- CAKE’s NFT space registered a decline, but revenue increased

- Metrics and market indicators remain supportive of the bears

PancakeSwap [CAKE] recently published a new proposal, one which is currently under the voting period. The new proposal is related to the formation of a new Syrup Pool with Ternoa.

Realistic or not, here’s CAKE market cap in BTC’s terms

Ternoa is a layer 1 blockchain infrastructure, designed for mass adoption of NFT technology. As per the proposal, PancakeSwap will allow users to stake CAKE tokens to earn CAPS tokens.

PancakeSwap will provide a CAPS-BNB farm in collaboration with the CAPS Syrup Pool. The proposal mentioned that the total number of tokens will be 7,000,000 CAPS and the distribution duration will be 90 days. There will be no CAKE cap for this Syrup Pool and unlimited CAKE staking will start after the Syrup Pool is launched.

Can Ternoa give CAKE a helping hand?

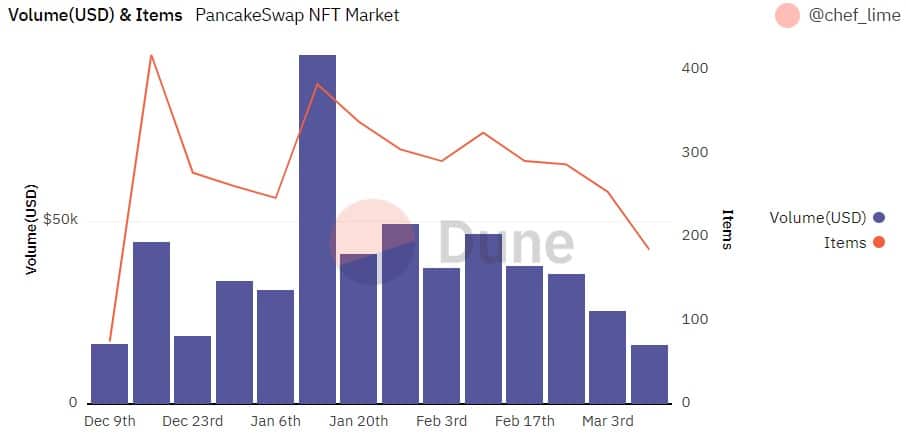

As Ternoa is a NFT-centric blockchain, its integration with PancakeSwap can help the latter improve its performance. In fact, Dune’s data revealed that PancakeSwap NFT Marketplace’s users declined over the last few weeks.

That’s not all either as a similar trend was seen on the volume front.

Source: Dune

However, it is interesting to note that CAKE performed well in terms of revenue generation.

Token Terminal’s data pointed out that CAKE’s revenue spiked on 11 March, which is a positive signal for a network. In addition to that, CAKE‘s burn rate also looked optimistic. PancakeSwap revealed that CAKE worth $27 million was burned on 13 March 2023 alone.

🔥 6,991,501 $CAKE just burned – that’s $27M!

💰 Trading fees (Swap and Perpetual): 134k CAKE ($510k) -47%

🔮 Prediction: 86k CAKE ($329k) +3%

🎟️ Lottery: 24k CAKE ($91k) -32%

🔒 NFT Market, Profile & Factory: 422 CAKE ($2k) -25% pic.twitter.com/DpLtGvk9yf— PancakeSwap 🥞 #Multichain (@PancakeSwap) March 13, 2023

How are CAKE investors doing?

While a majority of the market cherished the benefits of the bullish market, CAKE’s performance remained unsatisfactory. In fact, as per CoinMarketCap, CAKE’s price declined by over 1.4% in the last 24 hours. At press time, it was trading at $3.77 with a market capitalization of more than $681 million.

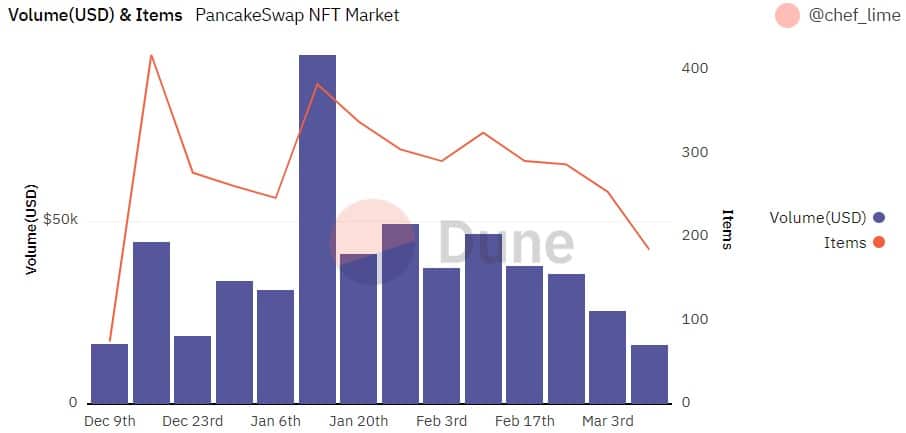

A look at CAKE’s on-chain performance gave an idea of what went wrong. The crypto-community’s sentiment around CAKE remained negative throughout the week, which was evident from its weighted sentiment. CAKE’s daily on-chain transaction volume in loss also remained relatively high.

However, despite a decline in the token’s price, its MVRV Ratio shot up over the last few days.

Source: Santiment

How much are 1,10,100 CAKEs worth today

What are the chances of recovery?

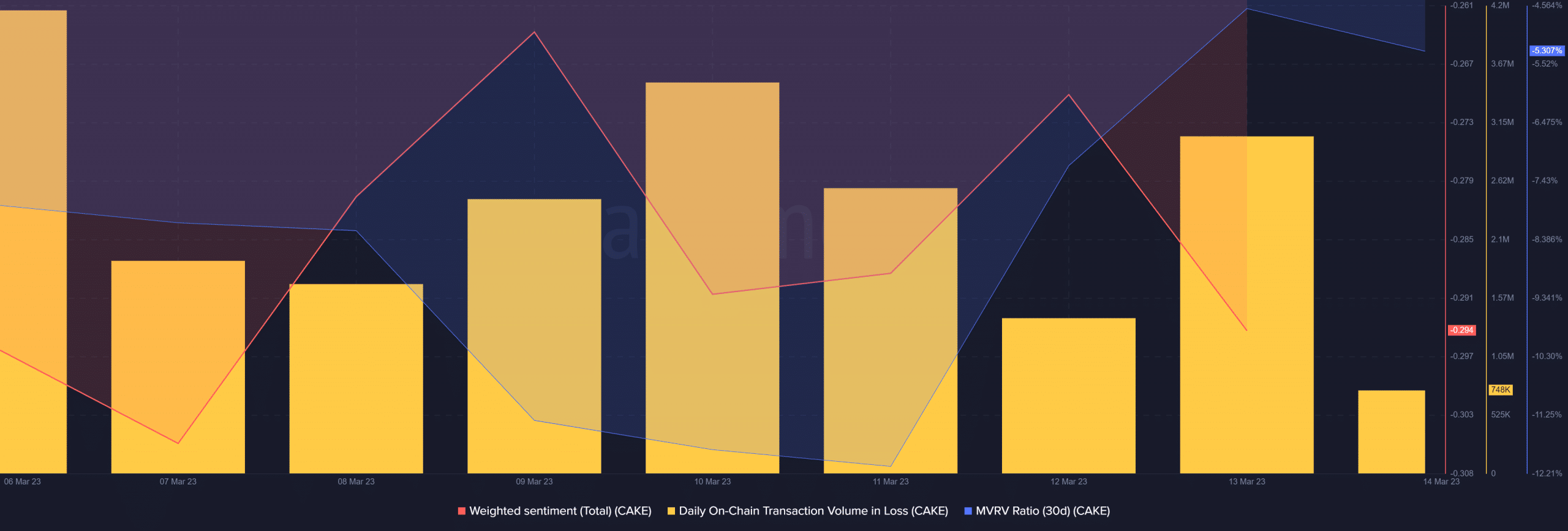

Hard days for CAKE might continue on as many of the market indicators pointed to a further price decline. For example, CAKE’s Relative Strength Index (RSI) registered a downtick and was resting below the neutral zone.

The Chaikin Money Flow (CMF) also went down, further increasing the chances of a sustained downtrend. Finally, CAKE’s MACD flashed hopeful signs of a trend reversal as it projected the possibility of a bullish crossover.

Source: TradingView