In a notable development, cryptocurrency technology company DeFi Technologies recently announced the acquisition of a leading Solana Trading Systems IP. The move underscores the firm’s commitment to expanding its DeFi footprint on the Solana blockchain.

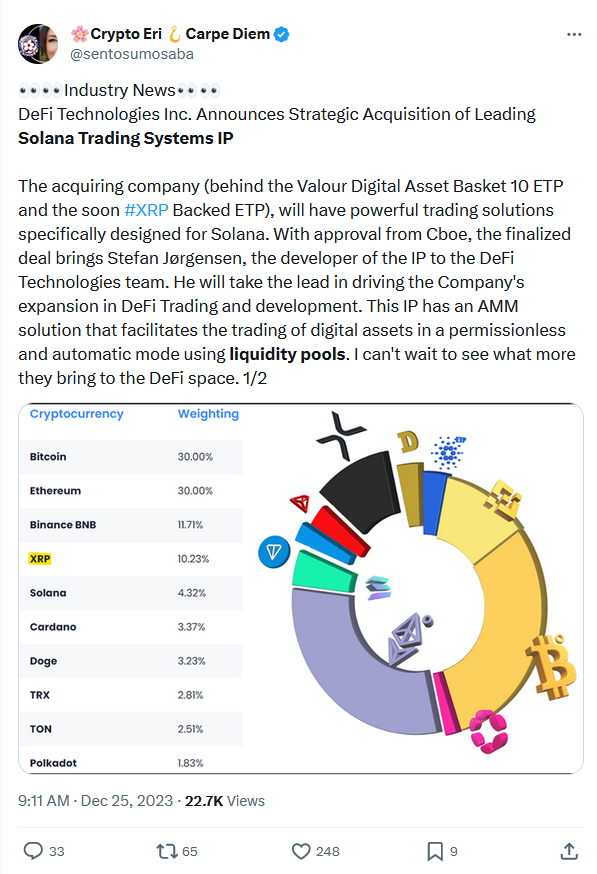

Prominent XRP influencer Crypto Eri noted this development in a recent post on the social media platform X (formerly Twitter). “The acquiring company (behind the Valour Digital Asset Basket 10 ETP and the soon #XRP Backed ETP) will have powerful trading solutions specifically designed for Solana,” she posted.

Industry News

The company acquired the IP trading system from prominent Solana developer Stefan Jørgensen. Furthermore, the IP purchased includes a wide range of complex functionalities. That includes advanced liquidity provisioning, cutting-edge trading tactics, technology, decentralized financial data distribution, administration, and analytics.

Following the acquisition, Jørgensen will join DeFi Technologies to develop the IP and lead the DeFi expansion efforts. In particular, the developer will lead the company’s efforts in DeFi Trading, development, and governance. However, the acquisition is subject to the acceptance of the Cboe Canada Exchange.

Per the announcement, Solana remains integral to DeFi Technologies’ subsidiary Valour Inc’s asset management portfolio. Importantly, Valour has Solana worth over $168.8 million in Assets Under Management (AUM).

Meanwhile, the acquisition mirrors growing development in the Solana ecosystem. Recently, the blockchain has gained prominence again following its sporadic market value rise, which has sent its price up 865% on the yearly charts. At the time of press, the token is exchanging hands at $110, data from CoinMarketCap reveals. While SOL is up 61% in the past week, the upward trend hit a slowdown in the past 24% following a 2.96% drop.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Criminally Undervalued?

Criminally Undervalued?

Let’s Find Out!

Let’s Find Out!