In the first quarter of 2024, approximately $43.8 billion, or 76% of the decentralized finance yield market, earned an annual percentage yield (APY) of about 5% in very low-risk contracts. Staking played a crucial role in the resurgence of decentralized finance, bolstered by the Ethereum network’s transition to a Proof-of-Stake model. The bridging sector experienced a 51% increase in total value locked (TVL), rising from $94.8 million to $143.6 million.

Three-Quarters of Defi Yield Market in Very Low-Risk Contracts

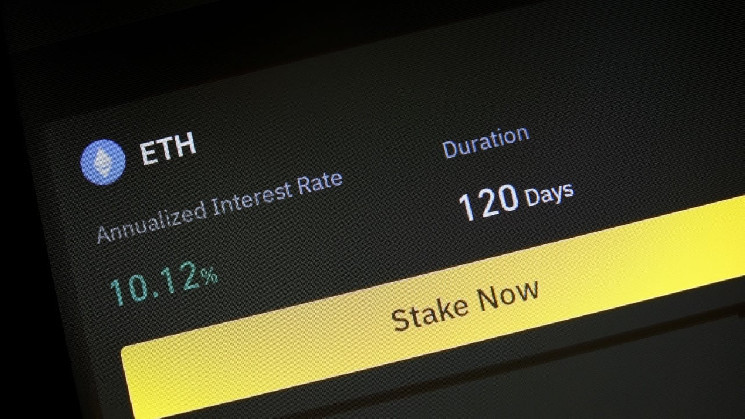

In the first quarter of 2024, decentralized finance (defi) investors generally favoured security over the pursuit of high yields. According to a study conducted by Exponential, about $43.8 billion, or 76% of the defi yield market, earned “approximately 5% annual percentage yield [APY] in very low-risk contracts.”

The data shows that around $10 billion, or 18% of defi total value locked (TVL), is in low-risk contracts, and $3.4 billion (6%) is in risky contracts. Despite highlighting defi investors’ apparent preference for less risky pools, the study’s findings indicate a renewed optimism in decentralized finance.

This renewed interest is best depicted by the surge in the TVL from $26.5 billion in Q3 of 2023 to $59.7 billion in Q1 of 2024. Commenting on the evolving defi jobs landscape, the Exponential study report stated:

“While there’s a significant shift towards low-risk endeavours like staking and secured lending, interest in sectors like insurance and derivatives has waned. This transition highlights the challenges of fitting certain financial activities into the defi framework due to inherent asymmetries in information between liquidity providers and yield seekers.”

Maturing Defi Market Increasingly Sustained by Real Onchain Activity

According to the study’s findings, staking, which received a boost from the Ethereum network’s shift to a Proof-of-Stake (PoS) model, was instrumental in decentralized finance’s resurgence. The data shows that staking now comprises 80% of decentralized finance TVL.

Meanwhile, the study found that decentralized exchanges (DEXs) experienced only moderate growth. Fears of impermanent loss, as well as media portrayals, were primarily responsible for the year-over-year decline in most DEXs’ total value locked.

On the other hand, the bridging sector saw a 51% increase in TVL, from $94.8 million to $143.6 million. Emerging Layer 2 rollups were responsible for this increase. A breakdown of the APY by source shows a reduced proportion of rewards-based yields. This decline indicates “a maturing defi market increasingly sustained by real onchain activity.”

What are your thoughts on this story? Let us know what you think in the comments section below.