- Bitcoin HODLing endures amid growing hopes of a long-term rally.

- Things could turn out even better for BTC HODLers in 2024

Bitcoin [BTC] holders are over the moon, so to speak, or at least hoping that the latest rally will rocket to the moon. A common phrase used for maximum gains. The rally is a refreshing turn of events considering that bulls have struggled to make sense of the market for roughly three months.

How much are 1,10,100 BTCs worth today?

Back with a bang!!!

The BTC bulls are back in full swing. And the evidence for this was the king coin’s robust upside. The next few months, especially 2024 could turn out interesting. Thus, it is important to assess how BTC is laying the groundwork for that future.

A recent Glassnode assessment of the state of Bitcoin revealed that HODLing is intensifying. More than 600,000 BTC has remained dormant for the last 10 years. This is important because it is a higher amount than the BTC that is available on exchanges. The implications of that outcome are clear.

According to Glassnode, there are now 600,000+ more Bitcoin that haven’t moved in 10+ years than there are on exchanges. pic.twitter.com/KCuOwF32C5

— Will Clemente (@WClementeIII) October 25, 2023

The fact that there was a lower number of BTCs in exchanges meant that the cryptocurrency’s floor price was rising. It also meant that the price was becoming more sensitive to liquidity flows. This is a situation that could lend itself to a bullish spiral.

Especially if we consider external developments such as inflation and the threat of economic collapse which make BTC more relevant than ever as an alternative.

Bulls usher in greed as investors amid growing hopes of the next major rally

The growing optimism for Bitcoin was especially evident now that 2023 has about two months before its conclusion. Many traders are aware that 2024 could be the year that Bitcoin really takes off particularly due to ETFs and the next halving.

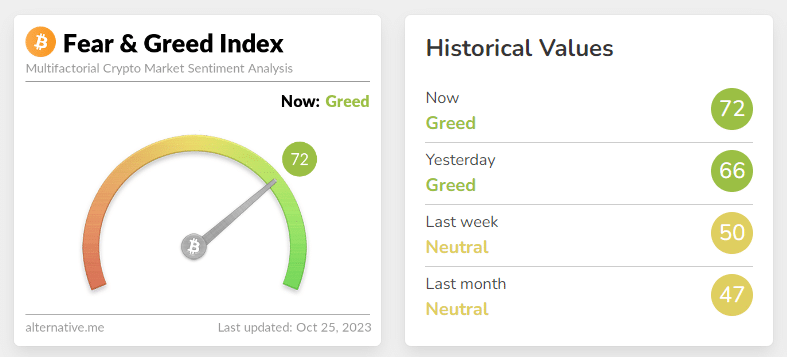

A convergence of events could be the reason for the boost in the current confidence level as seen in Bitcoin’s fear and greed index.

Source: Alternative.me

While the growing confidence could be taken as a good thing, it was also worth noting that the market still remains subject to the throws of volatility. Unexpected pullbacks are bound to take place along the way.

While the hopes of recovery remain high, the state of the traditional finance segment could also outline BTC’s robust future. Right now the world is struggling with inflation and the West is struggling to keep the economy afloat.

Read Bitcoin’s [BTC] Price Prediction 2023-24

More people are becoming aware of the potentially dark economic times ahead as confidence in TradFi diminishes. Because of this, many people are embracing Bitcoin as a safe haven for when TradFi finally breaks.