Defi lending platforms see a spike in stablecoin borrowing rates, signaling a market rebound with rising demand and potential arbitrage opportunities.

The current bull market has triggered a resurgence for the defi sector, as interest rates for borrowing stablecoins have significantly increased across most defi lending services.

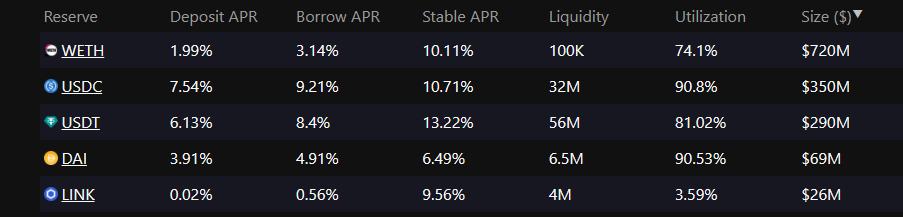

The interest rates for borrowing stablecoins such as USDC and Tether have exceeded the 10% mark on leading defi lender, Aave. This spike is indicative of an increase in traders’ willingness to borrow at higher costs, suggesting an uptick in leveraging cryptocurrency positions. The shift comes after a period of stagnation, where the once attractive returns of defi lending were eclipsed by the soaring interest rates offered by conventional bonds.

Crypto borrowing rates on Aave

Positive Momentum in Crypto Derivatives

In line with the heightened activity in defi lending, the perpetual futures market—a favored derivative product among crypto traders—has also seen a shift. According to Coinglass, a data analytics provider, the funding rates for contracts betting on the ascent of tokens like Ripple’s XRP have tipped into positive territory. This change implies that traders optimistic about price increases are now compensating their bearish counterparts to maintain their positions. XRP has also witnessed a 12% surge in value today, accompanied by gains across other altcoins.

You might also like: Is Ripple’s XRP headed for a new peak? Current trends and predictions

This buoyancy in defi and the derivatives market aligns with the broader rally in the cryptocurrency realm. Bitcoin has logged a remarkable 28% rise in October alone, marking its most significant monthly upswing since the start of the year. Such gains fuel expectations for future regulatory advancements, notably the potential approval of Bitcoin exchange-traded funds (ETFs) by the US Securities and Exchange Commission, an issue pending for over a decade.

The divergence between the rising defi borrowing rates and perpetual futures funding rates has not gone unnoticed by traders. Market participants are seizing these disparities as arbitrage opportunities, profiting from the price differentials across different market segments.

Read more: Bank of England releases stablecoin regulation plan