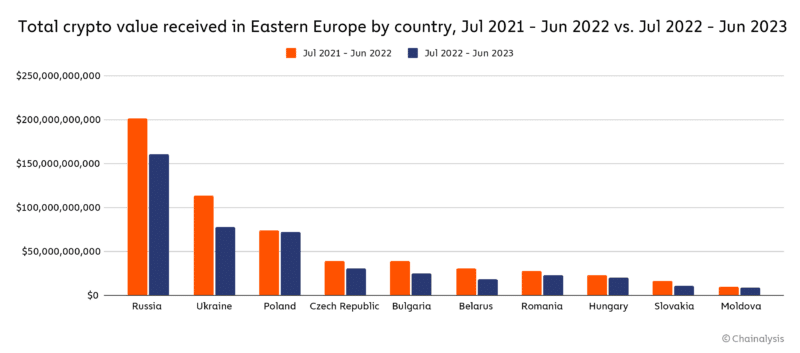

- Russia and Ukraine witnessed the worst declines in crypto usage in all of Eastern Europe.

- Russian usage of international crypto exchanges has halved in the last one year.

The Russia-Ukraine war dealt a sharp blow to the global economy, affecting supply chains and pushing up prices, particularly in the oil and food markets, to unprecedented levels. One and a half years after the conflict began, the world was still reeling from the financial fallout.

Just like the traditional markets, the war had far-reaching impacts on the crypto economies of the two warring sides. The two nations, being the two biggest crypto markets in Eastern Europe, witnessed a sharp decline in usage over the past year.

The crypto cost of war

Russia and Ukraine saw crypto transaction volume plunge by $35.8 billion and $41 billion respectively, marking the worst declines in whole of Eastern Europe, data showed.

Source: Chainalysis

Additionally, the conflict prevented the general public from adding cryptos to their portfolios. Ukraine and Russia fell two and four places respectively in the recently released 2023 Global Crypto Adoption Index.

Russia battling economic sanctions

Russia has been hit hard by punitive economic sanctions since it invaded its western neighbor. The NATO powers imposed huge costs in order to deprive Russia’s war machine of resources.

The scope of the sanctions was extended to cryptos as well. The European Union (EU) imposed a blanket ban on providing crypto services to Russian residents and entities last year. As a result, numerous foreign trading platforms popular with Russians were forced to suspend their services.

Recently, world’s largest crypto exchange Binance [BNB] sold its Russian business and exited the country. The move was most likely a response to allegations that Binance violated sanctions by enabling Russian users to access the exchange.

The impact of the sanctions was glaring. Since the war, Russian usage of international crypto exchanges has halved. On the other hand, the transaction volume on local crypto exchanges has steadily increased.

Chainalysis noted in the report,

“We believe that the restrictions are hurting Russia’s market, along with the same economic headwinds affecting crypto users in other parts of the world.”

Source: Chainalysis

The restrictions on crypto usage could also be viewed from a different lens. Most crypto backers would agree that protection of wealth during periods of war or economic strife is one of the major use cases of cryptos. A restriction, therefore, compounds their woes by shutting down safe haven avenues.

This was well manifested during the Russian Wagner insurrection, when many Russians sought refuge in stablecoin Tether [USDT] to protect their savings.

Ukraine throws up interesting insights

Crypto funds were extensively used to supplement war efforts, according to Ukrainian officials and government fundraising sites. Millions of dollars in cryptos were flown into the war-torn country to purchase military weapons and medical supplies.

As per a previous report by Chainalysis, donations worth nearly $70 million were transferred to the Ukrainian government as of February 2023.

This humanitarian aspect emphasized the value of digital assets in times of crisis. However, as the war dragged on, different sets of challenges emerged.

The cost to Ukraine’s economy has been devastating, especially the damage caused to the country’s infrastructure and its most productive industries.

According to official figures, Ukraine’s GDP plunged 29% in 2022. The economic hardships prompted millions to flee to other parts of Europe, adversely impacting crypto transactions as seen earlier.

Ukraine’s first cryptocurrency exchange, Kuna, relocated to Europe in the period following the war. Anna Voievodina, Сhief Legal Counsel of Kuna Exchange said and Chainalysis quoted,

“Since the Ukrainian economy is going down and towns are being destroyed, people are leaving. Now those Ukrainians living under European legal order are using financial instruments they weren’t using before.”

Because of the exposure to a much more sophisticated European crypto market, many residents embraced cryptos like never before. Moreover, crypto remittances sent to Ukraine saw a considerable rise in 2023.

Source: Chainalysis

Moreover, although big-sized crypto transfers may have suffered, as evidenced by the drop in transaction volume, the overall number of transactions increased in Ukraine. This implied that retail usage was still strong in the country.

It remained to be seen how these new behaviors would impact crypto adoption in Ukraine once the clouds of war go away and peace returns.