Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ALGO witnessed heightened selling pressure in the past few days.

- Funding rates fluctuated, and development activity improved after a sharp decline.

Algorand [ALGO] dropped from $0.30 to $0.18 region, plunging 40% since early February. Bulls tried to seek entry into the market as they struggled to defend the $0.18 area.

But bulls could attempt a recovery if Bitcoin [BTC] defends the $20K support and surges upwards.

Read Algorand [ALGO] Price Prediction 2023-24

In lower timeframe charts, BTC traded sideways in the $19.76K – $20.5K range. BTC’s price action could set ALGO into a consolidation in the short term, but the underlying market conditions will largely dictate long-term price action throughout March.

What’s next for ALGO – reversal, consolidation, or more dump?

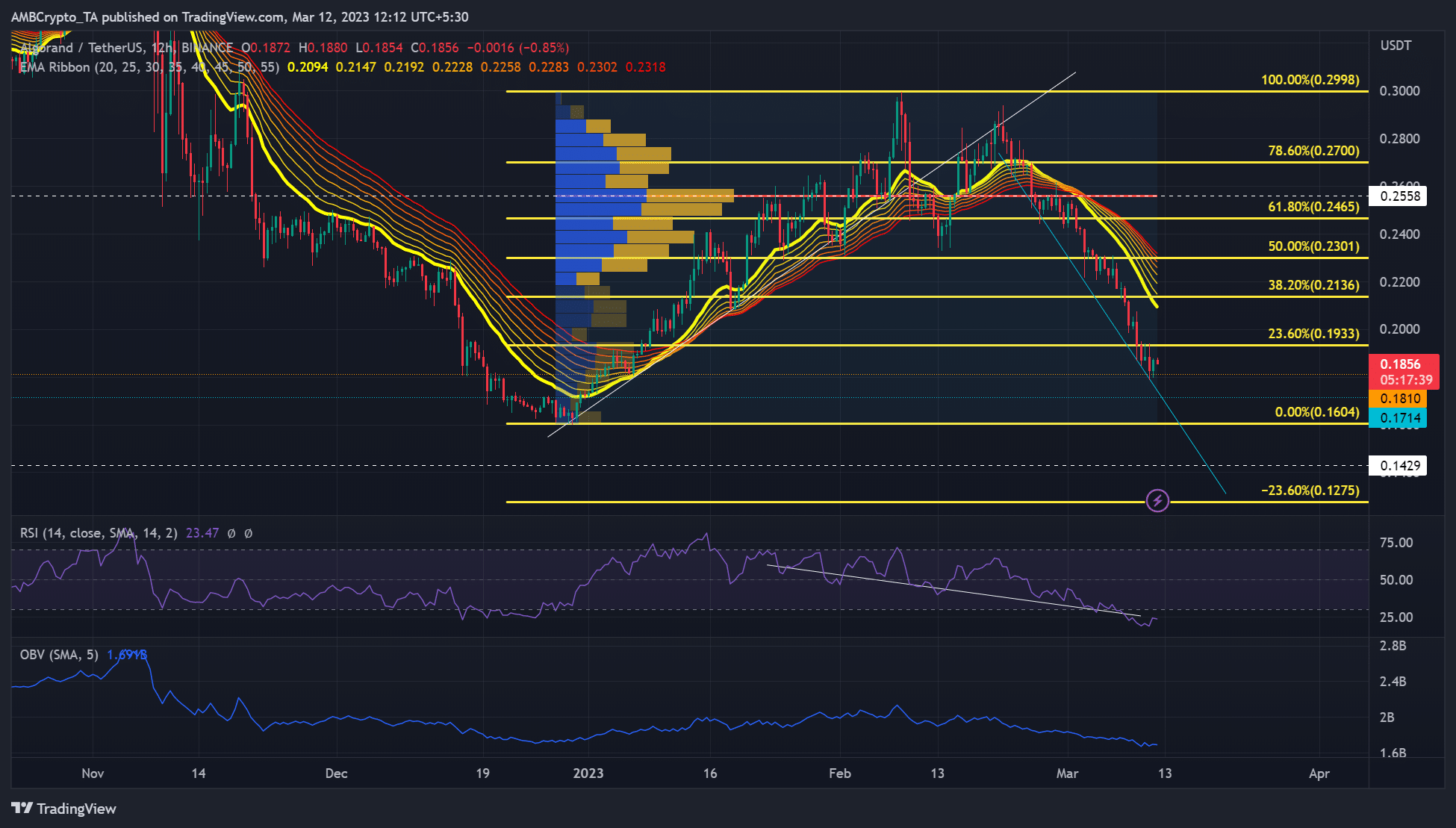

Source: ALGO/USDT on TradingView

ALGO’s strong rally in early 2023 hit the ceiling at $0.2998, setting it for a retracement. But the price bounced near the 50% Fib level ($0.2301), allowing bulls to inflict a recovery. However, the selling pressure around $0.30 proved too much for bulls to bypass it.

ALGO saw increased selling pressure after breaching below the key value area (red point of control line) of $0.2558, sustaining the price action below the EMA ribbon.

So far, ALGO has dropped, oscillating between the EMA ribbon and the downtrend line (cyan line). At the time of writing, it was trading in the $0.1810 – $0.1933 range on the 12-hour chart.

Bulls could attempt a recovery if there is a convincing close above the 23.6% Fib level ($0.1933). Continued recovery could face a barrier at the EMA ribbon ($0.2094). The next significant resistance lies between the 50% Fib level ($0.2301) and the $0.26 range if bulls close above the EMA ribbon.

Alternatively, bears could sink ALGO to January’s low of $0.17, especially if BTC drops below $20K and continues its downtrend.

How much are 1,10,100 ALGOs worth today?

The Relative Strength Index (RSI) made lower lows and was in the oversold zone, indicating increased selling pressure. But there was an uptick, suggesting easing selling pressure. In addition, the OBV declined since 8 February, limiting buying pressure in the same period.

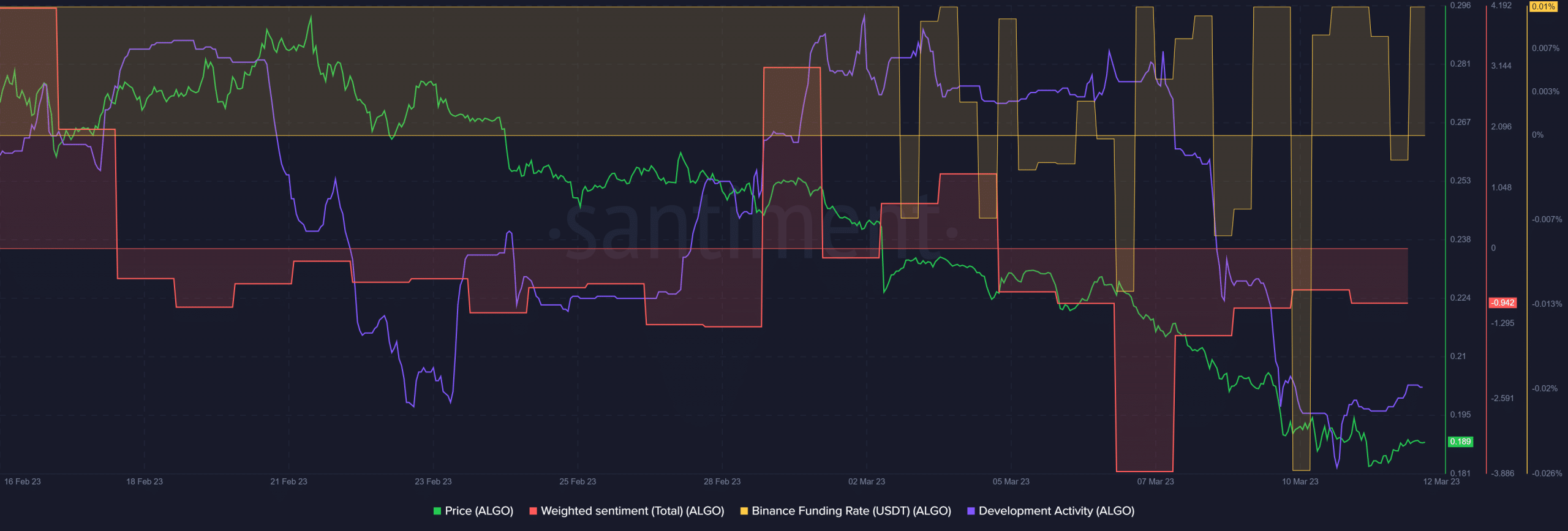

Funding rates fluctuated as development activity recovered

Source: Santiment

ALGO’s funding rates fluctuated since the beginning of March, showing unstable demand, which tipped the scale in favor of bears. Further fluctuation could give bears more influence to devalue the token; hence investors should track it.

However, sentiment and development activity improved after sharp declines. It could offer a glimpse of hope for bulls as investors’ outlook on the token and network building improved.

![Algorand’s [ALGO] downtrend slows down- Is a trend change likely?](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/03/pasted-image-0-62-1024x582.png)