- As per on-chain data, the market was in a consolidation phase at the time of publication.

- Most holders have been realizing losses since last month’s market crash.

Investor decisions, regardless of traditional finance or the crypto asset market, are driven by something as basic as profit and loss. Greed for further gains as markets rise and panic selling during periods of decline are natural reactions from market participants.

As a result, it is hardly surprising that analysts and traders evaluate the market in terms of financial motivations.

How much are 1,10,100 BTCs worth today?

Analyzing Bitcoin’s realized cap

Digital assets market goes a step further in introducing ‘Realized Capitalization’ to describe the economic value which is entering and exiting the market for an asset, in this case Bitcoin [BTC].

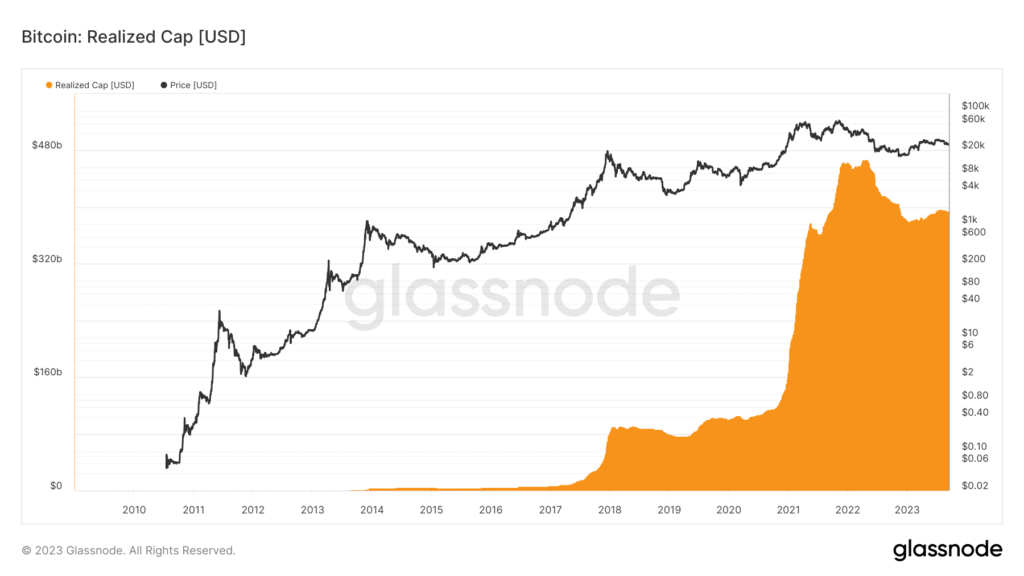

According to on-chain analytics firm Glassnode, realized cap values an asset based on the price of each of its coins when they last moved. For example, when BTC is spent at a price higher than it was last moved, realized cap increases and vice versa.

In this way, it differs fundamentally from the more conventional market cap, which measures the asset based on its current market value.

Logically, realized cap moves higher during strong bull momentum. This is because long-term holders (LTH) sell holdings, which were previously accumulated at discounted rates in the bear market, at very high prices.

The above deduction was corroborated by on-chain data as well. Notice how realized cap charged to steep highs during the historic 2020-21 bull market.

Source: Glassnode

Moreover, when expensive coins are dumped during bear markets, it pulls the realized cap lower. This period is then followed by a market consolidation phase during which coins again start moving in seasoned investors’ hands.

The above graph also captured this behavior. Notice how realized cap dropped lower during the peak of crypto winter in 2022. The subsequent recovery in 2023 represented the ongoing accumulation phase.

Decreasing impact of issuance

In the case of Bitcoin, apart from realized profit and losses, the new coins entering circulation through block mining also contributed to the daily realized market cap.

However, the quadrennial halving events have significantly reduced the dominance of issuance. As indicated below, the thermocap i.e., newly issued supply paled in comparison to the realized profit and realized loss components.

Source: Glassnode

Infact, Glassnode mentioned that since 2016, issuance constituted “at most” 10% of Bitcoin’s daily realized cap. That being said, miners’ dynamic became a significant source of interest for analysts during periods of muted trading volumes, as was evident at the time of publication.

Bitcoin holders in a state of loss

Similar to realized cap, the Net Realized Profit/Loss indicator is frequently used to ascertain market sentiment, capital inflows or outflows, and trends in network profitability.

From the depiction below, it could be clearly seen that most holders have been realizing losses since last month’s bloodbath. This indicated that capital was moving out of the market and the sentiment has been anything but upbeat.

Source: Glassnode

Another striking aspect of Bitcoin’s realized cap was that the drawdown was considerably lower when compared to the decline in spot prices. Simply put, if the price of Bitcoin falls by 75%, the drop in realized cap would be 3x-4x smaller in magnitude.

Source: Glassnode

As shown above, the realized market cap tended to reverse around cyclical price lows. This made sense as by this time most of the low-valued coins would have been grabbed by experienced investors who would wait for the next bull run to offload them.

Market sentiment still neutral

The bottom line from the analysis was that Bitcoin market was indeed in a phase of consolidation while the halving event next year could be the bull market everyone was waiting for.

According to the latest reading from the Bitcoin Fear and Greed Index, the market was in a state of equilibrium. with no extreme emotions dictating the market.

Bitcoin Fear and Greed Index is 41 — Neutral

Current price: $26,144 pic.twitter.com/bhrHXEbvce— Bitcoin Fear and Greed Index (@BitcoinFear) September 13, 2023

Is your portfolio green? Check out the BTC Profit Calculator

In the last 24 hours, the king coin jumped to breach the $26,000-mark to settle at $26,324.67 at the time of writing, per CoinMarketCap.

According to Shivam Thakral, CEO of Indian crypto exchange BuyUcoin, the steady stream of Bitcoin ETF applications, latest being Franklin Templeton, was keeping the market afloat.