- Arbitrum recently crossed the 9 million total addresses count.

- However, the daily transactions count on the network is falling.

While the cumulative count of distinct addresses on Layer 2 (L2) platform Arbitrum [ARB] recently crossed the 9-million mark, daily transactions on the optimistic rollup network were dwindling, on-chain data revealed.

Realistic or not, here’s ARB’s market cap in BTC’s terms

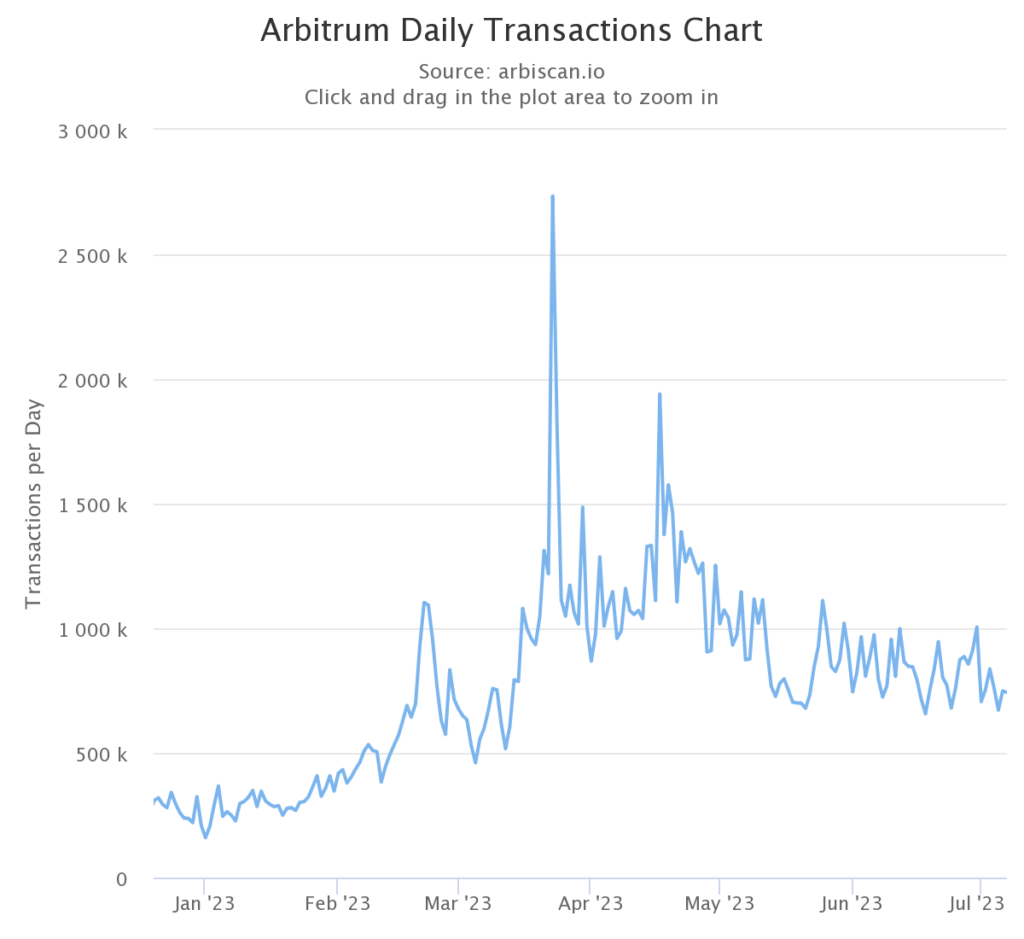

As of 7 July, the total number of addresses on Arbitrum was 9.67 million, per data from ArbiScan. Information from the same data provider revealed that the network has been plagued by a decline in daily transactions since the end of Q1.

After the count of daily transactions on Arbitrum registered an all-time high of 2.73 million on 23 March, it has since trended downwards. In Q2, this fell consistently by over 50%.

As of 7 July, daily transactions completed on Arbitrum totaled 742,667, declining by 73% from 23 March’s high.

Source: ArbiScan

While Arbitrum dealt with a shortfall in its daily transactions, data from TheBlock showed a steady increment in daily transactions completed on Optimism [OP] since the beginning of May.

According to the data provider, the daily transactions count of a 7-day moving average has since climbed by over 200%. As of 6 July, 484,710 transactions were completed on Optimism.

Source: TheBlock

Some wins and some losses for Arbitrum

For additional context on the drop in Arbitrum’s daily transactions count, an assessment of the total volume of Arbitrum’s transactions completed through on-chain decentralized exchanges (DEXes) in the past few months revealed that this has declined by 78% since mid-April.

Per data from Artemis, on-chain DEX volume rallied to a high of 1.2 billion transactions on 19 April. However, as of 7 July, this has plummeted to under 300 million.

However, despite the continued drop in DEX activity, Arbitrum’s total value locked (TVL) has increased since the beginning of June. It is imperative to point out that the L2’s TVL declined momentarily between 6 May and 16 June by 20%.

Sitting at $2.15 billion at press time, Arbitrum’s TVL has climbed by 8% since it bottomed out at $1.99 on 16 June.

Source: Artemis

Is your portfolio green? Check out the Arbitrum Profit Calculator

Regarding network fees and revenue, data from Token Terminal revealed a 44% decline in daily fees paid to use Arbitrum in the last month. Interestingly, the project’s revenue climbed by 19% during the same period.

In the last year, while network fees rallied by 12%, revenue dipped by almost 30%.

Source: Token Terminal