The Maverick Protocol (MAV) has garnered significant attention from investors since it was selected as the 34th Launchpool project on Binance. Despite being a relatively new project launched in March, Maverick has already achieved impressive results in terms of fee revenue on the protocol.

One of the standout features of Maverick is its Automated Market Maker (AMM) technology, which optimizes capital utilization by automatically concentrating liquidity during price volatility conditions. This enhances capital efficiency, increases market liquidity, and benefits traders with better prices, while liquidity providers earn additional fee revenue. Furthermore, Maverick’s integrated feature eliminates the need for costly gas fees by automatically adjusting trading positions based on the price level.

Liquidity providers now have the option to track the price of an asset in a single direction and effectively speculate on the price trajectory of a specific token. This approach is similar to one-sided liquidity strategies, where providers focus on a particular asset within a specific group.

These technological innovations are revolutionizing liquidity management models through the use of smart contracts. Maverick stands out as the first Dynamic Distribution AMM protocol capable of automating liquidity strategies that previously required daily maintenance or super complex protocols. The project pioneers a new approach and brings new opportunities to the decentralized finance sector.

Maverick has raised $17,460,000 through three rounds of private token sales to fund its development, selling 360,000,000 out of the total token supply of 2,000,000,000 MAV. In the most recent private token sale round, the MAV price was $0.1. As of June 13th, 2023, the total supply of MAV is 2,000,000,000, and the circulating supply upon listing will be 250,000,000 (~12.5% of the total token supply).

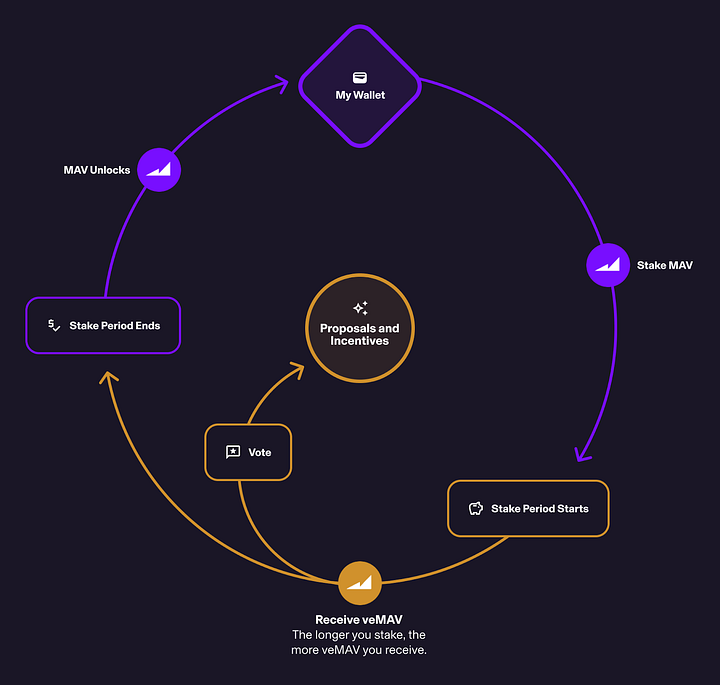

The MAV token serves as a joint utility and governance token, enabling stakeholders to stake, vote, and direct community and ecosystem incentives. These utilities operate on a voting-escrow model, where MAV holders stake their tokens to receive a vote-escrowed MAV (veMAV) balance.

With Liquid Staking Tokens (LSTs) emerging as the next crucial DeFi primitive, the stage is set for intense competition among liquid staking protocols reminiscent of the Curve Wars. As veCRV played a critical role in the Curve Wars, veMAV is expected to be pivotal in the upcoming LST Wars.

The stakes in the LST Wars resemble those of the Curve Wars: LST protocols require liquidity and trading volume for their tokens to gain traction, and they are already competing by offering various incentives to achieve their objectives.

The Curve Wars were contested by protocols now among the most prominent names in the crypto space, including FRAX, USDC, and USDT. Similarly, in the LST Wars, established players like Lido, Rocketpool, and Frax are already in the arena, alongside smaller LST projects emerging each week. These protocols are vying for a share of the same market and seeking a competitive edge.

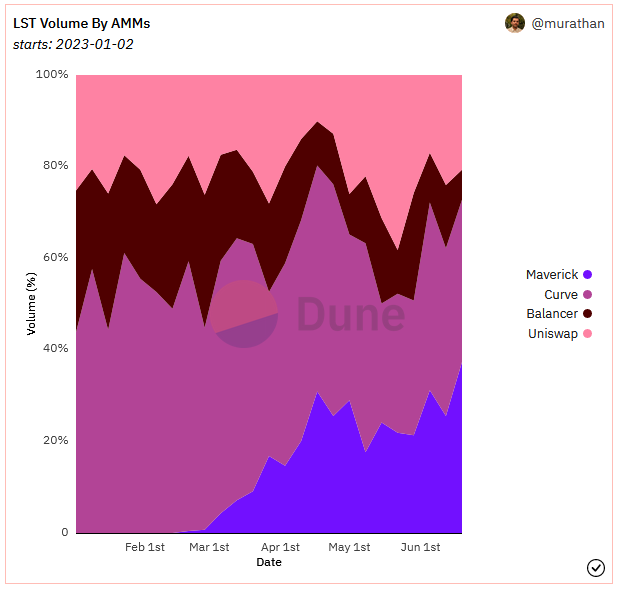

Maverick’s Dynamic Distribution AMM has already proven to be an ideal fit for LST liquidity due to its native automation of liquidity movements that track the natural yield of LSTs over time. Since its launch in March, the Maverick AMM has facilitated over $1 billion in trading volume for wstETH, accounting for 30% of all wstETH trading in DeFi. The list of LSTs available on Maverick continues to grow, including wstETH, swETH, cbETH, and rETH.

Source: Dune

Recently, Maverick Protocol has made significant strides in enhancing the utility and governance features of its MAV token through the introduction of the Voting-Escrow Model. This innovative mechanism has garnered attention and is poised to play a pivotal role in shaping the protocol’s future. Let’s explore what the Voting-Escrow Model is and how it functions.

Curve first introduced the voting-escrow (ve) concept and later adopted by numerous decentralized exchanges (DEXs). It establishes a decentralized governance system that ensures voting power remains in the hands of users who demonstrate commitment to a protocol’s long-term growth and development.

In the ve model, token holders must deposit the protocol token (e.g., MAV) into a “ve” contract in exchange for voting power, represented by a veMAV balance—the voting power increases based on the duration and size of the stake. The tokens staked by users are locked in the ve contract until the staking period expires. This mechanism prevents opportunistic voting power from manipulating the governance process to harm the protocol’s users and community members.

The advent of Curve’s vote-escrowed token (veCRV) led to the emergence of the Curve Wars. These wars resulted from two complementary innovations: first, Curve’s pioneering stableswap automated market maker (AMM) achieved a unique fit with the growing stablecoin sector, and second, the veCRV system offered a means for projects to compete for an advantage in the expanding stablecoin market.

Similarly, with the introduction of veMAV, Maverick now possesses a comparable framework that could become the battleground for the LST Wars. Firstly, Maverick AMM’s dynamic distribution mechanism provides a native solution for liquidity provisioning of LST pairs, just as stableswap AMM did for stablecoins. Secondly, the veMAV system will offer LST projects a fresh strategic option in their quest for liquidity within the AMM ecosystem.

Maverick’s VE (Voting Escrow) model offers compelling advantages that make it worth your attention, particularly if you are involved in liquid staking protocols or other projects seeking to bootstrap liquidity or incentivize a price peg.

The VE-based governance mechanics implemented by Maverick play a crucial role in attracting liquidity providers (LPs) to Boosted Positions and effectively competing with other projects for liquidity. By utilizing the veMAV (Voting Escrowed MAV) token to direct user incentives within the Automated Market Maker (AMM), Maverick enables projects to align their interests with the accumulation of veMAV voting power.

This alignment of interests leads to projects exploring additional incentives for veMAV holders to utilize their veMAV in ways that benefit their respective projects. Consequently, veMAV holders gain greater value and influence within the ecosystem.

One of the standout features of Maverick’s VE model, compared to existing VE systems like Curve and Balancer, is its critical improvement in targeting voting power to specific parts of the AMM distribution. Unlike other VE models that act as blunt instruments for incentivizing liquidity, Maverick allows protocols to create Boosted Positions, specific liquidity distributions within a given pool. Through the veMAV model, protocols can precisely drive incentives toward these Boosted Positions.

This precision empowers protocols with what can be described as “incentive efficiency,” enabling them to optimize the allocation of incentives to meet their liquidity goals with minimal capital expenditure.

Metaprotocols such as Convex and Aura have evolved to facilitate similar dynamics in other VE-based systems. It is highly likely that comparable metaprotocols will emerge specifically tailored for Maverick. These metaprotocols simplify the voting and direction mechanisms for ve holders while maximizing the utility of ve tokens through aggregated market power.

A common mechanism employed by metaprotocols involves attracting incentives from protocols to direct voting power to a specific position. Ultimately, these incentives flow back to the MAV community members, ensuring the value and engagement of the ecosystem.

Maverick’s VE model presents a unique opportunity for projects involved in liquid staking protocols and others seeking to bootstrap liquidity. By utilizing veMAV, protocols can precisely incentivize liquidity, drive engagement, and enhance their overall efficiency in achieving their liquidity objectives. Furthermore, the emergence of metaprotocols tailored for Maverick is likely to amplify the benefits and utility of the veMAV ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.