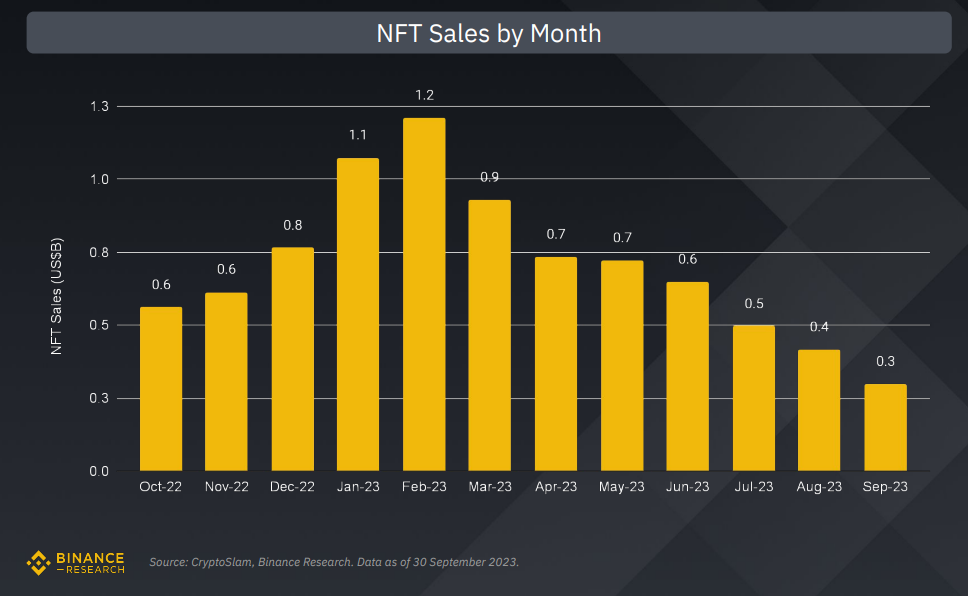

The third quarter of 2023 has been challenging for the non-fungible tokens (NFTs) market, with sales hitting their lowest point since the last quarter of 2020. September alone recorded a dismal sales figure of around $300 million. This downturn is primarily attributed to a significant drop in average sales prices and floor prices of popular collections.

The NFT market has been on a downward trajectory, particularly in September, which saw the worst sales figures since January 2021. The average sales price in September plummeted to $38.17, a stark contrast to its peak of $791.84 in August 2021. Collections like Azuki, BAYC, and MAYC have seen their floor prices decline by more than 25% quarter-over-quarter.

The newest Binance Research quarterly report shows while the NFT market is struggling, Ethereum and Immutable X have managed to gain market share. Ethereum’s share increased by 6% in Q3, partly due to lower gas fees and a decrease in ETH prices. Immutable X, a Layer 2 solution built on top of Ethereum, also saw its market share rise from 4% to 8%. The platform hosts popular blockchain games like Gods Unchained, which led in sales count for the quarter.

Our latest State of Crypto Report summarises all the key insights, events, and learnings from Q3.

Find everything you need to know about developments in the space, including analysis of:

🔸 Layer 1s & 2s

🔸 DeFi

🔸 NFTs

🔸 GamingStart reading here ⤵️https://t.co/ES5z6g8FMU

— Binance Research (@BinanceResearch) October 19, 2023

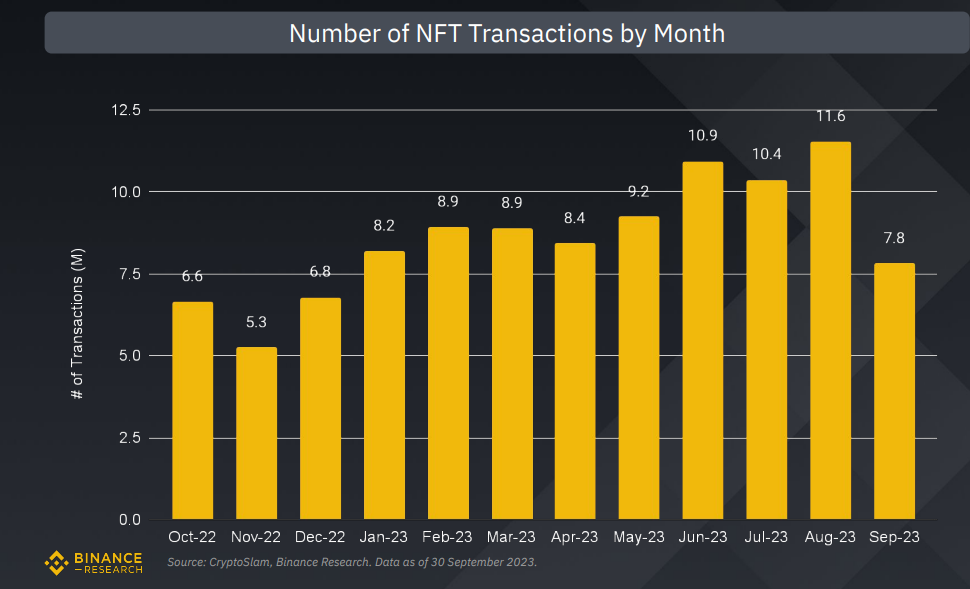

Despite the gloomy sales figures, the number of NFT transactions in Q3 increased by 4.6% compared to the previous quarter. Gaming NFTs like Gods Unchained, Axie Infinity, NBA Top Shot, NFL All Day, and Mythical Beings dominated in terms of transaction count.

Less Buyers, Lower Prices

The average number of daily unique buyers dropped by 14.1% to around 53,000, signaling a decline in overall market interest. What is more, the NFT-500 price index, a measure of NFT performance, also took a hit, declining by 31% in Q3. Various NFT collections across sectors experienced a fall in prices, contributing to the index’s poor performance.

While Blur remains the largest marketplace by sales volume, it has lost ground to competitors like Opensea, which led in terms of active wallets. New entrants like Element have also risen in the ranks, thanks to their integration with multiple networks like Base, Linea, opBNB, Bitcoin, and zkSync. This suggests that traders on Blur are dealing in higher volumes, aligning with its positioning as a platform for professional traders.

NFT Art Market Takes a Hit

The NFT market has been in a slump, particularly in the art segment, which has seen a continuous decline in both the number of sales and total sales value. This downturn is not recent; it has been ongoing since the 2022 crypto crash. While the market did show some signs of recovery, the overall trend remains negative.

Separate data from Statista and NonFungible confirms Binance Research numbers and shows that NFT art sales aggregated value across Ethereum, Ronin, and Flow blockchains was a mere $22.3 million in September 2022. This was a staggering 40 times less than the sales recorded in the same month the previous year. By the end of 2022, the monthly sales value had further dwindled to $17.1 million.

The data clearly indicates that the NFT art market is facing a prolonged downturn, with little sign of immediate recovery. This decline is not just a blip but appears to be a more enduring trend, raising questions about the future sustainability of the NFT art market.

Moreover, crypto and NFT thefts have surged, resulting in investor losses exceeding an astonishing $26 billion. Every hour, criminals are raking in $289,000.