- CEO Raoul Pal discussed the changing dynamic of Bitcoin’s correlation with Ethereum.

- Pal discussed these issues with Scott Melker on a podcast recently.

Real Vision CEO Raoul Pal believes that unlike other altcoins, the price action of Ethereum [ETH] isn’t dictated as much by that of Bitcoin [BTC]. He also placed his bets on Solana’s [SOL] price rise.

Pal made these remarks while speaking to Scott Melker on the “Wolf of All Streets” podcast, wherein he discussed Bitcoin’s correlation with ETH and other altcoins among an array of crucial concerns around the crypto industry.

ETH has a massive ecosystem of its own and its action is quite independent of how BTC performs, Pal said.

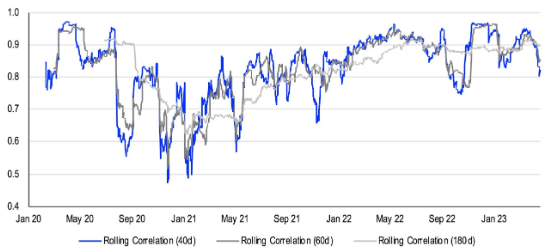

The correlation between BTC and ETH widened after the latter’s Merge in September 2022 and Shanghai fork in April 2023. In fact, the correlation especially widened after the Shanghai fork.

In the days immediately after the April update, Coinbase [COIN] published a report that underlined this trend. It noted that the correlation coefficient between daily Bitcoin and Ether returns had dropped from 0.95 to 0.82 (20 April) within 30 days.

Source: Coinbase

Ethereum’s independence in relation to Bitcoin also has a lot to do with the kind of institutions that are invested in ETH. A lot of institutional investors like assets with yields—something ETH offers, Pal added.

However, we should underline the recently declining yield of Ethereum.

Source: Bloomberg

At 3.5%, it was the lowest in the last 10 months, and much below the recent peak of more than 8%, Bloomberg recently reported. The report cited a recent JPMorgan Chase note, which said:

“The increase in staking has reduced the attractiveness of Ethereum from a ‘yield’ perspective, especially against a backdrop of rising yields in traditional financial assets.”

Source: ETH/USD, TradingView

ETH was trading at $1,813.50 at press time, a rise of 18% over a fortnight. Meanwhile, BTC was trading at $34,302 at the same time, rising 28% over a fortnight.

Source: BTC/USD, TradingView

Pal bets on Solana among all altcoins

Among other altcoins, Pal is bullish on Solana. Due to its better security and speed, it’s his best bet among the altcoins.

Solana was once notorious for its outages.

In September 2021, the network fell victim to a disruptive denial-of-service bot attack. In May 2022, another bot invasion struck the network. A consensus failure caused by a bug led to another outage in June 2022.

In February 2023, performance degradation issues caused transaction disruption.

However, the network has come a long way now due to the implementation of priority fees. In its July report, Solana claimed to have not suffered any outages since February.

In fact, Solana’s Head of Developer Relations, Jacob Creech, recently announced a $400,000 bounty for anyone who could turn the network off.

Fyi there’s a $400k reward for anyone that can find code that can turn off Solana

Please go ahead and find ithttps://t.co/2oxcB0EEyx

— Jacob Creech (@jacobvcreech) October 12, 2023

Pal said he bought substantial SOL during June-Dec 2022 before the FTX [FTT] fiasco. But its recent performance won’t keep him away.

SOL was exchanging hands at $34.74 at press time, a surge of nearly 65% over a fortnight.

Source: SOL/USD, TradingView