Popular crypto analyst Benjamin Cowen says that one benchmark on-chain indicator suggests that Bitcoin (BTC) is set for range-bound price action for the better part of this year.

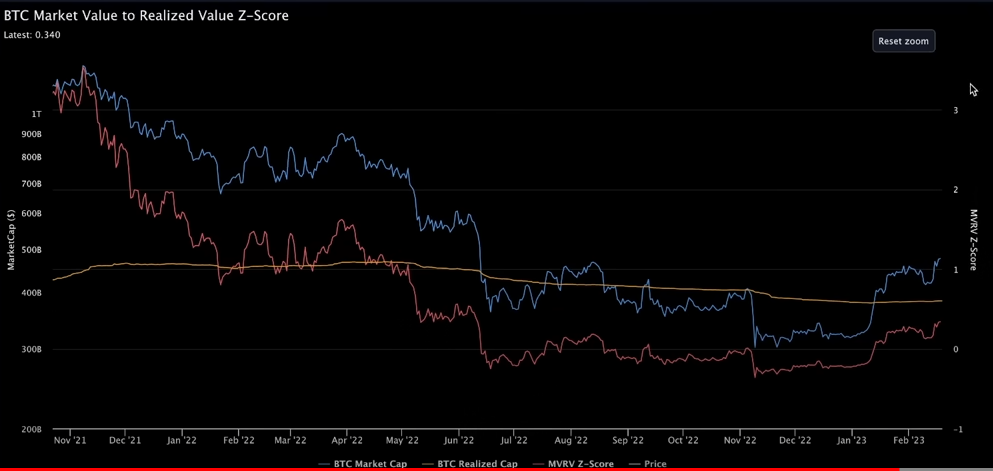

In a new strategy session, Cowen takes a look at the MVRV Z-score indicator, which compares an asset’s realized value to its market value.

The MVRV Z-score pulls out the extremes in the data between market value and realized value to attempt to identify long-term trend reversals.

Cowen says that based on the on-chain metric’s historical movements, BTC could theoretically consolidate in a range at least until 2024 before a sustained bull market rally.

“I would argue that what you’re most likely going to see this year is a recovery year, where you spend about half the time moving higher, and half the time moving lower. You can break that up in different months, so you know 2018, 2014, 2022, we had like eight or nine red months, but in the recovery years, it’s split more or less half and half. And I think you’re likely going to see the MVRV Z-score score do something like that, where it comes back above the zero line like it is right now, and eventually it probably comes back below it again. And we just spend some time consolidating.”

Following a recovery year, Cowen predicts that both the MVRV Z-score and the price of Bitcoin could erupt next year leading into the halving, an event when miners’ BTC rewards get cut in half.

“Once we get into 2024 and the next halving, ideally, a rally, a more of a sustained rally where we see the MVRV Z-score go to much higher levels. So that’s how I’m playing this year, is more or less a recovery year and that’s what I would argue that the MVRV Z-score is sort of saying it’s likely going to be as well, especially when you look at it in the context of coming out of these bear markets.”

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Emanuel Bustos