beginner

The presence of FOMO is pretty much the only predictable characteristic of the incredibly volatile crypto market. Every time a coin or a token moons, the community gets divided into two groups: those who managed to profit from the price spike and those who wish they did.

FOMO drives many people to make rash decisions, such as investing in a shitcoin that can crash right after they purchase it. However, Bitcoin is not as risky as your average run-of-the-mill coins and tokens — it is a lot more stable and has companies and institutional investors backing it up. Additionally, it leaves a lot of people wondering: What could’ve happened if I had invested in Bitcoin yesterday, last month, or three years ago?

So, what might happen if you invest $100 in Bitcoin today? Well, you might luck out and make a 100% profit in just a few days, or you may sell your coins at the wrong time and lose your $100. The size of your profit (or loss) will depend not only on the unpredictable crypto market and BTC price but also on your capabilities as an investor.

Some Questions You Should Ask Yourself Before Investing in BTC

While $100 may not seem like a lot, there are still a few things you should consider before investing in Bitcoin.

First of all, make sure you understand what Bitcoin is and what determines its value. This is essential for being able to anticipate its price movements. Don’t invest in BTC just because it’s the new cool thing to do. Besides, you stand to lose a lot of money if you’re still asking yourself: How does Bitcoin work?

To understand whether you’re just satisfying your FOMO or are genuinely interested in BTC, answer the following questions:

- Why didn’t I buy it earlier when Bitcoin was cheaper?

- Why am I buying it — to hodl or to make a quick buck?

- If it’s the latter, then why do I think I will be able to sell it later at a higher price?

- Am I OK with the risk? Can I afford to lose all the money that I’m going to invest in Bitcoin?

- Am I fully prepared to invest in BTC? Have I found a reliable cryptocurrency exchange and Bitcoin wallet?

Your answers to these questions will help you understand whether you should invest in Bitcoin or not.

Additionally, we would advise against investing in Bitcoin or crypto in general if you are prone to falling for gambling traps. The cryptocurrency market is highly speculative, and its high-risk, high-reward nature can easily suck in people vulnerable to a gambling addiction, causing them to lose all of their Bitcoin investments in just a few hours. Please remember to be careful.

What Is Bitcoin?

Let’s be honest — as the most popular cryptocurrency and a technological phenomenon, Bitcoin probably doesn’t need an introduction at this point.

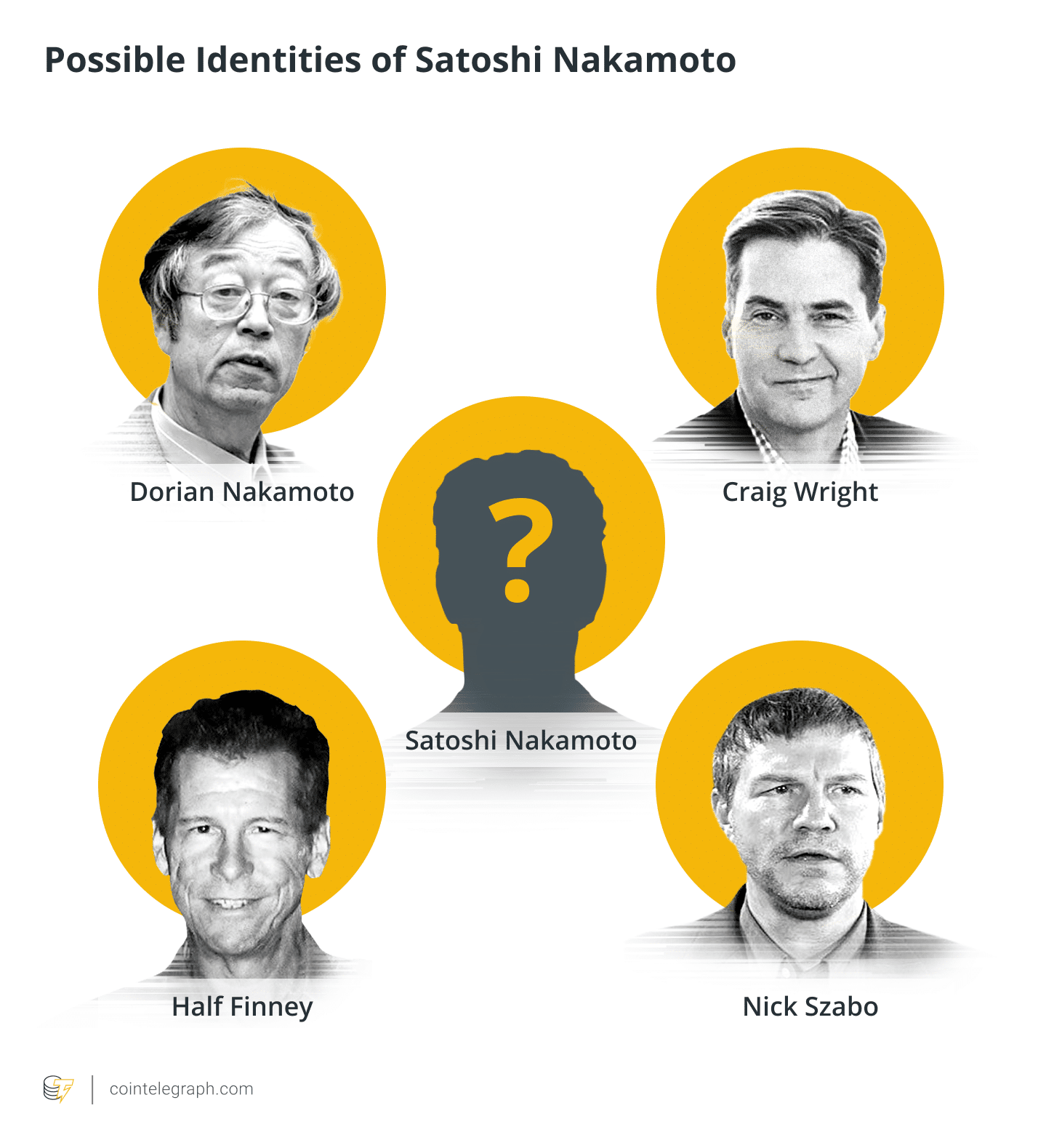

“Bitcoin” is a word that most people have heard at least once. It is a decentralized digital currency that was created back in January 2009 by an individual (or a group of individuals) that goes by the name of “Satoshi Nakamoto.”

Bitcoin promises its users a wide range of different benefits, such as anonymity, low transaction fees, genuine cross-border payments that are not reliant on politics, and so on. It revolutionized the financial world and spearheaded the creation and development of the crypto industry and the crypto market.

As more organizations start to accept Bitcoin officially and average users learn more about it, there is a chance BTC will become a mainstream currency. The more Bitcoin believers, the higher the chances that Bitcoin’s price will stabilize.

What Makes Bitcoin Valuable?

Unlike fiat currencies, Bitcoin is not given value by governments, and it is not widely used in retail (at least not yet). However, it does have its use cases, and its underlying technology, blockchain, is currently revolutionizing a wide range of various industries.

Like any other currency, Bitcoin can be used as a medium of exchange and a store of value, but currently, these are not its primary use cases. Bitcoin’s value is mostly derived from what people are willing to pay for it and is driven by its scarce supply and increasing demand.

As a result, it can be quite hard to predict its price, and Bitcoin ends up depending a lot on the general attitude of the market. As we have seen before, many Bitcoin holders are prone to panic and have “weak hands,” meaning they tend to sell off their coins when the BTC price starts to decline, driving the entire value of the asset lower.

Is It Smart to Invest in BTC Right Now?

At the time of writing, Bitcoin’s price has been in a relatively good position: it started going down after a brief growth streak earlier this year. TradingView’s technical analysis was also showing the “Buy” signal for BTC. Here’s their widget, updated in real time.

Still, Bitcoin was doing pretty well at the beginning of 2023. The cryptocurrency markets seem to be waking up from their slump in 2022, which makes them an attractive investment option once again. Looking at Bitcoin’s price chart over the years, we could be at the beginning of another bullish cycle.

However, the situation can change at any time. It’s important to remember that trying to predict and outsmart the market will always be a gamble. When it comes to cryptocurrency investment, it is generally advised to keep your FOMO in check and try investing bit by bit over a longer period of time.

Is $100 Enough to Invest in Bitcoin?

Whether $100 is enough or not depends on your end goal. If you want to reap enormous gains, then $100 might not be enough. But if your goal is simply to get some profit or to jump onto the Bitcoin train, then it is more than sufficient.

Can Investing $100 in Bitcoin Make You Wealthy?

Well, it depends on when you’re going to sell Bitcoin and how much it will rise in the future.

For example, if you had bought $100 worth of BTC when the price of a single Bitcoin was $40K and later had sold it when it hit $60K, you would’ve made a $50 profit. However, if you had instead bought $100 worth of BTC back when it was $1,000, you could’ve made $5,900.

Usually, when people invest low amounts, such as $100, they just reinvest their profit into their asset of choice instead of cashing out. Bitcoin is no longer at that stage where you can make millions of dollars by investing as little as $10 in it — if that’s what you’re after, you will be better off betting on the success of random shitcoins.

If you had invested $100 in Bitcoin when it was around $42K, it would’ve to go up to roughly $417 million for you to make one million dollars off the sale.

However, there’s another way to become wealthy by investing as little as $100 in Bitcoin: doing it on a regular basis, just like how you’d top up your savings account.

Can You Lose Money on Bitcoin?

There are many ways in which you can lose money by trading or investing in Bitcoin. Firstly, you may sell it at an inopportune moment and lose your initial investment. Secondly, your wallet may be stolen, or you might lose access to it. Thirdly, you may run into a scam… And the list goes on.

via GIPHY

Don’t let scammers take your money.

We give a few general tips on how not to lose your money while exchanging crypto in our article on refunds. Spoiler alert: It’s hard to refund crypto and Bitcoin transactions, so make sure to double-check all info you enter when making a purchase!

How Can a Beginner Invest in Bitcoin?

It’s as easy to purchase Bitcoin as it is to buy anything else online! All you need is a payment method (for example, a debit or credit card), a crypto wallet that supports BTC, and a Bitcoin exchange, trading platform, or any app that lets you buy the biggest cryptocurrency.

There are tons of great services that offer user-friendly and hassle-free ways of purchasing Bitcoin and other digital currencies. Make sure to choose a cryptocurrency exchange that will keep your personal data safe (or doesn’t ask for it at all) and has a favorable exchange rate. You can check out our guide on how to buy Bitcoin here.

Buying and selling Bitcoin is especially easy on Changelly. We aggregate offers from several fiat providers to ensure you always get the best deal.

Keep in mind that you also need to decide what happens when you purchase Bitcoin. Don’t just let it sit in your cryptocurrency exchange account: either store it in a safe place like a hardware wallet or look for an opportunity to sell or exchange it.

Should You Buy Bitcoin Today?

Ultimately, it’s up to you whether investing $100 in Bitcoin is worth it or not. If it’s a one-time investment and you just want to try crypto out, we would recommend going with a lower amount since you can’t profit much from $100 anyway.

However, if that $100 is part of an investment plan, or if you want to hodl that Bitcoin for years to come, then it might be worth it.

If you want to make huge immediate profits, then trading might be a better fit for you. You can trade Bitcoin or go for one of the smaller cryptocurrencies that tend to have more drastic price movements. We would advise against mining Bitcoin — unless you already have all the necessary equipment, it is unlikely to be profitable.

If you’re looking for more digital assets to invest in, check out our overview of the cryptocurrencies that we think might boom in 2023.

So, What Is Going to Happen If I Invest $100 in Bitcoin Today?

While cryptocurrency values are notoriously hard to predict, at this point, most mainstream investors and Bitcoin evangelists believe it will always eventually bounce back and conquer new highs.

If Bitcoin’s price skyrockets this year, then you will be able to multiply your investment tenfold. A hundred dollars is not a large sum, and as long as you invest $100 in Bitcoin and not a dollar more (or, at least, not a much more significant amount), then you won’t have to worry too much about losing your money. Of course, if $100 is a large sum for you and you cannot afford to gamble it away, you probably shouldn’t make such a speculative investment.

Final Thoughts

When contemplating investing in any asset, it is always a good idea to consider how it will fit into your existing portfolio. And if you don’t have one yet, contemplate what other assets — fiat currencies, precious metals, virtual currencies, and so on — you will have to buy up to mitigate the risk and achieve your profit goals.

An easy way to make a foolproof portfolio is to invest in a high-risk, high-reward asset alongside gold or other precious metals. Ultimately, whether you should buy a hundred dollars worth of Bitcoins right now depends on what you think about this coin and crypto in general and its future potential.

Please note that the contents of this article should not be seen as investment advice. Good luck on your crypto journey!

FAQ

What are the best crypto exchanges for buying Bitcoin?

Binance, Coinbase, Huobi, and Changelly are among the best cryptocurrency exchanges you can find for buying Bitcoin. You can also choose not to use a crypto exchange altogether and instead opt for buying Bitcoin on P2P platforms, getting it via a Bitcoin ATM, Cash App, PayPal, or even engaging in Bitcoin mining.

What are the common risks of Bitcoin investing?

As with any cryptocurrency investing, you must be aware of market volatility and the fact that Bitcoin purchases are unregulated. Crypto is also not protected by insurance from SIPC (the Securities Investor Protection Corporation).

There are no guarantees that you will make a profit or even get your money back — be sure that you have a sound investment strategy before making a Bitcoin purchase.

Additionally, you must be very careful with your chosen Bitcoin wallet: it has to come from a reliable provider. Don’t tell anyone your private key: as the saying goes, “not your keys, not your coins.”

Don’t invest in crypto if you don’t understand the risks involved and don’t have a high risk tolerance. Be careful with your money and always DYOR.

Is buying Bitcoin worth it?

If you have no issues with using fiat currency or a regular bank account, Bitcoin and crypto assets in general can lose some of their appeal. However, even if you don’t intend to use them as a payment method or aren’t interested in blockchain technology, you can still use a digital asset like BTC as an investment option.

Bitcoin can be a good yet risky investment to add to your portfolio. Although it is not a highly volatile asset compared to other cryptocurrency investments, it can still be considered a “high-risk, high-reward” option especially compared to investing in ETFs (exchange-traded funds), stocks, mutual funds, and so on.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.