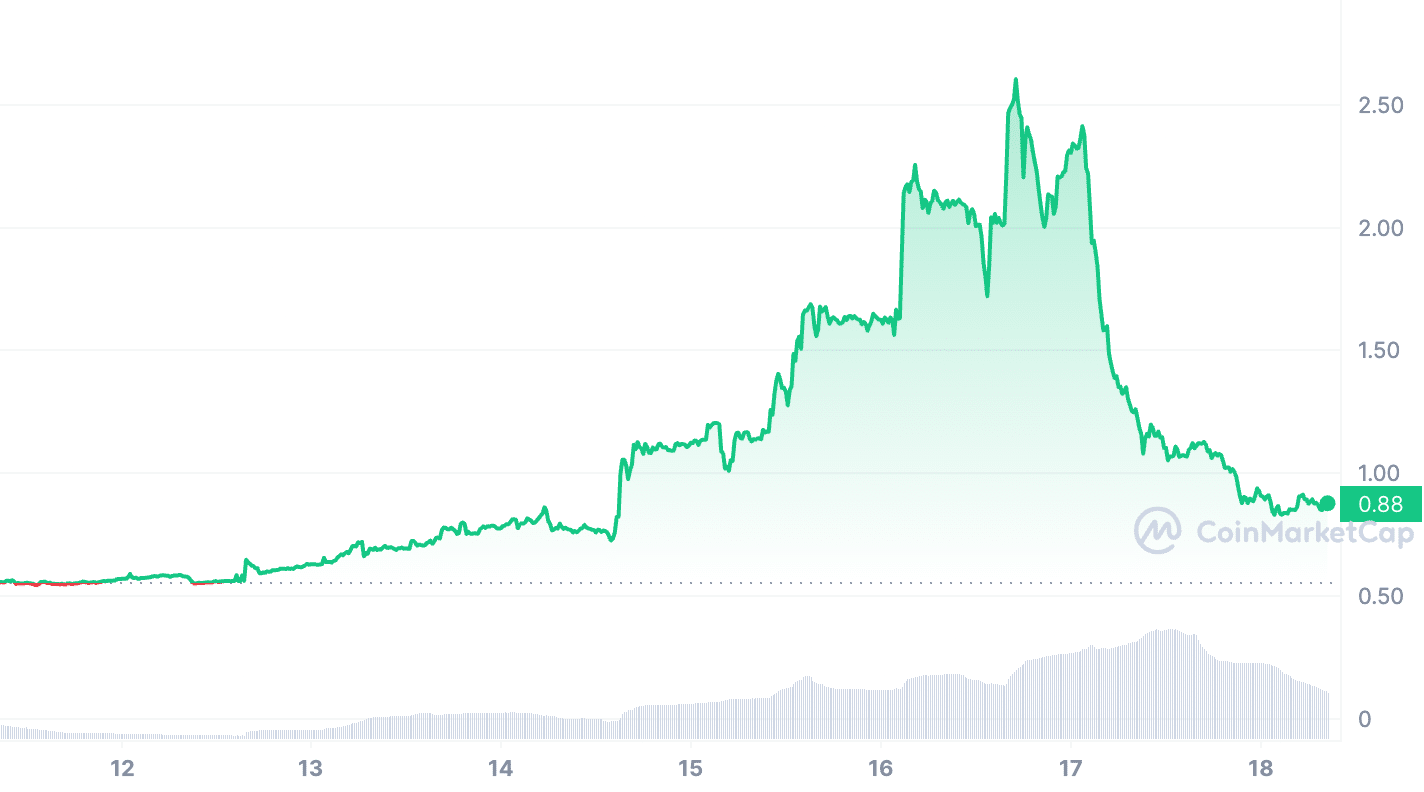

The Hifi Finance token has now plummeted 66% after recently capturing a new all-time high of $2.61 over the weekend.

The native token for Hifi Finance, an Ethereum-based lending and tokenization protocol, was the center of attention for a large chunk of crypto traders on a busy weekend. The Hifi token reached a new all-time high of $2.61 on Sept. 16 before a sharp decline to $0.88 at the time of writing.

Hifi 7 Day Chart | CoinMarketCap

The sharp price action for Hifi was largely linked to a flurry of listings on cryptocurrency exchanges. BitMart listed Hifi on Sept. 14, with Poloniex taking the same step two days later.

While both exchange listings coincided with an uptrend for Hifi tokens, the launch of Hifi perpetual contracts on Binance on Sept. 16 saw the asset enter a sharp downtrend, with traders able to short the asset by up to 20x.

Meanwhile, a listing on HTX (formerly Huobi) on Sept. 17 was not enough to spark a market reversal for Hifi.

According to CoinMarketCap, trading volume for the asset has dropped 54% in the past 24 hours to $540 million, while its market capitalization now sits at $83 million, down 27% within the same timeline.

At its peak less than 48 hours ago, Hifi had a market cap near $250 million, with trading volume soaring as high as $1.07 billion based on CoinMarketCap data.

Hifi Finance Enjoys Moment in the Spotlight

Hifi Finance is an Ethereum-based decentralized finance (DeFi) protocol that primarily offers lending for crypto assets and the tokenization of real-world assets. The protocol was formerly known as Mainframe before rebranding to Hifi Finance in 2021.

Since then, Hifi Finance has refocused its objectives and secured listings on leading exchanges. Yet, the total liquidity on the Hifi Finance lending and borrowing market is $262,000, while Sablier, a DeFi protocol that it acquired in 2020, has around $4.5 million in total assets locked.

It remains to be seen whether the recent moment in the spotlight will propel Hifi to new heights. Some speculate that the recent upsurge is merely a result of increased social hype. Notably, major DeFi tokens have held up better than most altcoins since the start of the bear market.