- Digital asset investment product saw the largest single weekly outflows on record last week.

- BTC’s outflows represented 95% of the total monies that left the market

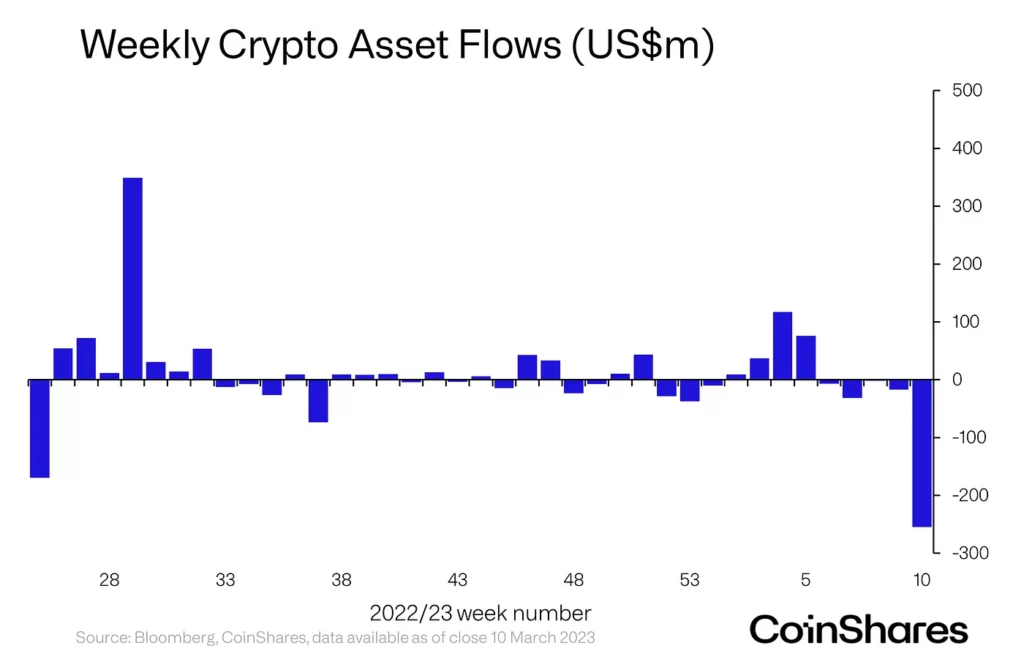

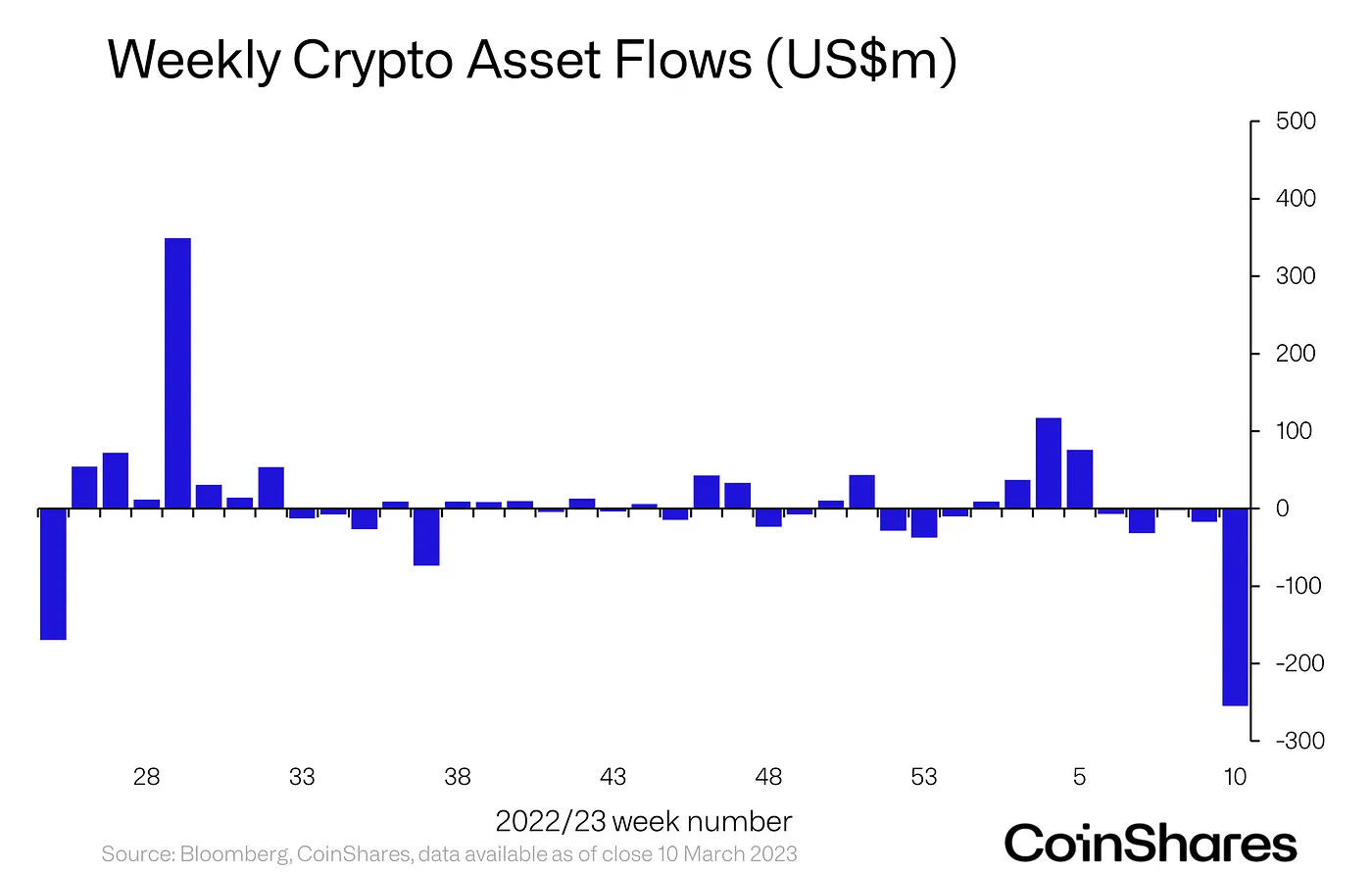

According to a new report by digital asset investment firm CoinShares, product outflows registered the largest single weekly outflows on record last week. It found that record-breaking outflows of $255 million were removed from digital asset investment products last week, marking the fifth consecutive week of outflows. Last week’s outflows represented a mere 1.0% of total assets under management (AuM).

The drop in AuM, however, culminated in a 10% decline in total AuM, reaching the same level as towards the start of 2023. Also, the $225 million outflows “wiped out all the inflows seen this year,” CoinShares found.

The significant decline in AuM is a sign of a lack of confidence among investors due to increased volatility in digital assets. The record-breaking outflows also indicated that investors took to withdrawing from digital asset investment products, possibly seeking safer investment options.

Source: CoinShares

Bitcoin and its short products counterparts

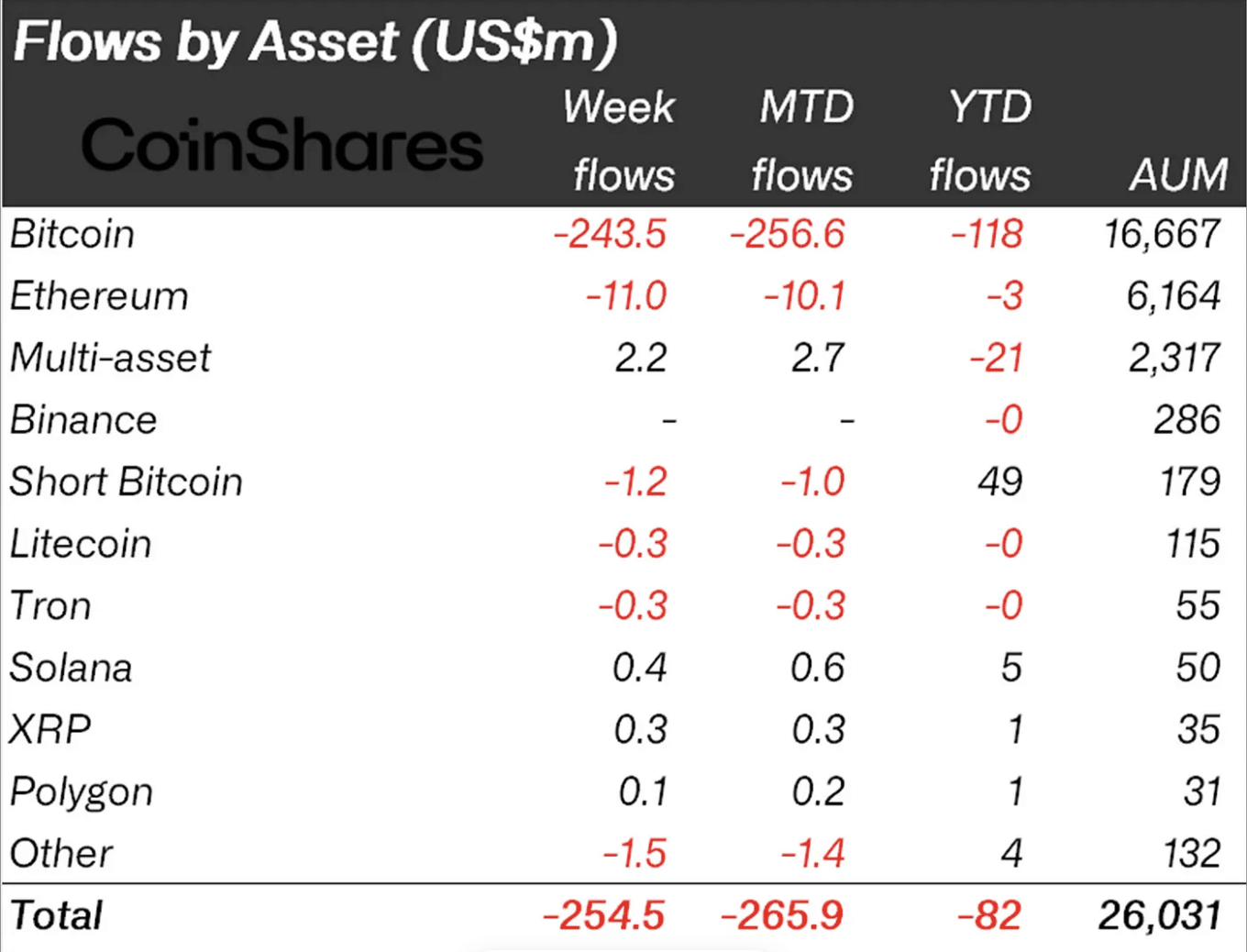

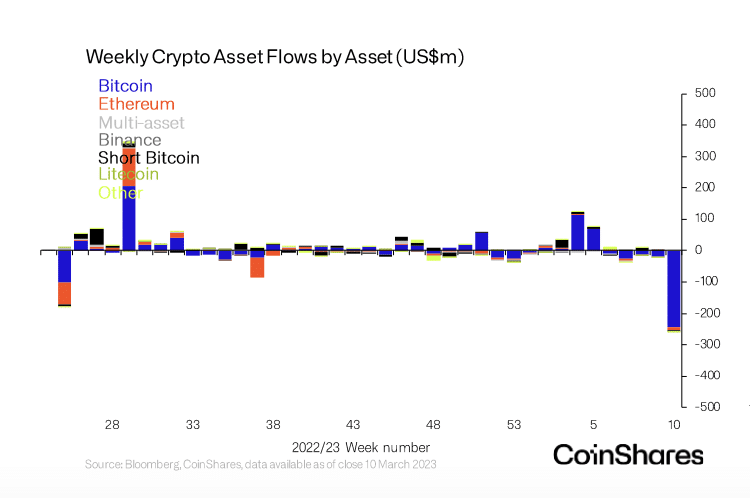

After several weeks of non-stop inflows into Short-Bitcoin products, they logged outflows that totalled $1.2 million last week. On a year-to-date basis, short-Bitcoin “is now the investment product with the largest inflows of US$49m,” CoinShares noted.

Of the $255 million removed from the digital asset investment products market last week, Bitcoin [BTC] recorded the highest outflows. According to the report, the king coin logged total outflows of $244 million, representing a whopping 95% of all monies removed from the sector last week.

Despite last week’s minor outflows from Short-Bitcoin products, the value of its AuM rose by 9%. This starkly contrasted with Long-Bitcoin AuM, which declined by 10% during the same period. Regarding BTC’s year-to-date fund flows, CoinShares found that this stood at $118 million in outflows.

Source: CoinShares

Bearish outlook for Ether as Shanghai Upgrade draws nearer?

With the Shanghai Upgrade scheduled to take place in a few weeks, there is a prevailing sense of caution among investors. Especially among those who are uncertain about the direction of Ethereum’s [ETH] price following the release of previously locked ETH coins.

This has led to several weeks of outflows from the leading altcoin. Last week not being any different, ETH logged outflows of $11 million, CoinShares found. This caused its year-to-date flows to turn negative.

“Ethereum also saw outflows totaling US$11m last week, while its flows year-to-date have also turned negative, but to a much lesser extent of US$3m.”

As for other alts,

“Other altcoins saw minor inflows, such as Solana (US$0.4m) and XRP (US$0.3m).”

Here, it’s worth noting, however, that the aforementioned report didn’t take into account Bitcoin’s and by extension, the rest of the crypto-market’s price performance over the last 24 hours. At the time of writing, the world’s largest cryptocurrency was closing in on $25,000 on the price charts, with the rest of the market in green too.

This might just fuel much-need impetus to inflows into digital asset investment products. The same should be evident when the next edition of the report is released.