which was deemed to be “historically high” as per the report. This might be one of the other reasons why the LTH cohort was exhibiting more conviction and less willingness to let go of their stashes.

Furthermore, a glance at the Revived Supply metric indicated that less and less coins held for longer than one year were being spent. The negative Z-Score reflected a regime of coin dormancy and strengthening of the bullish narrative.

Source: Glassnode

Short-term holders in a neutral state

While long-term investors remain unruffled, intriguing insights emerged from the behavior of short-term holders (STH) as well. The STH cost basis or the STH Realized Price (STH RP) was breached recently.

This meant that, on average, recent buyers of the coin were at a 20% gain on their investments.

STH RP has historically served as a reliable support level during strong uptrends. Previous breaches of this level applied significant bullish impetus to Bitcoin.

Source: Glassnode

As indicated, the STH-MVRV Ratio went above the STH RP after the latest rally. Notably, STH-MVRV saw losses of 10% during the August market crash. However, Glassnode dubbed this decline “shallow” in the report and claimed that the correction found good support from which it swung during this week’s bull run.

A similar pattern came to light when STH Spent Output Profit Ratio (SOPR) was examined. Note that unlike the MVRV Ratio that tracks unspent supply, SOPR looks at coins that have actually moved on-chain.

Source: Glassnode

Like MVRV, the STH SOPR went into positive territory after a “shallow” drop during August. Short-term holders recorded an average profit of 2% on spent coins.

Combining the two models, Glassnode’s analysis concluded that STH’s confidence has moved to a neutral state. This implied that STH who are spending have a similar cost basis to the ones HODLing, a sign of resilience.

Interestingly, the STH supply increased since the start of the week. This indicated either the entry of new market participants or the existing STH user cohort adding more to their portfolios.

Source: Glassnode

Is your portfolio green? Check out the BTC Profit Calculator

A look at the futures market

Bitcoin’s bull run also impacted the futures market positions. While the Open Interest (OI) increased, it wasn’t boosted by the long position traders.

As per data from Hyblock Capital, the market’s sell volume was higher than buy volume, implying that longs didn’t enter the market through aggressive orders. To the contrary, this could reflect the entry of shorts or bearish leveraged traders in the market.

Source: Hyblock Capital