A closely followed crypto analyst is warning Bitcoin (BTC) traders that bears likely have the upper hand as long as the king crypto trades below a crucial resistance area.

In a new blog post, crypto strategist Justin Bennett says that the future direction of Bitcoin depends on whether BTC reclaims the key resistance level at $23,130.

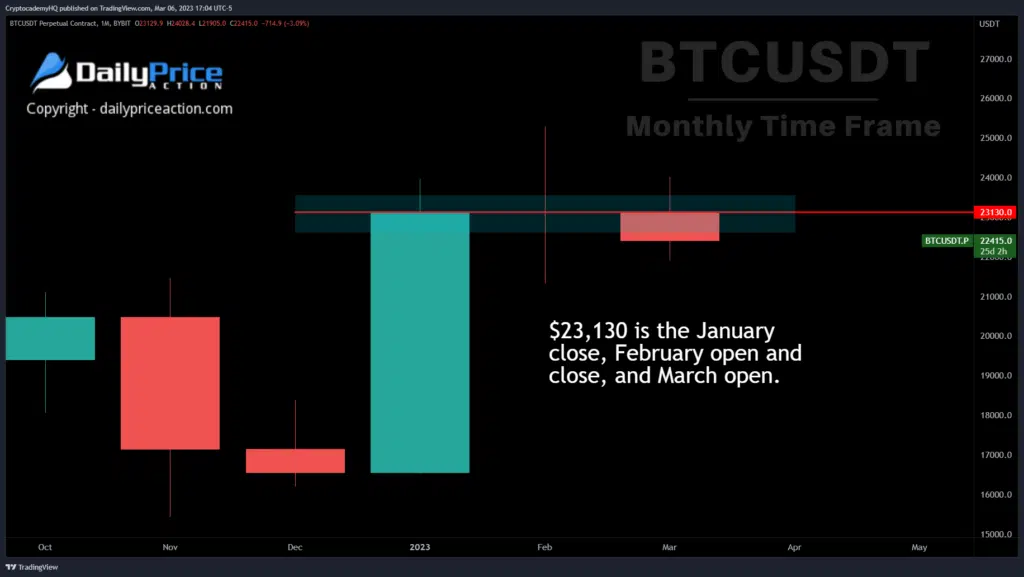

Bennett highlights that $23,130 has been a pivotal area for Bitcoin so far this year.

“It’s the January close, the February open and close, and the March open.

The above makes $23,130 an immensely significant level for Bitcoin.

Traders must be careful while Bitcoin trades below that level on the higher timeframes.”

At time of writing, Bitcoin is worth $22,201.

With Bitcoin trading below the analyst’s critical price level, Bennett says that BTC bulls can rely on a couple of support areas.

Should Bitcoin bulls mount a comeback and take out $23,130, Bennett says there’s nothing stopping the king crypto to go all the way up to $25,200.

“However, as mentioned above, shorting BTC while above the $22,000 January trend line is ill-advised.

A daily close below $22,000 would open up $21,500 support and the liquidity pool at $20,800.

However, if BTC takes out the liquidity pool at $20,800, there isn’t much to stop a retest of the $20,000 confluence of support.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney