- Traders reduced risk exposure as Bitcoin’s price stabilized.

- Supply constraints and hodler sentiment may amplify Bitcoin’s upward movements.

In the wake of Bitcoin[BTC]‘s recent price surge, optimism ran high among traders. However, some signs suggested their enthusiasm may be waning.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Reduced volatility anticipated

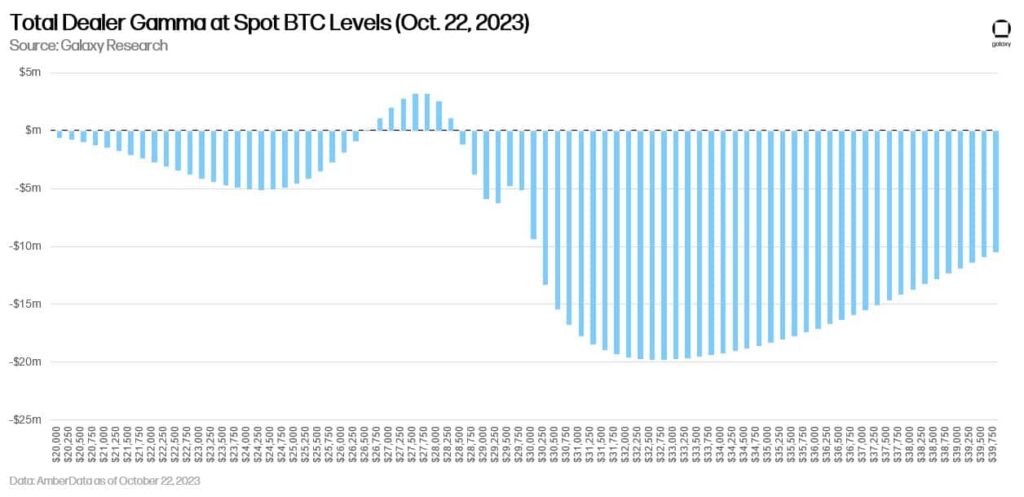

Market data indicated that options market makers dealing with Bitcoin were increasingly taking a short gamma position as the spot price of BTC rose. This suggested their anticipation of reduced price volatility. In the options market, being short gamma means that dealers are positioned in a way that benefits from price stability.

Alex Thorn, an analyst, highlighted the significance of gamma dynamics. When options dealers are short gamma, and the price of an asset increases, they need to purchase that asset (in this case, Bitcoin) to maintain delta neutrality.

The delta represents the rate of change of the option’s price concerning changes in the underlying asset’s price. As per data from Amberdataio, the analysis revealed that options dealers have increasingly taken a short gamma position. This started when Bitcoin’s price was around $28,500 and above.

Notably, when the price reaches $32,500, these market makers need to buy approximately $20 million worth of Bitcoin for every subsequent 1% increase in price. This positioning suggested that market makers will need to buy more Bitcoin as the spot price moves higher, potentially adding to upward price momentum.

options market makers in #bitcoin are increasingly short gamma as BTC spot price moves up.

when you’re short gamma and spot px rises, you need to buy back spot to stay delta neutral.

this should amplify the explosiveness of any short-term upward move in the near term. more 👇 pic.twitter.com/J0satUAilk

— Alex Thorn (@intangiblecoins) October 23, 2023

On the flip side, Thorn also noted that dealers were positioned long gamma in the $26,750 to $28,250 range. When they are long gamma and the spot price declines, they also have to buy back the asset to maintain delta neutrality. Therefore, any short-term downward movement in price will likely face resistance as options dealers buy back Bitcoin to manage their risk.

Source: Galaxy Research

BTC continues to see green

As of the latest available data, Bitcoin was trading at $30,621 at the time of writing. The cryptocurrency exhibited multiple higher highs and higher lows over the past week. This significantly contributed to a bearish trend. The Chaikin Money Flow (CMF) indicator was at 0.12, indicating some upward buying pressure, albeit relatively weak.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Additionally, the On-Balance Volume (OBV) for Bitcoin significantly increased over the past few weeks. The OBV measures the flow of volume into and out of an asset and can be an indicator of price trends.

Source: Trading View