- BTC was up by over 3% in the last 24 hours, and market sentiment was bullish.

- Most metrics and indicators were in buyers’ favor, but not the MFI.

After nearly a week-long wait, Bitcoin [BTC] finally managed to once again go above the $27,000 mark. Will Bitcoin be able to maintain its pump, or will it again plummet to $26,000?

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin is finally above $27,000

Bitcoin’s price witnessed a price correction on 9 October that pushed the coin’s price way below $27,000. But, after a few days’ wait, BTC’s price witnessed a sharp uptick. In fact, according to CoinMarketCap, BTC was up by more than 3% in just the last 24 hours.

At the time of writing, BTC was trading at $27,904.55 with a market capitalization of over $544 billion. The good part was that the price surge was followed by a more than 140% increase in Bitcoin’s trading volume, which is generally perceived as a bullish signal.

Santiment’s 16 October tweet pointed out a reason that might have had a major role in lifting the king of cryptos’ price up.

📈 #Bitcoin‘s return to $27K was likely aided by large amounts of older, stagnant coins that were finally moved. The largest amount of dormant $BTC changing wallets since July, these spikes in our Age Consumed metric indicate price direction reversals. https://t.co/0kztm781NO pic.twitter.com/EVDH9hHbBa

— Santiment (@santimentfeed) October 15, 2023

As per the tweet, BTC witnessed a massive amount of dormant supply movement. To be precise, the largest amount of dormant BTC has changed wallets since July.

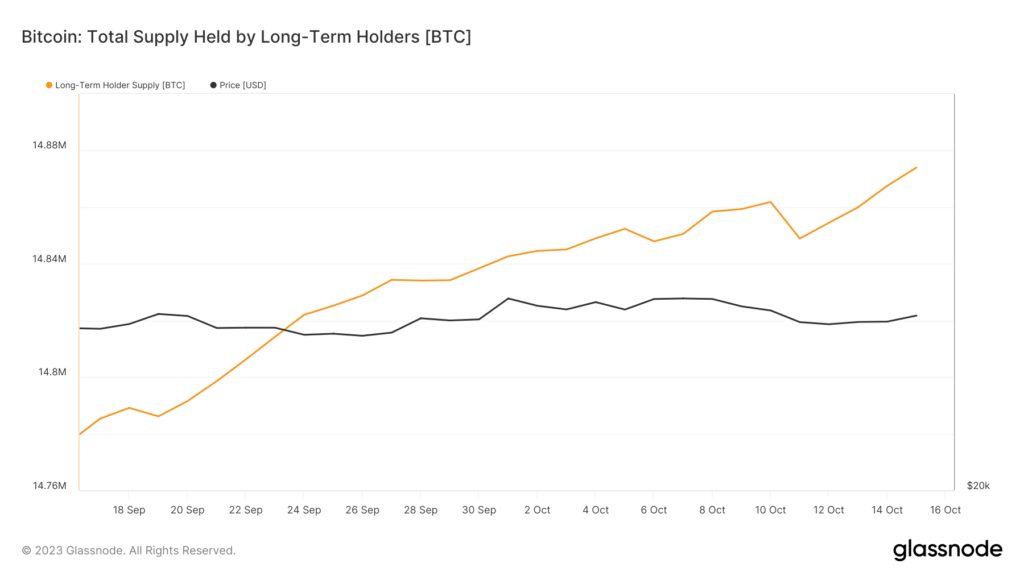

A look at Glassnode’s data revealed that the long-term holders’ confidence in BTC was also immensely high. This was evident from the sharp rise in long-term holders’ supply over the last month.

Source: Glassnode

Not only the long-term holders, but the general market also seemed to have high hopes for BTC as its Exchange Reserve was dropping. This meant that the token was not under selling pressure.

In fact, US investors were rather buying BTC, which was evident from BTC’s green Coinbase premium. Derivatives investors were also willing to buy BTC at a higher price, as showcased by its green Funding Rate at press time.

Source: CryptoQuant

Will Bitcoin sustain its pump?

Bitcoin’s other metrics also revealed that the possibility of BTC maintaining its uptrend was likely. For instance, bullish sentiment around the king of cryptos surged by over 19% in the last 24 hours.

Is your portfolio green? Check out the BTC Profit Calculator

The MACD displayed that the bulls might soon take over the bears. Additionally, Bitcoin’s Chaikin Money Flow (CMF) also registered an uptick and was headed towards the neutral mark.

Nonetheless, the Money Flow Index (MFI) was bearish as it took a southward path, which could restrict BTC’s price from going up.

Source: TradingView