- Convex Finance dominated Curve Finance’s governance.

- Protocol struggled while whales continued to buy CRV.

According to Delphi Digital, Convex Finance, a Curve [CRV] staking platform, dominated 45% of the overall governance on the network.

vlCVX holders can vote on the pools they want to incentivize or vote for specific pools and earn bribes paid by other protocols.

A Look at Convex’s Business Model and a Looming Catalyst is live now for PRO members

https://t.co/akrMZYuE8M

— Delphi Digital (@Delphi_Digital) February 28, 2023

Realistic or not, here’s CRV’s market cap in BTC’s terms

The dominance was created as Convex Finance held most veCVX and veCRV tokens. Holders of these tokens can vote on the pools they want to incentivize or vote for specific pools and earn bribes paid by other protocols.

However, one area where the protocol could make improvements would be in terms of volume.

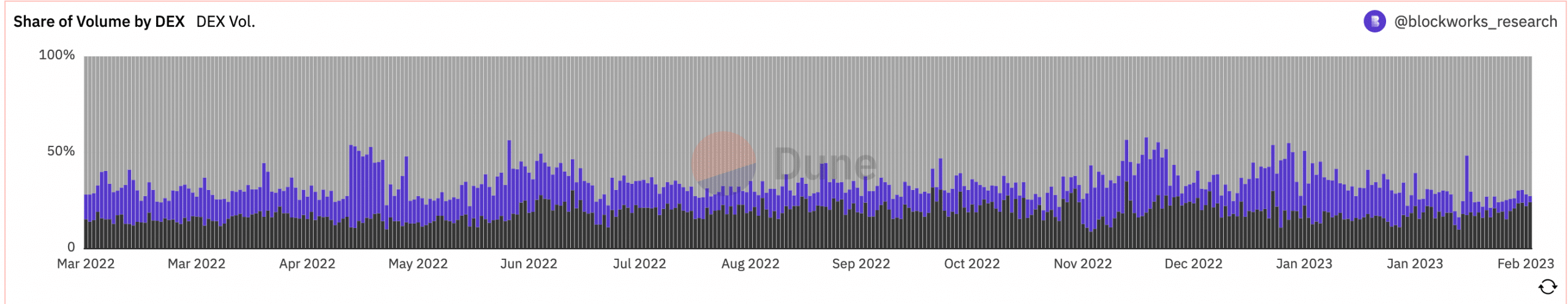

Curve faces the heat

Over the past few months, Curve Finance’s share of DEX volume declined materially. Based on Dune Analytics’ data, the overall DEX volume of the protocol fell from 15.2% to 4.4% since the beginning of this year. A large part of the share was lost to other DEX’s such as Uniswap [UNI].

Source: Dune Analytics

Despite the decline in volume, the Curve protocol generated ample revenue and increased its treasury holdings. According to Token Terminal, these holdings increased by 37.3% over the past month. The DAO could put these treasury holdings to good use if they use the holdings to make developments on the protocol.

It appeared that there were efforts being made by the DAO to improve the protocol, as indicated by the increasing number of active developers. Based on Token Terminal, the number of active developers on the Curve protocol increased by 8.6% in the last week.

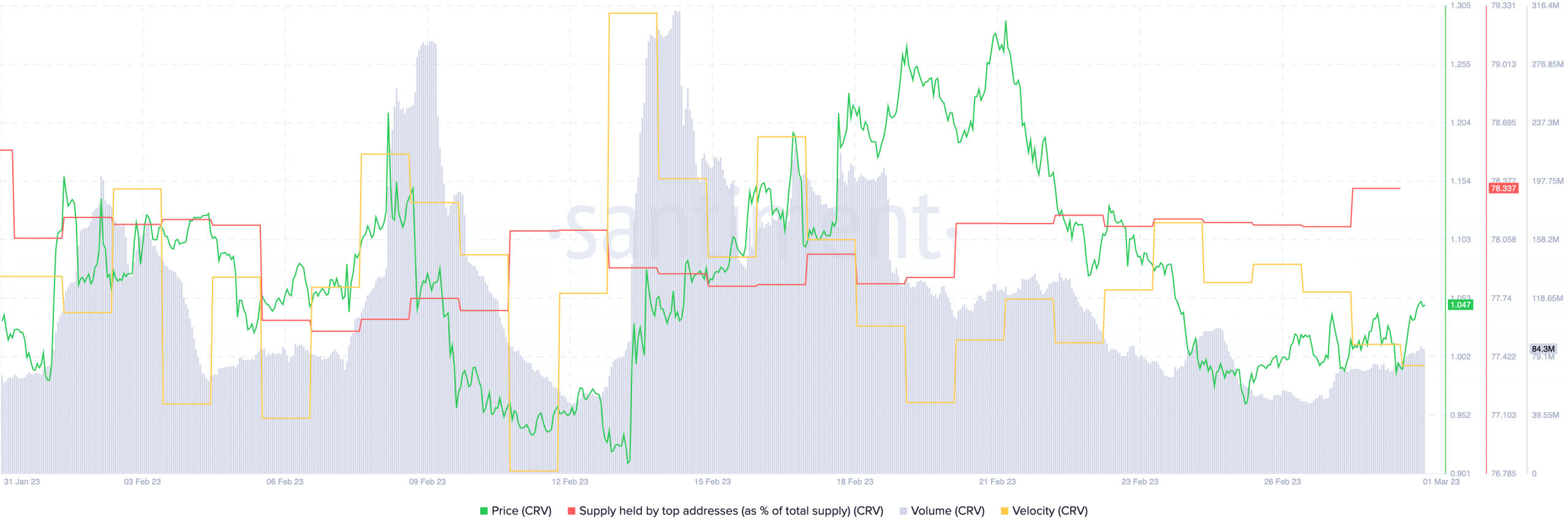

Whales show interest

Even though the protocol was doing poorly, it did not stop whales from investing heavily in CRV. Santiment’s data showed that the percentage of large addresses holding the CRV token increased over the past week.

Read Curve’s [CRV] Price Prediction 2023-2024

This interest from whales could be one reason why CRV’s prices surged. However, despite the increasing prices, the volume of the token declined. Along with that, the overall velocity of the token fell, suggesting that the frequency with which CRV was being traded had plummeted.

Source: Santiment

Only time will tell whether the whales are correct in their assessment of the Curve token.

OCTA: Things Are Melting Up Quietly

OCTA: Things Are Melting Up Quietly