- Market players seemed ready to take action whenever Bitcoin was ready to move upwards.

- Some profit-taking may occur, but macroeconomic factors supported an uptrend.

Since this cycle became the longest bear market in crypto’s history, many Bitcoin [BTC] holders have had no option but to wait for respite. At some point, it seemed that the worst was over.

Is your portfolio green? Check out the BTC Profit Calculator

But almost every time it looked like that, another retracement happened. Hence, the broader crypto market cap has found it challenging to get itself out of the $1 trillion range.

Lately, Bitcoin reclaimed $27,000 and has maintained the level up until press time. However, Santiment revealed that there could be another correction, as market participants could be involved in another round of profit-taking.

Brilliant potential for BTC

But on the brighter side, whales have been accumulating BTC and Tether [USDT]. Typically, Bitcoin accumulation favors an upward trajectory.

Also, when stablecoin accumulation like USDT increases, it means that market players have great buying power, which could be advantageous for BTC in the long term.

📊 The long-term outlook is bright for #Bitcoin with whales accumulating $BTC & $USDT. However, watch for a short-term correction with traders profit taking heavily as $27K hit Thursday. When the 7D MVRV gets below 0, that may be ideal for another leg up. https://t.co/oBSTRGumui pic.twitter.com/sO0S9SX7aS

— Santiment (@santimentfeed) September 29, 2023

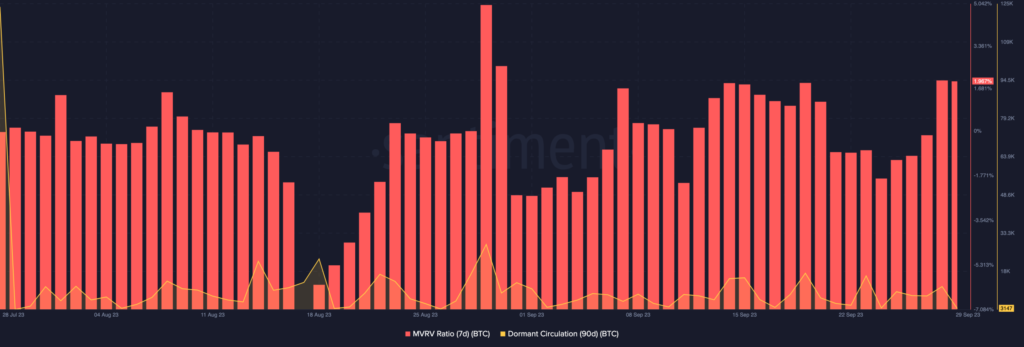

One metric used to assess Bitcoin’s long-term outlook is the Market Value to Realized Value (MVRV) ratio. The MVRV ratio is the ratio of the market cap of a crypto asset to its realized value.

While it helps in providing information about traders’ buying and selling behavior, it could also help in identifying tops and bottoms. As of this writing, the seven-day MVRV ratio had increased to 1.96%. This was because of the recent hike in BTC’s price.

However, a correction of the price could drop the metric down to zero. If this happens, then the whales and stablecoin holders in waiting could increase the buying pressure on BTC. This would consequently lead to another price hike.

Another indicator to watch out for is the dormant circulation. At press time, Bitcoin’s 90-day dormant circulation was down to 3147. The metric considers the activity of coins that have not moved for a long while.

Source: Santiment

The decrease in dormant circulation implies that most long-term holders have refrained from selling. If it remains that way, then Bitcoin could perform excellently in the months/years to come.

Long-term holders are equipped and ready

Interestingly, Bitcoin’s 90-day Mean Coin Age (MCA) has been increasing since August. The MCA is the mean value of all the coins on the blockchain, weighted by the average purchase price.

One explanation for this increase is that market participants have significantly stored Bitcoins in cold wallets.

With a lack of notable movement in the BTC value, one can interpret this to mean that holders are equipped enough to get involved in large trading activities whenever the bull market returns.

Source: Santiment

How much are 1,10,100 BTCs worth today?

Andrew Kuznetsov, co-founder and CTO of Islamic Coin, spoke to AMBCrypto on Bitcoin’s potential. According to Kuznetsov, the April 2024 halving could push Bitcoin toward a new All-Time High. He said,

“The halving, expected next April, alongside potential macroeconomic shifts such as spot Bitcoin ETF approvals and a rate cutting cycle from major central banks, sets the stage for a promising 2024.”