- Blockchain policy specialists’ opinions differ as per the crypto regulatory clampdown despite XRP’s long-standing SEC case.

- The U.S. Congress intends to look into the recent operation.

The recent hostility shown in the crypto sector could be vital to Ripple’s [XRP] final result in its battle against the SEC.

The final regulatory choices might have the most effect on XRP because it has been the most notable cryptocurrency subject to bureaucratic command.

Realistic or not, here’s XRP’s market cap in BTC terms

While there was still no certainty about the case’s trajectory, some influential figures in the crypto policy space took to Twitter to share their opinions.

Crossroads at Illinois

Andrew Hinkes, who is a blockchain lawyer, stood firm on his opinion that the Illinois Senate bill would negatively affect the blockchain strides in the country.

If you thought that was bad. Get ready to #Illinoize your blockchain! Yes, #Illinois is going to force you to re-write your blockchain- specifically by including smart contract code capable of responding to court orders. And if you don’t, you can be sued /10

— Drew Hinkes (@propelforward) February 19, 2023

On February 9, the Illinois Senate introduced the bill aimed at protecting digital property and blockchain transaction rights.

But Hinkes maintained the bill did not consider the protection of validators, miners, and node operators. Referring to some section of the bill which imposes fines on the parties above, Hinkes noted,

“The manner in which it seeks to protect consumers is to require node operators miners & validators to do impossible things, or things that create for themselves new criminal & civil liability at pain of fines.”

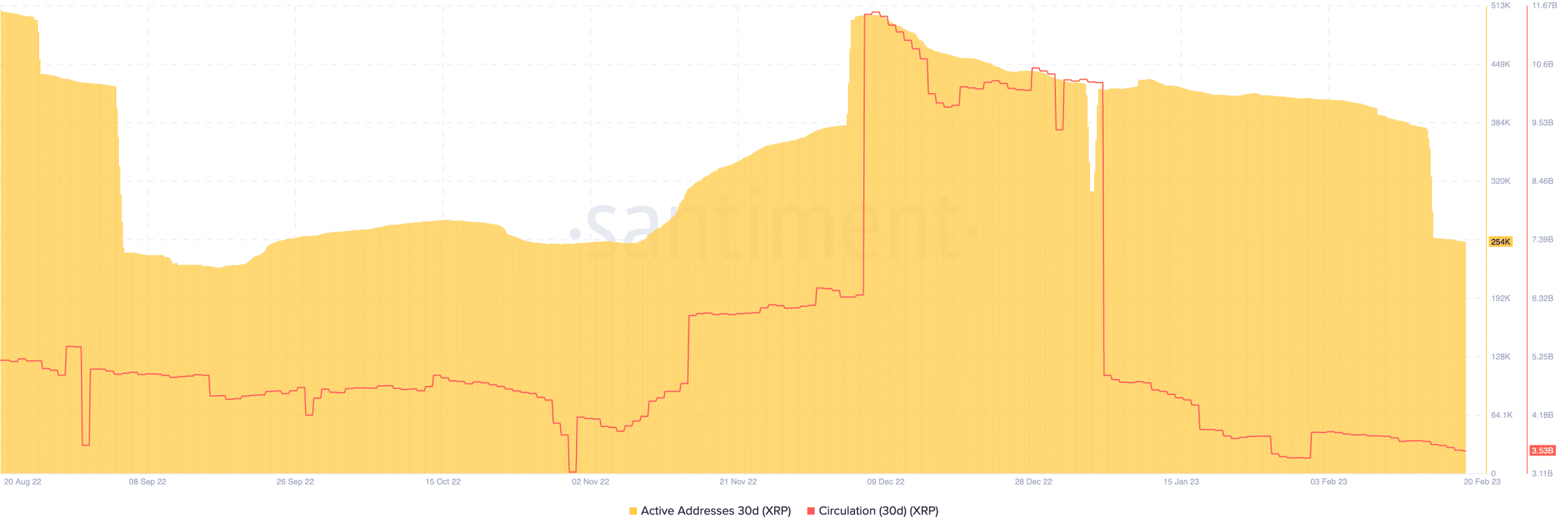

However, XRP’s on-chain condition over the last one month has not been the best. Despite notable hikes in active addresses in January, it had failed to replicate the performance.

At press time, the 30-day active address was down to 254,000.

This means that there has been a reduction in the number of sending and receiving wallets on the Ripple network. Moreso, the XRP circulation within the same period had decreased drastically.

Source: Santiment

An explanation of the state, as shown above, could point to caution exercised by investors due to the recent crackdown.

On the other hand, Jake Chervinsky, supported the regulatory heat, noting that policy might be necessary due to the way the FTX collapse happened.

Yes, it’s a regulatory crackdown.

The agencies were caught off-guard by FTX and 2022’s other failures, so now they’re overcorrecting with harsh enforcement and restrictive rulemaking.

They’re taking their pound of flesh, and it hurts.

No, it’s not the end of crypto in the US.

— Jake Chervinsky (@jchervinsky) February 19, 2023

Is your portfolio green? Check out the Ripple Profit Calculator

Halts spreading like wildfire

Meanwhile, Ripple’s general counsel Stuart Alderoty shared a Wall Street Journal report on the continuously broken relationship between banks and crypto firms. The news platforms referred to the recent repression, saying,

“Banks that kept their distance from crypto are trying even harder to stay away, closing accounts and shunning customers with potential connections to the industry.”

However, Senator Bill Hagerty tweeted that he had a clue about the challenges.

He mentioned that the current regulatory operation could destroy legal business while using banks as tools. But he also assured that the U.S. congress would look into the matter.

Make no mistake, this Operation Chokepoint 2.0 is an extreme overreach from the banking regulators, and they should expect to hear from Congress soon.

— Senator Bill Hagerty (@SenatorHagerty) February 17, 2023

At the time of writing, XRP exchanged hands at $0.394— a 3% decline in the last 30 days.

![Ripple [XRP]: On regulatory heat, crackdowns, and the way forward](https://cryptoinvestornewsnetwork.com/wp-content/uploads/2023/02/po-2023-02-20T120336.520-1000x600.png)