The long-awaited “crypto spring” may be upon us as Bitcoin (BTC) and other cryptocurrency markets rise in anticipation of a full-on bull market.

Over the recent crypto winter, many different projects have been growing, gaining users and building new networks. Some of these, like Polygon, are layer-2 (L2) solutions to help scale the primary protocol, Ethereum. But what are the implications of L2s? Are they a better protocol to build on or invest in? Are other layer 1s (L1s) doing anything to stay competitive?

These questions and more are the focus of a new report from the Cointelegraph Research Terminal. The report looks at up-and-coming projects in the cryptoverse, as well as case studies for L1s like Avalanche and Hedera and how they compare to the new tech that is on the rise.

Download the report on the Cointelegraph Research Terminal.

Cointelegraph’s “L1 vs. L2: The Blockchain Scalability Showdown” report is a primer to why scaling solutions are necessary for the shortcomings of L1s. The report provides explanations of what is currently going on in the world of scalability solutions to bridges and projects that focus on interoperability.

Layer-1 blockchains, such as Bitcoin and Ethereum, are base protocols that can be used in conjunction with third-party layer-2 protocols and are also known as mainnets or primary chains.

A layer-0 (L0) protocol allows developers to combine elements from different L1 and L2 protocols while retaining their own ecosystem to heighten interoperability.

L2 protocols enable thousands of low-value transactions to be processed after validation on parallel blockchains, with records then being transferred to the main blockchain or mainnet to ensure they are immutably recorded. This report will help get the reader ready for “crypto summer” with all the information and insights to make better-informed decisions.

Gas fees are just the start

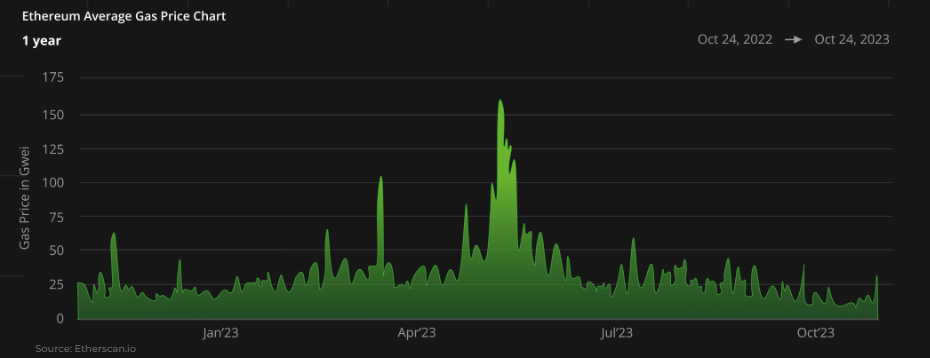

As veterans in the blockchain space know, Ethereum gas fees have been a significant issue, sometimes costing users more in the Ether (ETH) transaction cost (measured in gwei) than the value of the underlying asset. As the chart below shows, the price of transactions on Ethereum can fluctuate dramatically, leaving users with an unpredictable experience that can hurt further adoption.

This sparked the creation of solutions to combat the issue, as well as increased scalability, including transactions per second (TPS), interoperability and ease of user experiences for developers and users.

Ethereum average gas price chart

Protocol comparison, more than just speed

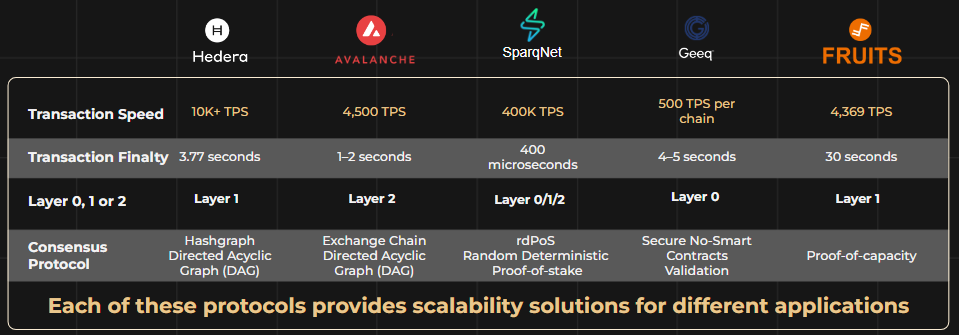

TPS is one crucial factor that separates newer protocols from the older generations, such as Bitcoin and Ethereum. Bitcoin and Ethereum act as their own L1s but do not have intrinsic solutions to operating at speeds comparable to newer networks, as seen in the table below.

Today, there are layer-0 protocols that serve as a base layer in which different protocols can work interoperably. Layer-2 protocols are built on top of L1s to help fill in and overcome gaps that may exist on the L1.

For example, if a protocol has a low TPS, an L2 may provide an inexpensive and efficient way to still use the same programming language and infrastructure of the L1 for security.

TPS speeds of newer protocols. Source: Cointelegraph Research

Top trends for the future

The report provides several insights, including the top emerging trends that are leading the narrative of protocols outside of the traditional L1s, such as asset tokenization and account abstraction.

Asset tokenization, including the digital representation of real-world assets (RWA) onto decentralized ledger protocols, will play a significant role in the spread of next-generation protocols.

The migration of assets to these protocols will increase transaction congestion as adoption rates climb. This increased adoption also has consequences, including the need to make custody for average users easier. This is where the next trend, account abstraction, comes into play.

Account abstraction will help user experiences by removing requirements like keeping seed phrases for account recovery. It could also allow for the batching of smart contract executions like complex payment structures to be simplified. By making user experiences easier, L0s and L2s can help spur the next leg of mass adoption.

Cointelegraph Research’s latest report is a starting place to help analyze these newer protocols. The report also includes insider insights from industry professionals who are on the cutting edge of different technologies in the decentralized ledger space.

The Cointelegraph Research team

Cointelegraph’s Research department comprises some of the best talents in the blockchain industry. Bringing together academic rigor and filtered through practical, hard-won experience, the researchers on the team are committed to bringing the most accurate, insightful content available on the market.

The research team comprises subject matter experts from across the fields of finance, economics and technology to bring the premier source for industry reports and insightful analysis to the market. The team utilizes APIs from a variety of sources in order to provide accurate, useful information and analyses.

With decades of combined experience in traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to put its combined talents to proper use with the “L1 vs. L2: The Blockchain Scalability Showdown” report.

The opinions expressed in the article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.